The common answer is to arrange the debt that you owe either by size (popularised by Dave Ramsey as the Debt Snowball) or by interest rate (see Debt Avalanche Definition | Investopedia).

The common answer is to arrange the debt that you owe either by size (popularised by Dave Ramsey as the Debt Snowball) or by interest rate (see Debt Avalanche Definition | Investopedia).

But, both of these methods are flawed because they incorrectly assume all debt is bad (see Good Debt Vs. Bad Debt), but this is only true before you take on debt.

But, once you have taken on debt, debt is either cheap or expensive and requires a whole new way of thinking …

There’s an old adage that says a penny saved is a penny earned.

Well, this is also true for debt, where the currency is not pennies, but interest rates:

A percent saved in interest is exactly the same as a penny earned in interest.

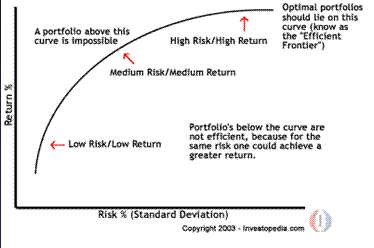

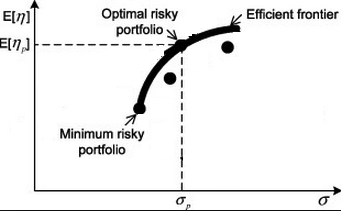

This means that you should sort all of your debts and all of the possible ways that you could earn interest on your money in order of interest saved or earned.

It would work something like this example:

I still owe $1,487 on my credit card at 19% interest

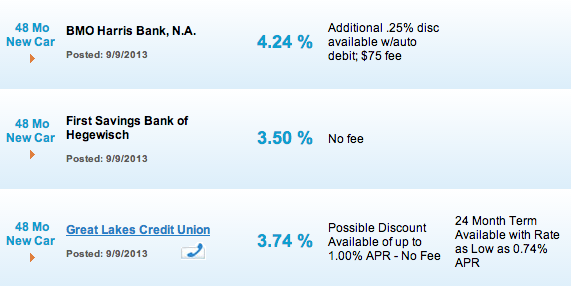

I still owe $5,352 on my auto loan at 11% interest

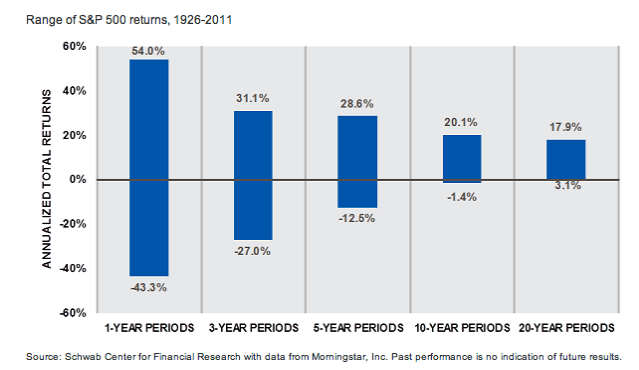

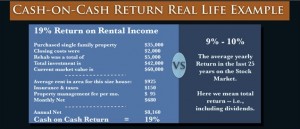

I can invest my money in a low cost stock Index Fund and earn 8% return

I still owe $142,694 on my home loan at 5% interest

I still owe $11,223 on my student loan at 2% interest

I can invest my money in a CD and earn 1% interest

Notice how this list is sorted by amount of interest paid or interest (return) earned?

So, if you would have cash left over each month after making the minimum payment on each of the loans, instead of simply keeping it in the bank (earning 0% to 1%) as most people would do, this table makes it very easy to …

Pay off your expensive debts quickly and safely earn a much higher return on your investments:

Step 1: Instead of making the minimum payment on your credit card, make the minimum payments on your auto loan, your home loan, and your student loan, then

Step 2: Pay as much as you can then spare that month on your credit card. Repeat monthly until paid off.

Step 3: Once the credit card is paid off, move to the next on the list (i.e. your auto loan). Notice how you should have much more available to pay monthly, as you no longer have to make any payments on your credit card – which was your most expensive debt, at 19% interest!

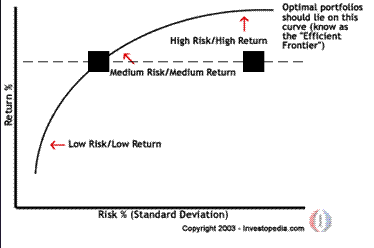

Step 4: Once the credit card and auto loans are paid off, stop paying down debt (this is where the Debt Snowball and Debt Avalanche & all other ‘pay off all debt’ strategies fail), instead:

Step 5: Continue to make the minimum payments on your low interest home loan and student loan, and pay as much as you can spare each month (which should be quite a lot, now, as your most expensive loans are now paid off!) into an investment such as a low-cost stock Index Fund. This is Dollar cost averaging into the whole US stock market, and is Warren Buffett’s preferred strategy for non-experts to invest (source: Warren Buffett to Heirs: Just Use Index Funds).

Step 6: Revisit this list every 6 to 12 months (simply resorting your debts owed and invest opportunities into strict interest-rate (paid or earned) order, and follow the steps, starting at the top and working your way to the bottom.

Note: If any of your loans has a term (i.e. has to be paid off by a certain date) and your minimum payments are not sufficient to pay them off in time, simply withdraw some of your Index Fund balance a few days before the loan falls due and pay it off. Then, resort your list and start again.

You will thank me when it comes time to retire …

{Also published on Quora: https://www.quora.com/What-is-the-quickest-way-to-pay-off-debt}