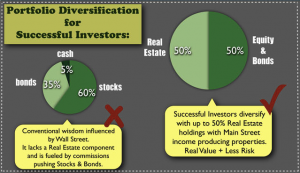

I came across this excellent infographic that talks about real-estate and its place in your investment portfolio:

I came across this excellent infographic that talks about real-estate and its place in your investment portfolio:

It (rightly) questions the typical “Wall Street” view that (a) asset allocation is important, and (b) that a 60/35/5 stocks/bonds/cash mix is the only way to secure your financial future.

Of course, a ride through 2008 fixed that view for a lot of folk …

So, I was quite impressed that a site that provides financial / portfolio allocation advice actually considers real-estate to be a viable investment option, and an equally important part of your portfolio.

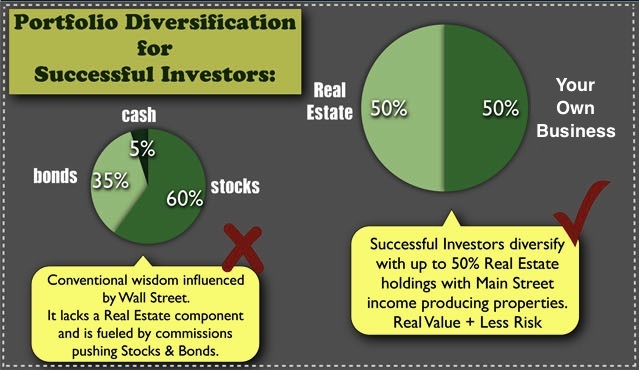

The suggestion is to use real-estate to provide the real diversification that you need.

And, it may even be the right for successful investors (although, I prefer a portfolio that is more like 90/5/5 real-estate/stocks/cash) …

… but, it is not the right approach for investors who want to become successful.

Let me explain.

The balanced portfolio may help you retain your wealth if you already have it (i.e. if you are already a successful investor), but is unlikely to make you rich on your own.

You see, in order to:

– Become wealthy, and

– Maintain your wealth along the way

… you need two things:

1. An Income Driver: i.e. something to provide an ever-source of cashflow, and

2. A place to invest that cashflow that compounds.

The good news is that you can achieve this simply by modifying the second, larger section of the pie-chart, somewhat:

Your own business is the best way to provide a rich vein of income that you can then tap to fund an ever-growing investment empire in real-estate.

Now, you can certainly grow income in other ways besides having your own business: you could look for a sales job that pays very high commissions (hundreds of thousands per year; or, a management job (preferably, c-level: ceo/cfo/cmo/cto) that pays the same, or better; or, take on a second job or a part-time job; and, so on.

But, nothing has the earnings-growth potential of your own business (although, the ceo’s of certain Fortune 500 companies might – quite rightly – argue that point).

But, why real-estate?

Because both the capital value of the asset (i.e. the amount that you paid for it) and the income stream grow at least in line with inflation, given a long-enough investment horizon … so, you get a double-whammy of increase in your net-worth (i.e. the building grows in value) and the ever-growing rental income stream – if you save it rather than spend it – will eventually help you buy another, and another, and so on.

Keep this up for long enough, say 7 years, and my experience says you can become rich 🙂

Now this is an excellent post that really spells out some hard realities.

“But, why real-estate?”

Here are three other benefits: tax deductions (can be considerable), leveraging your money, and locking in debt at historically low interest rates (currently).

As a side note:

One thing that many people fail to understand is that the path to wealth is paved with tax breaks.

@ Adrian – you forgot the often quoted advice to have a portion of your wealth in gold 😉

@ Michael – leverage is one of the great adavantages of real estate over other asset classes. Can’t get long term fixed rates in most countries (largely a US thing) and even short term fixed rates are either not available or too expensive where I live. I’d be careful of tax based investing – governments have been gradually reducing those benefits as they scramble to extract more revenue from their citizens – NZ abolished the depreciation allowance on residential property which (in my case) more than doubled the amount of tax I had to pay.

@ Michael – agree with leverage. As for tax breaks: I love them when they come, but it’s dangerous to expect them … governments have a habit of giveth/taketh 😉

@ traineeinvestor – nonsense, I have gold on my arm, gold around my neck, gold in my pocket … 🙂 You & Michael hit the nail on the head re RE.

Interestingly, even in retirement – when I advise to DE-leverage all of your real-estate holdings, RE is still best because it’s one of the few reliable asset classes where both the CAPITAL and the INCOME generated increase roughly in line with inflation (unlike gold, which does neither).

@ Adrian – the emoticon was an unsuccesful attempt to denote sarcasm. My views on gold haven’t changed since I wrote this in 2006: http://aprivateportfolio.blogspot.hk/search?q=gold

And I am happy to admit both that buying gold would have been a good investment at the time and that I have a token amount in safe deposit box “just in case”.

As an aside, when I retire in a few months time, most of my properties will still have mortgages on them.

@ Traineeinvestor – I guess my counter to your counter was equally unsuccessful. We’re on the same page: gold is for wearing, not investing 🙂

I am now entering retirement (early) sold a couple businesses and recently sold most of my commerical real estate holdings and have cash. Mistake perhaps, but one should also consider when is the right time to get out. I find that all investments have an ideal window to exit (no perfect investment) and if one misses that window they tend to ride that investment into the ground (hoping for a comeback). I think the perfect portfolio is congruent with relative position (mentally and financially) of the investor. With that said I am in the position of finding the new perfect portfolio ! One other point about real estate it can be changed through renovation, zoning, tenants etc. so new/different value can be achieved with the same Investment. Adrain you and I are about the same age what do you do with cash at our age?! DE-leveraged real estate majority hmmm I don’t think so.

@ Will – my next property acquisition – one that I am preparing to make within the next 3 months – will be exactly that: a circa $1m commercial property (offices) paid for entirely with cash.

This will be my first such 100% cash RE purchase, but not my last!

Adrain,

Do you have timeframe on how long you will hold or at what price you would get out?

@ Will – because this is an “income + inflation-hedged capital protection” retirement strategy: until the day I die 😉