If you find yourself asking a personal finance question like this one, this post will give you all the tools that you need to answer it for yourself:

If you find yourself asking a personal finance question like this one, this post will give you all the tools that you need to answer it for yourself:

I am in my early 20s, earning between $110-180k/yr depending on my bonus. Would it be inappropriate for me to drive a $50k Mercedes Benz?

Most people would deal with this by saying things like:

– Can you pay cash for the car?

– If you buy a Merc now, what will you buy next year?

– Save for your own home

– And, so on …

Which are all valid concerns …

… but there is one important question that nobody thinks to ask:

What is your current net financial position (i.e. net worth)?

Yet, this is the most important question to ask!

Why?

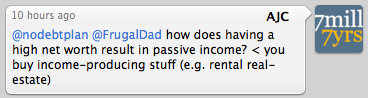

Because it’s your Net Worth that sustains you in retirement:

– Before your retire, you earn income

– You save and invest as much of your income as possible to build up your ‘nest egg’ (this is your net Worth on the day that you retire)

– After you retire, you live off the income (e.g. interest, dividends, investment income, etc.) generated by your Net Worth and/or deplete it over time

And, this takes you directly to The Golden Rule of personal finance …

… because, it’s the one financial rule to live by; the one above all others; the one that – if you follow it – will answer all of your financial questions and guarantee your financial future:

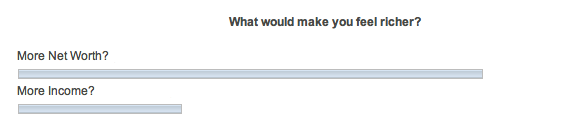

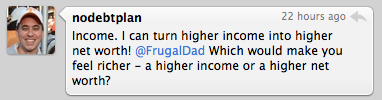

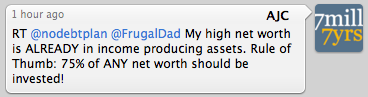

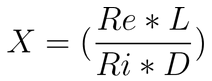

Always have 75% of your net worth in investments.

This means: at least until you retire at a time and place of YOUR choosing, that you should always have no more than the remaining 25% of your current net worth (tested yearly) as equity in your own home, car, possessions, etc..

These rules of thumb then follow:

– Have no more than 20% of your current net worth as equity in your own home

– Have no more than the remaining 5% of your current net worth in your other possessions. It is typical to split this 50/50 between your car and your other ‘stuff’.

– This means that you should have no more than 2.5% of your current net worth in your car. I suspect that the reader’s proposed Mercedes would break this rule.

There are a few important things to note, if you’re going to obey The Golden Rule:

1. You can – in fact, should -break the 20% Equity rule for your first house (otherwise, you will never be able to afford to buy one), but don’t upgrade for as long as you will be breaking this rule.

2. You will probably need to borrow money to buy your house (first and/or future home), but don’t spend more than 30% of your take home pay on the mortgage repayments, except – again – for your first house (but, only if you absolutely have to).

3. Never borrow money to buy a depreciating asset (e.g. car) UNLESS it’s required to earn income AND you have no other way of buying one. Even then, obviously buy the cheapest that will do the job, borrow the least, and pay it off early.

4. For a pleasant surprise, test these numbers annually: because your Net Worth will go up each year, yet your car and other ‘stuff’ will depreciate (check eBay). This means, you can actually afford to buy more ‘stuff’ every year or so, if you like, or just save up your ‘spare net worth’ for a couple of years to upgrade your car, etc. when ready.

So, are you following The Golden Rule?

If not, what do you have to change in your life so that you do?