Feel free to also leave a comment explaining your answer; the more the merrier 🙂

Tag Archives: Rich

Reader Question: How can I start a small business with no capital?

I guess some of my readers appreciate small / online business advice as well as personal finance advice, so I’ll keep the mix going for a little while longer.

On that note, let’s take a look at Jeff’s question; it’s a very common one, indeed:

I have always wanted to run my own business, and I know what business it is. I have planned out all the details, even got as far as making the business plan for startup, short term and long term. But i keep becoming discouraged at the idea when I hit the same wall every time. Which is startup capitol. Do you have any suggestions as to where or how someone who is smart and determined, but has virtually no personal capitol, can get the means to start a small business?

I don’t have enough (any) information on Jeff’s personal financial situation to make any specific recommendations. However, since this is such a common reader question, let me try and answer it for everybody in this situation.

Startup capital almost always comes from the Four F’s:

– Founders – What does your personal ‘balance sheet’ look like? Do you own a house, car, etc. Many a business has been started by refinancing existing assets, borrowing money on credit-cards, and so on. Desperate times call for desperate measures.

– Friends/Family – These two groups will invest small amounts – from $100 to $10,000 each. Pull a few together and you may get enough. Usually, they are investing in YOU, so financial results are less important to them. But, if you have a business plan that reads well, and you have a wide circle, you’re ready to start asking!

– Fools – These are seed-stage investors who MAY invest in an idea, but they are VERY hard to come by. You probably need more than one cofounder (one-man businesses are usually seen as too one-sided), and you will need to demonstrate a business with good upside.

Putting together business plans is one giant step forward for Jeff.

But, now he finally needs to decide if he’s going to drop it, or go for it. Only Jeff can make that decision 🙂

Anatomy Of A Startup – Part VI

If you’re a Dave Ramsey Fan, welcome!

But, you probably won’t stick around … no Baby Steps here, just Giant Leaps in (mainly) personal finance and (sometimes) business from a genuine mult-millionaire (that would be me!) who went from $30,000 in debt to $7 million in the bank, in just 7 years … no BS 🙂

We don’t pay off our mortgages early, here. We don’t debt snowball. And, we don’t save until we bleed (but, we do practice delayed gratification).

We DO find our Life’s Purpose, use that find our Number, and do any one of a hundred things to get there, If you do choose to stick around (unlikely, I know) … enjoy! And, feel free to drop me a line to tell me what you think [ajc AT 7million7years DOT com] …

_____________

We’ve done a little bit of FaceBook advertising while we are waiting for the ‘better’ landing page to appear, with mixed results.

What is clear, is that advertising is a great way to test your New Product Idea, but a very expensive way to acquire customers; which is OK, as right now, we are testing various strategies.

One of the things that we learned is that keywording on your more established competitors names is A GOOD THING … for us 😉

One of the other things that we have learned is that the key technical feature of our site may be a lower takeup than we expected, which is why the ‘pivot’ was invented:

Basically, a pivot is a fancy New Age Term for “doing less of what doesn’t seem to work, and doing more of what does”. Also known as: common-sense.

So, right now, we have a nice, new design idea that could be disruptive in its own right.

We will launch with this …

But, that means that I have to change the Executive Summary:

Click to download the Executive Overview <<<<==== CLICK HERE

The Executive Overview is the two or three page document that outlines what your business is all about:

– What problem you are solving,

– How you are solving it,

– What your ‘secret sauce’ is,

– Who your competitors are,

– Your business plan (how you intend to make money),

– Your marketing plan (how you intend to acquire customers)

– Your implementation plan.

This document – with various sections added or removed can be given to partners, key staff, investors, and bankers.

Oh, and don’t forget that it begins with your USP.

PS Obviously, the documents that I am sharing are NOT for my current venture. Sorry. 😉

Brick Wall Retirement

[pro-player width=’530′ height=’253′ type=’video’]http://www.youtube.com/watch?v=MdmbkeJe6zo[/pro-player]

Late last year we had some discussion about so-called “safe withdrawal rates” i.e. what is the ‘magic percentage’ that you can withdraw from your bank account (or other investments) each year, once you are retired, so that you don’t risk running out of money?

