Albert Einstein was wrong … the financial experts are wrong … and, we’re about to debunk perhaps the greatest – and, most misleading – of all finanical ‘truisms’ …

Albert Einstein was wrong … the financial experts are wrong … and, we’re about to debunk perhaps the greatest – and, most misleading – of all finanical ‘truisms’ …

… and, you’ll be able to say that you read it here first 😉

You see, the cornerstone of almost all personal finance books and philosophies is the so-called ‘Power of Compounding Interest’ … if you need a primer, check out this little video that I ran last Sunday: http://www.youtube.com/watch?v=qEB6y4DklNY

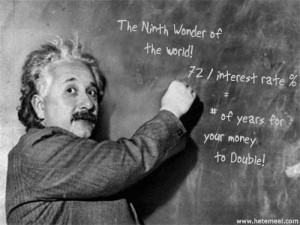

There is no disputing that compounding interest has immense power, but only when compared to so-called simple (or ‘flat’) interest; use the Rule of 72 (that Albert is writing on the blackboard) to see for yourself: simply divide any old interest rate into 72 to see how many years it will take to double your money …

… for example, at 10% interest, you would double your money in just over 7 years.

Neat.

Neat, but useless …

You see, Luis gently reminded me of this blog’s “motto”:

Now, find out how you can make $7 million in 7 years … no scams, no schemes … just good old financial advice!

As Luis pointed out, we aren’t trying to double our money in 7 years … we’re trying to make $7 million in 7 years!

Unless you’ve already got $3.5 million in the bank, you simply won’t get there … and, if you do have $3.5 million in the bank, you’re not reading this blog, you’re reading the one about “How to get to $170 million in 7 years” 😉

You see, in order to work, compounding interest needs a key ingredient … one that we don’t have much of:

Time.

In order to produce a large outcome (say $7 million) – starting from a small base (say $50,000) – compounding needs BOTH a high compound growth rate and a lot of time.

For example, if you start a business that has the potential to deliver an annual compound growth rate of 50%, you still need to wait 13 years before you reach the magical $7 million.

If you choose a more ‘mundane’ investment, such as managed funds that might deliver a 9% return (after fees), you could wait 38 years and still barely crack your first million.

And, if you manage to save 30% of your salary (say, $50k starting salary, growing 3% per year) and invest it in those same managed funds, you should manage to crack the $1 million mark in ‘just’ 21 years, and you will be well on-track to write your own blog: “How I enslaved my way to $7 million in just 40 years”.

Compound interest isn’t a ‘force’, it’s an effect that occurs when you simply sit back and don’t do anything!

Do you think you should be handsomely rewarded for that? Do you seriously think that sitting on your hands will propel you into the top 1% of Net Worth in, say, the USA?

Or, is your goal simply to save your way to the biggest Number that you can achieve before you are retired? If so, compounding is an effect that you should study very closely.

But, this is a blog about how to get Rich(er) Quick(er); it’s for those with Large Numbers / Soon Dates …

… to us, compounding interest is slavery … if this is your prime investing strategy you enslave yourself to a life of work and frugal living, running the risk that being able to truly live your Life’s Purpose will remain just a dream.

Do you have a link for the $170 million in 7 years blog??!! 😉

@ Ryan – I’ll send it to you; I read it every day 😛

Hmmm. You didn’t prove anyone wrong. All you said that the philosophy you are talking about does not rely on the compounding effect of interest.

But in fact, I would claim that you actually really need the compounding impact of interest when executing your approach. Isn’t what you are talking about a kind of uphill snowball? Take some capital + sweat equity + bit of luck and turn into a larger payout than the initial investment, then reinvest that payout again “snowballing” yourself to ever larger payouts until one magical day you hit the “number”, right?

Well that relies on compounding interest. Every time you re-invest, you invest your original capital plus gains (aka interest), when you then achieve a return on that investment you have interest upon interest or compounding interest. In fact, if you could only get simple interest, it would take you *much* longer to hit your “number”.

Or does it sound like I speaking in tongues? 🙂

“How I enslaved my way to $7 million in just 40 years”.

Ha ha ha! Sad but true. And you are describing the frugal people – most will not save anywhere near that.

Understanding compounding (and its limitations) is vital though, if only to team you how dangerous a poorly managed credit card is.

Note to self: Maybe one of my business ideas should be starting my own CC company. Anyone with over a 750 credit rating want to borrow money from me at 18% interest?

Compounding interest is a very big part of getting to the magic number needed to retire. But there are many ways to get there faster no doubt, starting a business,winning the lotto,getting an inheritance. All that can happen but compounding interest is a sure safe way to go in the long run.

Neil,you had better get your Tax number from your state before thinking in terms of charging 18% interest huh? to avoid that pesky usury thing. 😉

@ Modder – Point taken, although it’s probably more akin to a chain reaction – or hitting a j-curve or three [ http://7million7years.com/2009/06/11/its-all-about-the-curve-part-iii/ ] – than ‘simple’ compounding, that you (and I) are describing.

Adrian,

I think you made very good points here- with a small amount of time compounding isn’t the tool that will get you where you want to go.

>if this is your prime investing strategy you enslave yourself to a life of work and frugal living, running the risk that being able to truly live your Life’s Purpose will remain just a dream.

I wonder though- is a small time window a real necessity or just impatience? I don’t think the time working toward your life’s purpose is a waste. Nor should it be viewed as slavery. In fact, I suspect your life’s purpose would be less valuable to you if you were just given the money to accomplish it.

-Rick Francis

Rick ,no one is saying to give anyone their dream. You’d be working even if you find a way to do it quicker. Ok, lets say you open a business, and spend 20 years building your number . If you could do the same in half the time, its not as if someone handed you this, you still worked for it,only you found a better/faster way to get to that number, so you have more time left to do what you enjoy most(be it fishing , or travel or whatever.

Pingback: Cars and radiation …- 7million7years

Don’t need 7 million. All I need is $100 grand to pay off my mortgage and I’m rich.

David says:Don’t need 7 million. All I need is $100 grand to pay off my mortgage and I’m rich.

David, I don’t know how old you are, but , it seems to me, that if you have more then 10 years to live, your gonna want(and need) more than 100 grand to be feeling rich , or even to have much of a retirement to speak of.Unless,of course, you plan to spend your retirement sitting there watching reruns of Andy Griffith for the rest of your life.

@ David – I presume that the $100k is so that you own your house free ‘n clear and that you also have (or will have) plenty of cash in your retirement account to live a long and happy life without working?

I think your point about “How I enslaved my way to $7 million in just 40 years” is right on. I am all for being out of debt (credit cards, cars, school loans, and personal mortgage) but focusing all your time and efforts on saving money and being frugal is missing the point. I think David proved that.

Rather focusing on making money, and focusing on growing that money rather than just letting it sit there and grow, actively growing it.