The New Year brings new choices … think of each choice or decision as two doors, and you have to choose one to step through.

The New Year brings new choices … think of each choice or decision as two doors, and you have to choose one to step through.

Choose the wrong door and it seems you have changed the course of your life forever … but, will it change for the better or worse?

My son has finished high school and now has to choose from his top two college / course choices. What decision will he make?

Will it even matter?

I’m not stressed for him, even though he may be – facing such seemingly life-altering choices – because I remember that I made a few – and, really important – ‘wrong’ choices in my Life’s Journey, yet here I am today.

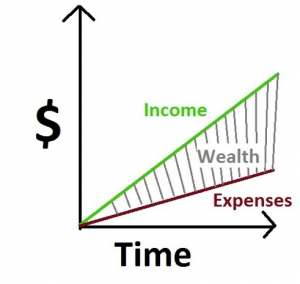

You see, I now believe that I would have arrived at roughly this point, no matter (within reason) what choices I would have made – or, decisions I would have taken – along the way …

… and, if you implement just one key change in your life, you will come to see that, too.

First, you need to understand that when you choose to go through Door A or Door B, as my son is now, that’s not the end!

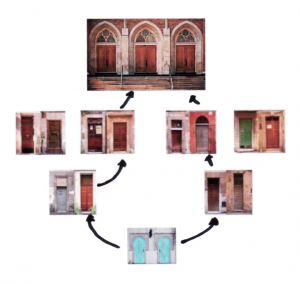

There’s always another two doors behind Door A, and yet another two doors behind Door B

What are the correct choices to make, when presented with these two new doors? How will you know for sure?

The answer lies in knowing your overarching goal: if you know your Life’s Purpose, then you will have a compass that will guide you back to the right course, even if you choose Door A, when perhaps you later realize that you should have chosen Door B.

Life is really just a series of decisions and choices that we need to make – or, doors that we need to go through. Our choices can sometimes be difficult … as a result, our decisions can seem random or less than optimal. Sometimes, we make the out and out wrong choice.

But, when you have the compass that is your Life’s Purpose, then it will guide you back to the correct path through later and later choices.

With your Life’s Purpose to guide you, no matter whether you choose Door A or Door B, you can end up living your Life’s Purpose; your choices along the way may affect exactly how you get there and what you will be doing when you finally get there …

… but, it will be close enough.

For example, I now know that no matter what path I would have taken, I would ultimately be sitting here and writing this blog post for you.

How do I know this?

Simple. Because I would not have stopped choosing doors until I got here!

So, I’m not sweating my son’s choices … neither should he.

And, neither should you sweat the choices that you make this year.

May it be a good one!

.

.