Take a look at the chart on the left … yes, the one that I’m busy drawing for you 😉

Take a look at the chart on the left … yes, the one that I’m busy drawing for you 😉

… because, if you’re in business – or aspire to be – whether online or offline, this is a lesson that you simply have to ‘get’ … and, early:

For those of you who have been to business school, there is a space between the sales [blue] and expense [red] lines called PROFIT.

Profit is for growing the business and returning value to the shareholders.

But, in a small business it’s mostly known as OWNERS’ SALARY, because the owners live off this instead of taking a wage … and, it’s usually (barely) enough to fund their ever-growing (assuming the business is becoming more and more successful) lifestyle.

Instead, it should be known as CAPITAL.

You see, large businesses (particularly publicly listed ones) find it easy to raise capital: they simply issue stock.

They trade bits of paper (stock) for more bits of paper (cash) to go ahead and do all the things they need to do in order to expand their businesses (e.g. buy new machinery, open new branches, fund acquisitions).

But, small business owners can’t do that … it’s very hard to raise money as a small business owner, for anything … including expansion.

So, my advice is to fund your own expansion, by retaining profits (instead of spending them on yourself) and using those retained profits to grow the business.

There’s your capital!

Fellow Aussie and business/success coach, Jon Giaan (knowledgesource.com.au) similarly advises aspiring business owners:

When starting a business, most people focus on generating income and lose sight of their long-term goal of having a successful and ‘sustainable’ business that will provide freedom, independence, wealth and support many years into the future. Keep focused on building a long-term asset.

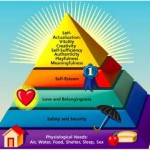

No doubt this is true; Maslow’s Hierarchy puts food/shelter/clothing right at the top …

No doubt this is true; Maslow’s Hierarchy puts food/shelter/clothing right at the top …

But, once your business has grown to supporting those needs, your mind starts to look at wants, and before you know it, you NEED your business just to survive mortgage payments, expensive car leases, private school/coach/country club fees, and the list goes on.

Right from the beginning, we had a different view, one that saw the owners of an [eventually] profitable business jointly deciding that the partner not working in the business – my wife – still needed to work her $60k – $90k per year ‘day job’ (as an IT Project Manager with a major telco).

The reason was exactly as Jon says: we wanted to keep “focused on building a long-term asset”.

We knew that it was only by reinvesting the cashflow produced by the business – both within (reinvesting in the business) and without (buying good quality buy/hold real-estate and other investments) that we would eventually reach our Number.

[AJC: Right there, in a nutshell is how we reached $7m7y: use the cashflow from the business to invest instead of spend. A side benefit being that we didn’t need to rely on the ongoing success and/or sale of the business to reach our Number. Too easy, huh?]

In fact, we eventually blew our first $7m7y out of the water … but, that’s a whole, other story 🙂

Great post. I rather knew that sometime , we would hear that this is how you did it(and how we should too). This only makes sense.

Great point… although we work on building our businesses in order to build passive income, we have to store some seeds away in order to grow a bigger harvest next year!

Pingback: Weekend Reading: Me and My Money | Invest It Wisely

Pingback: The only personal finance chart you need …- 7million7years

Pingback: Small Business Advice Blog Carnival, January 2011