Jacob from Early Retirement Extreme said:

It’s fairly well-established (by the original Monte Carlo paper) that the 4% rule is only good for 30 years. Also it only pertains to a broad market total return portfolio. For shorter periods I’ve seen people quoting up to 7%. For longer periods, 3% or less seems to be in order.

He also suggested for a “more extensive discussions see Bob Clyatt’s book”, which we started discussing last week.

Bob undertakes a reasonably good strawman-analysis of some of the existing thinking on Safe Withdrawal Rates then uses some of his own analysis to come up with three rules:

1. It’s OK to withdraw between 4% and 4.5% of your portfolio each year, but

2. You only need reduce the $ figure of the previous year by 5% to cushion the effects of a down-market, as long as you

3. Follow his recommendations for a highly diversified portfolio of stocks, bonds, bicycles, and sausages.

[AJC: OK, I made up the bicycles and sausages bit ;)]

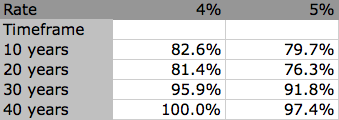

If you follow these rules, here’s your chances of NOT running out of money, depending on your time horizon:

Now, a few things bother me about this, indeed most discussions on this and other so-called Safe Withdrawal Strategies:

1. Here’s a bunch of people who generally advocate NOT to try and time the stock market, yet, in most cases (including Bob’s strategy, if you take the 5% option) you are trying to TIME the worst possible market of all: how long you expect to live!

2. There’s always a chance that your money will run out before you do – including in 7 of Bob’s 8 (recommended as ‘safe’ and ‘sustainable’) categories; and, in the one ‘safe’category, you still have to run the gauntlet of a nearly 20% chance of perhaps losing your money for 2 whole decades.

3. Even if you wind down your % to Jacob’s suggested 3% withdrawal strategy, Bob’s numbers [AJC: you’ll have to see the book for this one] still show an almost 15% chance of losing your money in the first decade.

Now, there are other Monte Carlo studies that show that withdrawal rates on 3% to 3.5% are pretty damn ‘safe’ … BUT:

a) Personally, I expect to live forever and expect my money to do the same, and

b) How close to ZERO (but never quite reaching it, according to the statistical analysis of 3% – 3.5% withdrawal rates) do I allow myself to get before I panic?

I can’t help thinking that you need to substitute the words “safe withdrawal %” for “the right length and strength of vines” in the video, above, to really understand what it would mean to suffer a prolonged market downturn in retirement 😉

I’ve said it before, and I’ll say it again: unless you have a perpetual money machine set up, there ain’t no safety in withdrawal rates!

Anatomy Of A Startup – Part III

Now that the term sheet bartering (i.e. “how come you got more equity worth nothing than I did?!”) is out of the way, we moved on to (re)creating the business model; if you don’t know what a business model is, then this fantastic presentation should give you all the help that you need:

Another case AGAINST dividends …

The graph shows the promise of dividend-investing, but Canadian Couch Potato states the reality – the case AGAINST dividends – far more eloquently than me:

Why do shareholders believe so strongly that a $1 dividend is preferable to a $1 capital gain? Meir Statman looked at this question in a 1984 article called “Explaining Investor Preference for Cash Dividends,” coauthored by Hersh Sheffrin. He also reviews the idea in his new book, What Investors Really Want, pointing out that receiving $1,000 in dividends is no different from selling $1,000 worth of stock to create a “homemade dividend.”

Even when this idea is explained to people, most refuse to accept it. Statman suggests that it comes down to a cognitive bias called mental accounting. Investors categorize $1,000 in dividends as income that they will happily spend, but the idea of selling $1,000 worth of stock is “dipping into capital,” which causes them great anxiety. This idea is deeply ingrained in many investors, but it is an illusion, because a company that pays a dividend to shareholders is depleting its own capital.

If you want to understand the arguments – both for and against – investing in so-called ‘dividend stocks’ for the sake of the dividends, you would do well to read Canadian Couch Potato’s whole blog post AND the comments … all for/against arguments are well thought out.

