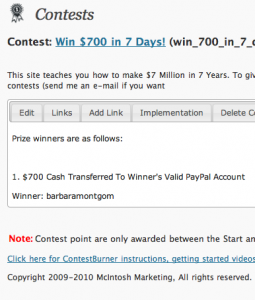

UPDATE: We have a winner in my $700 in 7 Days Giveaway … yep, ‘barbaramontgom’ (with 6 points) was chosen by random drawing (see below) and wins the entire $700 Cash!!!!!! Barbara just needs to send me an e-mail ajc [at] 7million7years [dot] com to claim her $700 cash prize (less any PayPal fees)!

UPDATE: We have a winner in my $700 in 7 Days Giveaway … yep, ‘barbaramontgom’ (with 6 points) was chosen by random drawing (see below) and wins the entire $700 Cash!!!!!! Barbara just needs to send me an e-mail ajc [at] 7million7years [dot] com to claim her $700 cash prize (less any PayPal fees)!

Bet you wished that you had entered 😉

Special thanks to Steve and Trisha who tied at the top of the leader board … if you send me an e-mail with your name/mailing address I will send each of you a $60 Apple Gift Card! Thanks to all of the others who entered and promoted the contest like crazy!

LAST CHANCE to enter my free contest: CONTEST OVER: in just ONE more today, I am giving away $700 cash to one lucky reader (drawn at random) as part of my $700 in 7 Days No Strings Attached promotion. It’s free to enter simply by clicking here.

________________

CNNMoney fields a question from a reader who’s scared that her money will run out before she does:

Question: I recently had to take early retirement at age 57 because of back problems. I’m now looking for a safe place to invest my retirement money where I’ll have no risk losing it. Any suggestions? — Donald H., Morris, Alabama

Yes, I have a suggestion: don’t post your questions to a financial ‘expert’ who still works for a living!

If you do, you’ll get answers like:

Answer: If the threat of losing principal were the only financial risk you had to protect yourself against in retirement, then finding a safe haven for your money would be pretty simple. You could plow your entire nest egg into Treasury bills or spread it among FDIC-insured savings accounts and CDs (taking care to stay within the FDIC coverage limits).

But while doing this would insure that you would never lose a cent of your money, it would also insure that your retirement stash earned a pretty measly return.

Good, so far … so, no cash. Got it!

What should she do instead (?):

If you want to have a decent shot at your retirement savings lasting as long as you do, you also want to invest in a way that has at least some potential for long-term growth.

[Keep some in cash and the] rest of your savings you want to keep in a diversified portfolio of stock and bond funds. Again, there’s no single correct mix. Typically, though, someone just entering retirement might have 50% or so of his or her portfolio in stocks and the rest in bonds.

Zowie!

Question: If you are aiming to retire, why do you want long-term growth?!

Answer: Because, you expect to lose some significant proportion of your capital to:

– Spending too much,

– Inflation,

– Market downturns.

In other words, the expert recommends to invest in a ‘wiggly line’ investment, hoping that the upswings outweigh all the downswings + spending after inflation is taken into account.

How well has that been working out for the past, oh, 20 years?

So, can you think of an investment that tends to grow with inflation, and provides income that also tends to grow with inflation?

Well those treasury-protected bonds certainly have principal that keeps up with inflation, but the returns are so low that income will become a real problem.

But, what about real-estate?

It’s where ‘the rich’ have kept the bulk of their retirement savings since time immemorial … I wonder why? 😉