Thanks to all of you who voted, especially those who backed up their vote with an opinion (via the comments section of my post)!

Jason asked whether he should continue renting the commercial condo that his business is in for $1,800 per month OR buy it for $160,000? When he asked his friends earlier he didn’t get much help:

I have asked a lot of people and get about half giving me one suggestion while half give me the opposite!

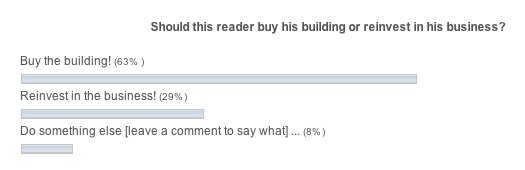

Unfortunately, as is often the case with these difficult decisions, our vote is split 3:2 … but, in favor of buying the building.

For example, Zach is emphatically FOR buying the building:

More information would be helpful, but that seems like a good price for $1,800/mo rent. Business or no business, I would take that deal every time.

Whilst, Victor is equally AGAINST:

Don’t invest in something you don’t know much about, you know your business, invest in that, pass on what you don’t know.

So, Jason is right back where he started 🙁

My general advice in these situations, without having nearly enough enough info to give specific/personal advice, is to …

… do both. Every single time.

You see, it comes from the advice that my Grandpa once gave me: I remember him recounting an argument that he had with Grandma when they were just starting out. Grandma wanted to buy a modest home, instead of renting what amounted to little more than dumps, being all they could afford as poor immigrants, but my grandfather had other ideas; he said:

From a business, you will always be able to buy a house. But, from a house you will never buy a business.

Sound advice (it certainly guided me), but how does it help in this situation?

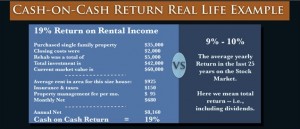

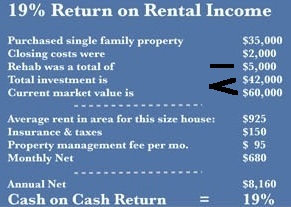

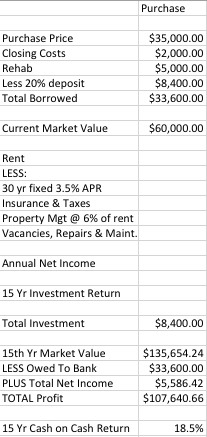

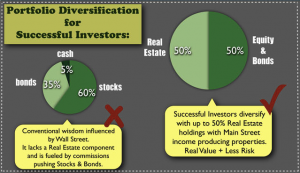

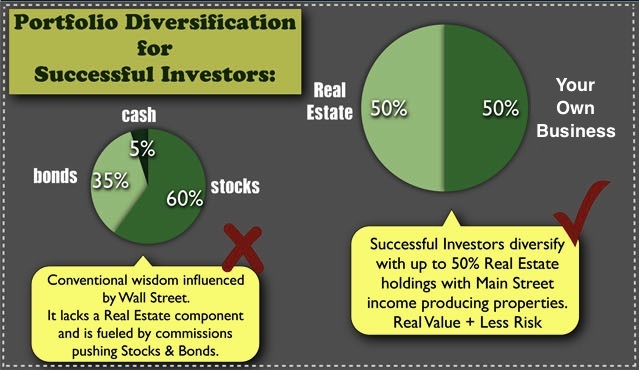

Well, it applies in reverse: when you have a business that’s generating cashflow, you have to start thinking about external investments, and buying your own premises is often the best place to start. Of course, you still have to keep the reinvestment needs of the business in mind … after all, that’s what’s generating the cash!

But, what happens when it seems you don’t have enough capital to do both?

That was the situation that I found myself in when we outgrew our last rental office:

I found a building that we could rehab for our purposes, but that I felt had good future capital appreciation value: in other words, a building that I thought – first and foremost – would be a good investment.

It was way over budget (e.g. when comparing old rent v new mortgage), but it seemed too good an investment opportunity to simply pass up.

I had no idea how to value it properly, and it was going for auction, but I found out that the only other serious bidder was a property developer. I knew that he would only pay land value, not much more.

This was a trick that I had employed successfully once before: find a property that developers are interested in, but that you want to own/occupy and pay $1 more than they are willing to bid.

And, that’s roughly what happened (cost me $1k over his losing bid of $1.36m) …

Then the worry started: how was I going to pay for this monolith? How was I going to find the deposit?

I dealt with the second issue (finding the deposit) by employing a tried-and-tested short-term funding method: shorten the time to receive payments from clients and lengthen the time to pay suppliers.

This (temporarily) reduces the amount of working capital tied up in the business at the (hopefully, manageable & short-term) expense of happy customers and suppliers.

I dealt with the first problem (plus, the new problem of quickly replenishing the working capital situation) by not eating for 6 months 😉

This means, maximizing the profits of the business to help cover mortgage costs and rehab costs, whilst quickly rebuilding the working capital of the business.

Tough – very tough for a while – but, manageable.

And, that’s how I made my first real $1 million: I sold the building just a few years later for nearly $2.5m. It remains one of the best real-estate investments that I have ever made.

The only catch, if Jason were to employ this strategy, is that his building doesn’t look like it has much upside potential – with “32 units, of whitch 24 are currently vacant shells” in the complex.

Perhaps, Jason is better off using the month-by-month lease time, when his lease expires, to give him time to find something with a little more upside potential?