Here is my argument against dividends in a nutshell:

Since you can create a dividend stream yourself (“ignoring taxes and transactions costs, a stock that pays no dividend but increases in price by 6% provides precisely the same return as one whose share price rises 4% and pays a 2% dividend”), it boils down to what could the company do v what can you do with the ‘spare cash’ that the company plans to issue (or not issue) as a dividend:

1. If the company keeps the dividend:

– They could buy more inventory: if their business is a volume business, more inventory = more profits. Consumer products companies such as Kraft and Unilever are great examples.

– They could do more R&D: investing in R&D is necessary gambling on the future; often it will be money wasted (in which case it’s better off in your pocket as a dividend), but sometimes it will provide a huge payback, such as when a pharmaceutical company develops a breakthrough medication, or a venture capital firm finds the next FaceBook.

– They could invest in marketing: more marketing = more sales; pretty simply, huh? Consumer products and technology companies are classic examples; the more often they put their products in front of the consumer, the more sales they seem to get.

– They could invest in more infrastructure: more factories, more locations = more revenue and more profits. Manufacturing companies, high tech businesses, and retailers are all tied to physical infrastructure.

– They could invest the cash – Many companies (think Microsoft, Apple, the tobacco companies, and the brewers) are sitting on a ton of cash. Heck, Berkshire Hathaway is sitting on so much of it, even Warren toys from time to time with giving it back to the shareholders (i.e. by issuing a dividend); after all, if they can only get 3% while it’s sitting in the bank and you can get …? Inevitably, though, they use this cash to make a spectacular purchase that transforms the company: think Google’s $6.5 billion offer for Groupon, or Berkshire Hathaway’s $44 billion purchase of BNSF Railway.

2. If you take the dividend:

– You could buy more stock in the same company: this is the basis of the automatic ‘dividend reinvestment policy’ that most companies now offer. So, let me see … you invest in company ABC because it issues a dividend, and you use it to, what? Oh, buy more stock in company ABC?!

– You could buy more stock in another company: why invest in another company? Oh, because it provides a better return. So, why not pull ALL of your money from the worse-performing dividend paying stock, and put it all in this company?

– You could buy more stock in a bunch of companies: diversification is often seen as a good thing [AJC: by many reading “how I became rich” blogs; rarely by those writing them]. The more you diversify, the more you tend towards average market returns. Why would you want to take your cash out of a company that produces spectacular returns [AJC: that’s why you invested in the ‘dividend stock’ in the first place, isn’t it?!] in order to put your money into something that produces average returns?

– You could keep your cash in the bank: strangely enough, this one makes sense; if the company can’t do anything better with their ‘spare cash’ than give it to you, wouldn’t you rather have it sitting in your bank account rather than theirs, so that you can at least have the flexibility to make the decision what to do next, eg leave it in the bank, buy some index funds, pay down debt, or even buy back into the company stock when they get out of the ‘sit on a ton of cash with no vision for the future’ doldrums.

… but, if any of these things are better than leaving the money in the company, wouldn’t you be better off taking all of your money out of the company all in one go (i.e. sell the stock) rather than in dribs and drabs (i.e. taking small dividends)?

Let me finish off with a story:

Warren Buffett got started by purchasing a textile company and immediately canceling it’s dividends!

Why?

So that he would have more money to invest in growing the company.

Potential investors who wanted dividends invested elsewhere … those who didn’t invested in Berkshire Hathaway and became multi-millionaires!

Berkshire Hathaway still operates on the same principle: why pull money out of BH when Warren can grow your money faster?!

Anatomy Of A Startup – Part II

As I mentioned in my first post in this (occasional) series: “building a startup is one (highly risky) way of making $7 million in 7 years!”

My first B2B (business to business) startup was 100% offline (a.k.a. B&M a.k.a. ‘bricks and mortar); it funded my entire investment strategy – you have to get your cashflow from somewhere, right?

Even though it made barely more than a wage in terms of profits, I was able to scrimp, save, twist, and manipulate my way into an unbeatable combination of Business + Real-Estate to make my first $7 million in 7 years … even before I sold the business!

Nowadays, my twin passions come together in this post: writing about personal finance + working on startups.

I still own one fully b&m business (a finance company, established for nearly 20 years) and own 50% of another (a startup selling a unique product to cafes), but my ‘passion within a passion’ is actually web 2.0 (or, more trendily known these days as ‘social media’) startups.

