What do cars and radioactive material have in common?

What do cars and radioactive material have in common?

Well, besides each being a potential environmental disaster if not managed well … they both have a half-life:

– For radioactive material, it’s the period of time for a substance undergoing decay to decrease by half,

– For your car, it’s the time it takes for you to lose half your money!

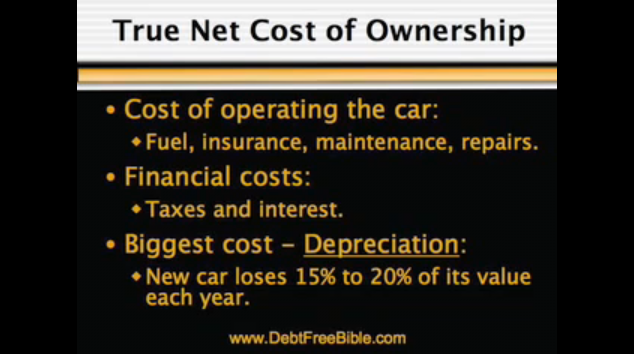

This is because the largest cost of auto ownership is not the finance charges, the taxes, the gas that you put in the tank, or even the tires or repair costs … it’s a largely ‘hidden’ cost called depreciation.

You see ‘depreciation’ when you sell the car as The Amount You Paid less The Amount That You Get Back.

Even the amount that you get back helps to hide the true depreciation cost because you will often trade in the vehicle and the dealer might ‘sweeten’ his offer by giving you a higher trade-in figure than the car is really worth … but, what he is really doing is giving you a discount on the purchase price of the new car (a discount that you may well have received – or exceeded – even if you didn’t offer a trade-in).

Even if the 15% to 20% p.a. depreciation claimed by Debt Free Bible is true, what effect does that have on the value of the vehicle?

The chart shows if you paid $25k for your new car, you can only get $12,800 if you sell it after 3 years, even if you decide to hang on to the car, it has cost you $25,000 – $12,800 = $12,200 …

… or, $4,067 a year!

[ AJC: And, don’t forget all of those other costs that we mentioned: “the finance charges, the taxes, the gas that you put in the tank, or even the tires or repair costs” 😉 ]

So, how accurate is that “15% to 20% p.a. depreciation claimed by Debt Free Bible”?

Well, a paper published by the IAES, which evaluated the depreciation rate of 15 automobile brands available in the USA for the years 2000-2004, yielded 5 tiers of depreciation rates:

Tier One: Honda and Lexus with an average annual depreciation rate of 13.4-14.1%.

Tier Two: Volkswagen and Toyota with an average annual depreciation rate of 16.5-16.8%.

Tier Three: Nissan, Mercedes, BMW, Hyundai, and Mercury with an average depreciation rate of 18.9-21.2%.

Tier Four: Chevrolet, Chrysler, and Saturn with average annual depreciation rates of 25.4-27.5%.

Tier Five: Dodge, Ford, and Buick with an average annual depreciation rate of 31.1-32.6%.

Now, using these rates, I have calculated the Half-Life of each brand for you, simply by using the Rule of 72 [AJC: divide the depreciation rate into 72; the answer is the number of years it will take to halve the purchase price] ….

Use this table to find 7 Million 7 Years Patented Half-Life For Your Next Car:

Honda / Lexus: 5 Years 3 Months.

Volkswagen / Toyota: 4 Years 4 months

Nissan / Mercedes / BMW / Hyundai / Mercury: 3 years 7 Months.

Chevrolet / Chrysler / Saturn: 2 Years 9 Months.

Dodge / Ford / Buick: 2 Years 3 Months.

Using this information, you could do some very fancy tables about the break-even point of spending more to buy a new (say) Lexus instead of a new (say) Nissan – factoring all the other costs of ownership, if you want to get real fancy – given that you have a couple of years worth of depreciation to play with …

… rather, I would like you to see that you are far better off buying a second-hand vehicle of the type that you are after, so that you can pay half-price 😉

You do this, simply by buying a 4 year, 4 month old Volkswagen, or a 3 year, 3 month old Buick, etc.

Get it?

And, even if you were determined to buy new, you are still probably better off buying a slightly ‘better’ brand used – even if it means going up a tier or two – than you are in buying a new ‘standard’ brand auto.

Sorry GM and Ford, but you are in DEEP trouble, because you simply aren’t competitive!