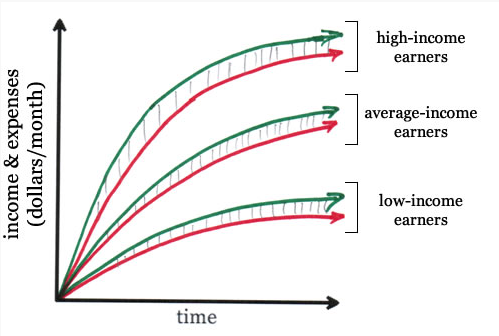

Fellow blogger, Jonathan Ping, was kind enough to include a chart from one of my earlier posts in one of his recent posts, so I thought that I should repay the favor by including one of his charts, here:

I recommend that you read his original post, but the chart itself is pretty self-explanatory; it shows the problem in personal finance … and that’s:

As your income grows so do your expenses.

It’s called ‘lifestyle creep’ and is one of the key reasons why the actual wealth of high-income earners (as indicated by the grey shading between the green income line and the red expense line) is not necessarily that much higher than that of some medium- (or even low-) income earners.

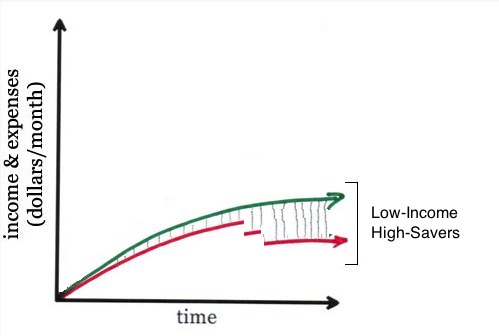

The obvious solution, according to Joe and many other pf bloggers, is to reduce your spending:

This way, you decrease the red expense line relative to the green income line …

… in the process, enlarging the grey-shaded area between the two lines i.e. allowing, at least in theory, even low-income earners to increase their wealth!

The problem with this strategy is that saving – especially, saving more (probably a lot more) than you do now – is really, really, really hard.

Austerity hurts. Austerity is against nature (well, my nature).

It gets worse: saving now so that you can spend later simply doesn’t work!

To make this type of cookie cutter personal finance plan actually work, you need to be debt-free and be able to live on just half your current annual income for your whole life.

In other words, you need to drop the red savings line to no more than half the green income line … not later, but now … and keep it there for the rest of your life.

Never fear, I have a better plan …

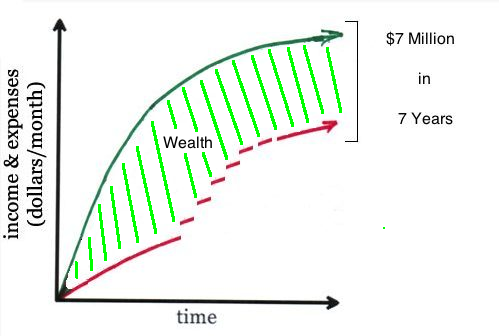

… it’s one that is far more natural, because it allows you to maintain your current standard of living, even increase it over time:

Let’s say that you start off as an average-income earner; here are your steps to success:

1. You can start to save a little, perhaps more than you have done in the past. Don’t worry, this austerity is temporary … after all, you already know how I feel about too much belt-tightening.

2. Once you have a little money beginning to pile up, you should find a way to put it to use to help you grow your income. Perhaps you could: start a part-time business; buy an ‘absentee-owner’ franchise; or open a car wash. You could work a little smarter and score that big (or little) promotion. Maybe you could collect a windfall: a tax refund; find a rich aunt who dies and decides not to leave all her money to her cat after all; or, you get really lucky and hit a small jackpot at Binions.

3. As your income grows, you should increase your spending by no more than 50% of your after-tax ‘pay rise’. The rest must go back into your little pile of money. Then you should concentrate on finding even more ways to put it to use to help you grow your income. Are you beginning to see a pattern here?

4. As your income grows at a (much) faster rate than your spending, you will slowly begin to see that you are actually already tending towards saving 50% of your income without even trying!

Keep it up for 15 to 20 years, and you’ll be able to sustain that savings rate all the way through – and beyond – retirement, as you build a big enough bucket of wealth (your net worth) as shown by the green-shaded area between your income and expense lines.

What’s more, this fully sustainable standard of living is always more than your current standard of living, so you never, ever need to tighten your best. The secret with this plan is that you simply don’t loosen your belt as fast as other high-income earners tend to do.

Obvious, really …

Now, that’s what I call eco-friendly finance 😉

[You can also read this post in the Carnival of Personal Finance: http://wealthpilgrim.com/

Nice post AJC. I can totally relate to this and agree with you. The challenge for many is that in the start up phase where a lifestyle adjustment may need to be had just to level set and get started.

I went through some short term pain (2 years) of paying down debts and building new income streams. We are by no means finished but just bought our 4th rental property and have plans to keep going.

Investing and growing wealth is addictive and taste better than any meal at a 3 star restaurant that I have had to forego (poor me I know!).

I get my kicks out of making money now… not spending… although one day in the future I will allow some of the creature comforts to creep back in.

@ Mike – I agree. Although, my wife did just send an e-mail to our friends suggesting that we book the #1 restaurant in Australia & we are seriously thinking of making the one hour drive from Barcelona to the #1 restaurant in the world, when we are in Spain later this year …

… BUT, like you, we did more than our fair share of belt-tightening to put ourselves, financially, in this position 😉

AJC, great minds think alike. I was just perusing the SP Top 50. This is one of the hobbies (working through the list) that I do miss. August tables for Noma open on the 6th of May… If you’re going to come to Europe you may as well stop at the former number 1 as well!

It certainly worked for us. As our income increased we did increase spending, but by less than the after tax additional income. And a lot of this was during the period when we got married, purchased our first home and had children.

Two problems I see too often are:

– people who increase their spending in anticipation of future increases in income; and

– people who permanently increase their spending in response to a temporary increase in income (e.g. a bonus).

I set savings goals and then try to force my budget to conform to them. It doesn’t always work, but after a year or two you figure out where the the comfort level is and things just kind of move on autopilot.

It’s not that easy, because life gets in the way. Every so often you’ll get a new job or have to move across country or maybe get married or have kids. Then things get shaken up again.

Travel trip. In Spain now and I strongly recommend the “alkimia” restaurant in Barcelona. Not cheap, but a great experience. For most meals, we have been enjoying the tapas.

Adrian, if you are coming here in the height of the Spanish summer, be prepared for some heat.