And, I have just agreed terms with my two partners on my latest 100% online project (I found these guys by joining a meetup group online … kind of like meeting your future wife on PlentyOfFish.com!) .

The question that will obsess you most at this stage (it shouldn’t!) is “how much equity” did each partner get?

There’s many ways to cut-and-dice the pie:

The simplest is when two or three founders get together at a party and come up – in a flash of drunken inspiration (which is exactly how my LAST idea came to fruition) – with The Idea. Then they all do a handshake and a business is formed with each holding equal shares.

It only gets complicated – killing the business and the friendships – when one of the partners doesn’t pull their weight, or when one needs to go full-time to take the idea to the next stage, or …

The other way is to recognize different contributions at the outset:

– Who came up with the idea? Let’s say that I came up with the idea, and have begun the patent process (for whatever that’s worth).

– When did you come on board? Let’s say that I found you, and need you for a specific job (e.g. web-marketing).

– Who needs to draw a salary? Some partners will need SOME money to live … hopefully, nobody’s stupid enough to believe that this is a real, paying job (yet/ever).

– How many hours a week will each partner work? What about after launch?

– What are the basic milestones?

These are the real questions that we had to address in the past week or two, and here’s how we dealt with them [AJC: the real numbers are close to the following cooked up example]:

We agreed a NOMINAL dollar value for everything:

– The idea was given a nominal value of $200,000 (normally in the $100,000 to $200, 000) range

– It was agreed that each partner’s time pre-launch (and, to a specific point after: see milestones, below) would be worth an identical amount (we chose $100k each for the sake of simplicity; not to be confused with a real salary i.e. nobody will actually draw $100k in salary, at least not for quite a while!)

– We also agreed to keep an extra ‘salary’ for an extra partner that we would still need to find to plug a gap in our teams’ combined skill-set

– We also agreed to keep an extra few $ (initially, we wanted this to be $100,000 … we settled for less) as an extra incentive for PAID staff who may come on board in the future, but not as partners

– We also agree that we needed an ‘advisory board’ of 3 members, who would split about $35,000 in nominal ‘salary’ (remember: they will take this in % equity, not in cash!)

– We then agreed who was going to get paid in real $$$ before we actually make any money, and agreed that would be only one of the three founding partners who needed $40k to pay the bills at home! That was easily dealt with by taking down his starting position from $100k to $60k

– Finally, somebody needed to come up with some cash to start the company off (seed money); fortunately, asking me to reach into my pocket to offer $100,000 was a relatively easy decision for the group.

Now, realize that these are not real $$$ (except for the $40k salary for one of the partners and my very real $100k cash contribution) …. nobody is going to get paid $100,000! Nobody is going to give me $100,000 or $200,000 for the idea! I’m only going to put in the $100k as and when/needed!

These are NOTIONAL dollar amounts:

What we did next was to add all of these $$$$ together to come up with a single total, in this case just under $700,000.

Then it was a relatively easy matter to calculate everybody’s share of the equity e.g.:

– the founder who was not drawing a salary would receive $100,000 / $700,000 = 14% starting equity

– the founder who was drawing a $40k starting salary would receive ($100,000 – $40,000) / $700,000 = 9% starting equity

– The advisory board would split $35,000 / $700,000 = 5% (we would eventually offer 1.5% each and keep the rest as ‘spare equity’)

… and so on.

Note: whatever equity is left over (remember the ‘spare equity’ for the extra founder and for future staff incentives, plus any left over from rounding down as we did for the advisory board?) is actually owned by the founders in equal proportion to their starting equity. Equally, though, as future rounds of funding are taken on, the founders will be diluted in the same proportion.

Oh, but how do we know that we will actually work well as a team?

Simple: we didn’t hand out the equity all in one lump, we came up with a vesting arrangement tied to key business milestones.

