In his bestseller, The Number (2006), Lee Eisenberg relates the story of a man who outlined for him what somebody else told him [AJC: already, this sounds like an Urban Myth] about what it takes to be rich:

This is really interesting, because it matches what I was told when I began my Journey (to $7 million in 7 years) by a well-known finance guru; at the time, he said [AJC: paraphrasing; my memory’s not THAT good!]:

In order to live a ‘rich’ lifestyle (i.e. you can drive the cars you want, live where you want, travel whenever and wherever you want) you need an income of at least $250,000 per year.

Now, that was back in 1998 … so, when I bumped into him a year or two ago, I reminded him of what he told me then, and asked him what he thought the ‘number’ was now: he said “$500,000” [AJC: that’s per year].

In fact, that $250k (times the 20 multiple that he also told me that I needed) was the exact basis for my $5 million Number, because I didn’t know how to calculate it any better (then) … and, along with discovering my Life’s Purpose, started the journey that totally changed my life.

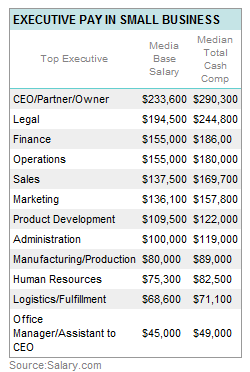

Seeing this table, excerpted from Lee Eisenberg’s book [AJC: which, he admits ripping from somebody else … apparently, that’s how these ‘rules’ get written!] only reinforces that … so, just decide whether you want to be “comfortable” (or, “comfortable+”), “kind of rich”, or plain ol’ “rich” and your Number is virtually set!

Which brings me back to the question of whether CEO’s are rich, in the first place?

[AJC: we already know the Fortune 500 CEO’s are, but what about the ‘ordinary’ CEO’s of all of those small-to-medium-size businesses out there?]

Really, it’s only the CEO’s of those businesses (and, their highly-deserving legal advisors) who can even claim to be “comfortable+”.

Most senior management in these businesses can only claim to be ‘comfortable”, at best …

… so, the real reason why most CEO’s aren’t rich is that they simply don’t earn enough!

My question to you is:

If you know your Life’s Purpose, and if you know your Number (particularly if it’s a Large Number / Soon Date) why are you wasting your time:

– kissing up to your boss,

– back stabbing your work mates, and

– running ragged for your company’s customers?

… just to have the slightest-possible-chance of getting to the ONE job in the WHOLE company that ONLY makes you “comfortable+” AT BEST?

Seems silly to me …

When I crunched those odds (way back in 1990), I very quickly made a rush for the Exit Door at my high-flying corporate job 🙂