The wrong way to buy a car is to lease it:

The wrong way to buy a car is to lease it:

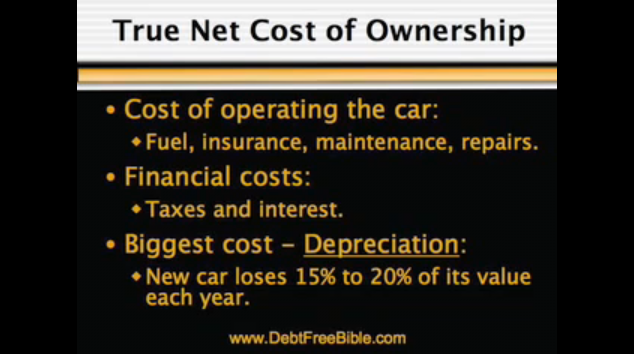

You’re financing a depreciating asset: so, as the car goes DOWN in value over time, your investment in it is going UP, payment by payment.

Dumb, huh?

The frugal way is to buy a used vehicle and run it into the ground.

But, what if you like and can afford to buy a ‘certain quality of car’?

Well, I would never buy a new one, and I would usually buy one of a lesser standard than I can afford, because cars do depreciate and are simply NOT an investment (even when you think they are).

Now, this is a blog for aspiring MULTI-millionaires, so I am going to spare you the usual reasons for buying used rather than new [hint: something to do with depreciation vs future resale value curves], because you can actually afford to buy new!

No, what I have to share works on the assumption that you can afford to buy a new car, but you do have budgetary contraints: i.e. a Number that has to fund your required standard of living for life. You can’t afford (literally) to have your money run out before you do!

If you’re either too rich or too poor for that to apply then this post [AJC: actually, my whole blog] does not apply to you …

But, this post DOES apply if you have a new car budget, be it a new $250,000 Ferrari 458 Italia [yum] or a new $11,000 Chevrolet Aveo [yuk]:

No, the problem is that IF your mindset is to buy a new vehicle, then how do you feed your desires in 3 to 5 years when your ‘new’ car becomes just another ‘used’ car?

However you justified the ‘new car’ purchase – new car smell, new car warranty, new car reliability, new car status – in just 3 to 5 years, the ‘gloss’ will have well and truly worn off, and you will be in exactly the same position as you are in today:

You will want ANOTHER new car!

And, you will want another one – similar to the first one (or better!) every 3 to 5 years thereafter, until you are too old to care about cars anymore … and, take it from me, you will be pretty old when THAT happens 🙂

That’s why, when I ask people to calculate their Number, I ask them to come up with their required annual spending plan (and, multiply by 20), then add in any one-off costs: usually just houses plus your first post-retirement vehicle purchases (what’s your chances of your spouse settling for less than you?).

But, for non-annual repeat purchases (the annual ones should already be in the budget … get it?), I simply ask them to calculate a lease / finance rate for the occasional purchases they are interested in (e.g. cars, around the world trips) as though they were going to finance those purchases, and build that cost into their required annual spending plan (basically, their expected retirement living budget).

This will include your replacement vehicles … the ones that you will need to buy after the first 3 to 5 years in retirement.

How to calculate the correct amount?

It’s actually quite simple:

1. Choose the car from today’s model lists that seems to be likely to suit your purposes from a new car pricing web-site.

Right now, I drive a BMW M3, my next car is likely to be no less expensive. But, I actually want more, so I will build in the cost of a Ferrari 458 Italia (that should pretty much cover me for any other car I decide to ‘graduate’ to as I get older, e.g. top-of-the-line Mercedes). If I didn’t aspire to more in the future then I would use the current list price of a 2011 BMW M3 as my ‘base’.

2. Find the current price of a 5 year old Ferrari F430 (because the 458 Italia wasn’t around 5 years ago) from a used car pricing web-site.

3. Subtract 2. from 1.

4. Find an online auto leasing calculator and use 3. (i.e. the amount over the trade-in of your current auto that you will need to come up with every 3 to 5 years) plus the age of the vehicle that you selected in 2. (i.e. how often you expect to want to changeover cars) plus select an interest rate that is likely to reflect long-term averages for investment returns on your remaining money (6% – 8% is plenty)

5. The calculator should then spit out the monthly amount that you need to add to your required annual spending plan

Now, why should you choose “an interest rate that is likely to reflect long-term averages for investment returns on your remaining money” rather than the expected cost of FINANCING such vehicles?

Didn’t you read the opening paragraph of this post?!

You’re not financing anything, you are SAVING to replace you current auto (or, the one that you first bought when you reached your Number and stopped working), and you are building in the LOST OPPORTUNITY COST of having your cash tied up in your cars rather than sitting in your investment account working for you, and you are accounting for inflation pushing up the price of your future, future, future replacement vehicles.

What if you make a mistake with you future financial position or the price of your next car?

Well, you simply hang on to the cars that you already own for a while longer … or, ‘down-size’, if you have to …. who says that you HAVE to replace your cars every 3 to 5 years?

Now, you can apply this same strategy before you retire: it’s called saving up for your next car (and, the one after that, and the one after …) rather than financing it 😉

AJC.

PS If you run these numbers again, here’s an even better strategy:

Instead of buying a new car, buy a slightly used – but much better – make and/or model of vehicle. Because I’ve found that cars – just like radiation – have a half-life (but, different for each brand of vehicles) and some depreciate 20% as soon as you drive them off the lot, you may find that you can buy a much better car for the same money albeit 1 to 2 years old. If you choose well, you may find that you are (a) driving a better vehicle and (b) can keep this vehicle for another 4 to 6 years before replacing it (because ‘classic cars’ tend to remain classic long after your shiny new American/Japanese/Korean production-line ‘beauty’ has well and truly gone off the boil). Plug a 6 to 8 year replacement cycle into you calculator v the 4 year one that you chose for new and see what that does for your retirement plans!

I have a confession …. and, an announcement!

I have a confession …. and, an announcement!

What do cars and radioactive material have in common?

What do cars and radioactive material have in common?

I’m glad that some people still rummage through my

I’m glad that some people still rummage through my  We all have a car … otherwise, we’d be cycling to work. But how much car? Do you buy new/old or somewhere in-between? After all, our car is one of our largest purchases … if not, largest purchase outside of our own home.

We all have a car … otherwise, we’d be cycling to work. But how much car? Do you buy new/old or somewhere in-between? After all, our car is one of our largest purchases … if not, largest purchase outside of our own home.