Here’s what we came up with (each founder had exactly the same vesting arrangement, as did the advisory board, just to make sure that it didn’t cost us too much to get rid of any ‘lemons’ in our team); 20% of the offered equity would be released to each founder / advisory board member at each of the following milestones:

Milestone 1: Project Commencement (date of incorporation of (working name))

Milestone 2: Market launch of first functional web site

Milestone 3: Receipt of first substantive revenues (>$5,000 in aggregate from time of startup)

Milestone 4: Receipt of >$150,000 in aggregate revenue from time of startup

Milestone 5: Receipt of >$500,000 in aggregate revenue from time of startup

This way, everybody needs to pull their own weight until the business is truly firing on all cylinders before they ‘earn’ their full allocation of equity.

The complication will come if additional outside funding is required before these milestones are reached. Then again, if all founding partners are still on board, everyone will be affected equally (well, in proportion).

Now, why did a say this equity discussion is not important?

There’s no equity if the business doesn’t get off the ground: your prime focus, at this stage, is to make sure that you have an idea that the market wants and that you have the skills to bring to the party … and, that’s all about commitment and execution (as well as a little luck)!

If you have a startup, leave a comment to share your experience with horse trading starting equity 🙂

Make money while you sleep?

Making money while you sleep … isn’t that everybody’s dream?

Making money while you sleep … isn’t that everybody’s dream?

Erica, my favorite small-biz-whiz, shares her success with a business that makes her money not just when she’s sleeping, but also while she’s away:

You don’t need to stay home to work. Whoosh Traffic had its 1st $1000 day, hit $10K in total revenue, & became profitable while I was gone!

But, there’s a problem, the kind of business that lets you make money while you’re asleep / away is also the type of business that tends to produce small numbers. Take a look at Erica’s results: $1k a day in sales, $10k total revenue.

Now, we know that this isn’t Erica’s only income stream – and, even this one is new and growing – but, I’m sure that Erica will be the first one to tell you that there’s a (low) ceiling to the income that a business can grow that can truly “make money while you sleep”.

In fact, I wager that in aggregate, Erica’s “make money while you sleep” businesses actually keep her pretty busy … and, she has plans to be even busier.

You see, I am willing to bet London to a brick (whatever THAT may mean) that Erica has a Number [i.e. the amount of money that you need in order to begin life after work a.k.a. retirement] that is pretty big, but most “make money while you sleep” businesses won’t be enough to help her get there:

a) The income they produce may not be enough to build up the Number on their own, and

b) They have no – or insufficient – resale value.

Of course, there’s a third alternative: if the business makes money while you sleep, and that income is enough to pay the bills, why do you even need to reach your Number?

Simply because no business lasts for ever … and, do you want to bet your financial future in the face of ever-changing technology and market conditions that you will continue to find replacements?

My businesses made money while I slept or went away – on some days. But, whenever my cell-phone rang – wherever and whenever I was in the world – I HAD to answer it because the buck ultimately stopped with me … banks and ceo’s demanded it!

But, the advantages were:

1. The businesses eventually produced enough cash to fund both my ever-growing lifestyle AND my long-term retirement investment strategy i.e. I could buy enough investments that I reached my Number by my Date, without needing to sell my businesses,

2. Even if I hadn’t already invested externally, I could (and did) sell my businesses for more than enough to reach my Number before technology and/or market conditions could change to my detriment.

Two paths to reach my Number: invest and/or sell [AJC: I did both and advise you to do the same … never rely on being able to sell your business]

Price: restless sleep!

So, is there a place for ‘Erica Style’ businesses?

Absolutely:

– You could build up a portfolio of those businesses; in doing so, you are making building these types of business your business! What?! That’s exactly what Erica is doing: she puts in 110% effort to build these types of businesses and to teach you how to do the same. I bet that she doesn’t have a ‘kick back on the sofa and let the business make money while I sleep’ attitude at all!

– More simply: you can build one or two of these types of businesses while you are sitting around at college, writing your blog, or working your ‘day job’, and use the EXTRA income that this business generates to fuel your investment strategy – or, build up the seed capital for that ‘real business’ …

… the one that WILL keep you up at night, until you sell 😉

The ‘No New Year’s Resolution’ Resolution!

I’ve just returned from my longest vacation-from-blogging that I’ve had in the the 3 years since I’ve been writing this blog.

Some of it had to do with poor internet access where I was traveling; it was supposed to be a ‘first world country’ but had ‘third world’ internet access. But, that was also probably a side effect of the second reason that I didn’t post: I was too damn tired/busy from touring.

I made the ‘mistake’ of agreeing to take a two week educational/discovery tour with a busload of other families from my childrens’ school: whilst educational, it was hardly a vacation! On the bus / off the bus … next historical site … on the bus / off the bus … three to four times each day. Crawl into bed each night exhausted, on the bus again by 8am the next day.

And, being a group tour, the hotels were set at the lowest common denominator: around 3 stars, hence the poor internet access.

Now, this probably sounds like fun to my main readership base (sub-30’s singles or young couples / no kids) … the rest of you are nodding in silent agreement: there comes a point where Hilton-hopping is REALLY what you need in a vacation!

Anyhow, we’re back and enjoying Resort Cartwood (i.e. home) with it’s huge landscaped and tiled 5-star surroundings, pool, tennis court, home theater, and so on … who needs a holiday away from home!

We celebrated New Year whilst away … which really means that we did nothing but had a wonderful view of the fireworks from our hotel window.

But, it did get me thinking:

Why make resolutions on New Year?

Does that mean that you wait – on average – 6 months to finally build up the courage to ‘resolve’ to do something that you already know is important for you to start doing / quit doing?

Does that mean that you put off for an average of 6 months that which you ALREADY know you must change?

Does that mean that New Year Resolutions are yet another means of justifying procrastination?

Does that mean that you build up the change to such a crescendo that by the time New Year comes and you – for some reason – fail to succeed in making the change, you’ll be too ashamed to try again (at least until 10-12 months later when the next New Year comes around and you build up the courage to ‘try’ again)?

So, why not have a New Day’s Resolution?

If you have something that you need to change, don’t wait until a New Year to resolve to change it, wait until the next day?

Well, I even have an issue with that!

You see, why delay – even a tiny bit – by RESOLVING to do anything?

Why not just DO? Now!

And, don’t even fool yourself into ‘trying’; do as Yoda says:

Try Not. Do or Do not. There is no try.

That’s why I’ve just resolved to never again make another New Year Resolution … at least, not until next year 😉

A very short vacation …

I’m still technically on vacation – half way around the globe from my usual abode as I write this – but, I did promise to share the ‘missing piece’ of the Formula for Wealth:

This formula – were it not for the one factor that I added – would fail on two counts:

1. Wealth being a function of Capital and Time is merely another way of confirming the so-called ‘power of compounding’, which is no great shakes as 1,000 others have already sung its praises and hardly justifies me adding my voice, and

2. It doesn’t explain The Bill Gates Effect: why Bill Gates (and, Steve Jobs, and Warren Buffett, and Mark Zuckerburg, and Oprah) is rich and the rest of us (present company excepted) are not.

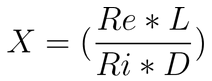

That’s why I added the key: the X-Factor …

… which, in itself would be totally useless, if I couldn’t explain it so:

For the non-mathematically minded (and, you have to be, because as a strict formula this is nonsense), the first part of the ‘formula’ expresses the classic Risk (Ri) versus Reward (Re) tradeoff.

This is logical: “Bill Gates is richer because he takes bigger risks. I’m risk-averse so I cannot be rich. No problem, back to frugality and 401K’s …”

The good news is that Risk and Reward are related: for every financial activity there is a built-in level of risk. Choose one and you automatically choose the other.

To a greater or lesser extent, you can treat this Risk/Reward Tradeoff as a constant (actually, a curve, but there is a fixed point on the curve for whatever financial investment activity that you undertake).

In other words:

1. You choose the level of Wealth (W) that you want to achieve i.e this is your Number

2. You choose the Time (T) that you have available i.e. this is your Date

3. You have a set amount of Capital (C) that you start with i.e. this is your savings

4. You calculate the required Annual Compound Growth Rate, which tells you what financial activity you need to undertake (e.g. stocks, business, real-estate, etc.)

5. This automatically puts you on a set point of the Risk/Reward curve.

So, by selecting your Number and Date in advance, you have – in effect – taken away all decisions and the Wealth Formula works automatically for you.

You have only two levers to pull that will determine if you succeed – and how well (Bill Gates well, AJC well, work-for-40-years well, or hobo well):

Leverage (L) and Drag (D).

I’ll explain these in the New Year 🙂