Speak up, everybody … it’s important!

Speak up, everybody … it’s important!

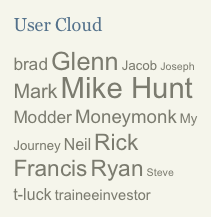

Take a look at the image (or scroll down to the very bottom of this page, to see the ‘live’ version) … it’s our ‘user cloud’ and reflects the quantity of recent comments by various users. It would be great to see your name on this list …

… in fact, while this blog receives its fair share of comments, it doesn’t – IMHO – receive its fair share of NEGATIVE comments.

C’mon guys, I write a controversial blog, one that flies in the face of conventional financial wisdom … don’t I? 😛

If not, I may as well shut shop …

Now, don’t get me wrong, I love positive reinforcement-style comments – the ones that let me know that I’m on the right track, BUT …

… it’s the negative comments that drive change and we should all be challenged from time to time [AJC: now, let’s not go overboard on the negative, shall we? 😉 ]

Later on in the week, I will introduce Dan, who challenges the notion that paying off your mortgage is the dumbest thing that you can do …

Hi Adrian

Controversial? If preaching setting ambitious goals and do-it-yourself financial independence is controversial then our society is in worse shape than I feared.

You have a great blog which is one of my regular reads. I listed it as one of my three favorites when I was asked to give a list of resources for people to refer to: http://aprivateportfolio.blogspot.com/2009/09/resources-for-personal-finance-and.html

Since you asked for some negative comments, here goes:

1. we haven’t seen a live feed for a while

2. although you do differentiate between optimal wealth creation strategies and wealth preservation strategies, this is not done consistently. For regular readers the difference is obvious but new/less frequent visitors may not always grasp the essential difference

3. information about resources/reference material that you find useful (if such things exist) would be appreciated

In the overall scheme of things, these are pretty trivial points (and please feel free to tell me my comments are wrong, stupid etc).

If I could add a request for future topics, anything you have to say about starting a small e-business while holding down a full time job would be appreciated. I’m sure I’m not the only reader who is not going to quit a job which pays enough to hit my number in an acceptable time frame but would like to do something a bit more entrepreneurial on the side. I’m looking forward to hearing more about your son’s business.

Cheers

traineeinvestor

OK . . . I have a few gripes. There is not enough substance to a good number of your posts. The topics are strong, but they are just barely touched or glossed over. Common sensible things like “In order to reach your number, you need to start an eBusiness”. Great advice . . . but nothing of real substance. If I told someone they would be healthier if they lost 30 lbs, they know that, I know that, but they are still in the same position they were. I would be inclined to read the posts and respond more if there was more “meat” to the subjects.

@ Trainee – Thanks for your suggestions; I’ll try and make the MM201 (wealth creation) and MM301 (wealth preservation) distinction a little more obvious. Thanks for naming me as one of your fav’s … I’m still blushing 🙂

@ David – Check out tomorrow’s post (assuming that you’re into real-estate!) … and, if you need more on a topic, simply add a comment with your question/s to any of my posts and/or drop me a line [ajc@7million7years.com].

AJC,

7M7Y is also a favorites in my browser…!

On the comments, wouldn’t you rather have quality over quantity? That’s the dilemna, you want participation but many blogs have tons of trolls that make comments but are of low quality IMHO…

You want more comments, start bashing the federal reserve and the debasement of the dollar. That’ll get the comments out in droves.

Be careful what you wish for.

-Mike

@ Mike – LOL. No, but I think SOME questions, criticisms, what-have-you improve the quality of any blog. Just trying to encourage those who may have thought about it, but haven’t yet put ‘pen to paper’, to speak up 🙂

Pingback: Your mortgage as a risk management tool?- 7million7years

By looking at your Popular Categories and their totals I see a pattern that you might want to address.

Popular Categories Totals

* Rich 132

* Starting Out 76

* Investing 67

* Business 54

* real estate 51

* The Number 44

* Saving 35

* Stocks 25

* retirement 20

* Uncategorized 15

* Your House 11

* Spending 10

* net worth 9

* money 8

* Your Car 6

* property 4

Rich seems to be the prominent category but should it be?

Blogs motto:

“Now, find out how you can make $7 million in 7 years … no scams, no schemes … just good old financial advice!”

Almost everyone hear understands your MM101, 102, and 103. Would it be better to categories your entries into these?

for example:

MM101: Starting Out

MM102: Starting Out

MM103: Starting Out

MM101: Real Estate

MM102: Real Estate

MM103: Real Estate

MM101: VIDEOS

MM102: VIDEOS

MM103: VIDEOS

MM101: INVESTING

MM102: INVESTING

MM103: INVESTING

MM101: NETWORTH

MM102: NETWORTH

MM103: NETWORTH

etc.

Another suggestion is that it is hard to find the many tools you have introduced.

Where’s the compound interest tool? Dunno

Where’s the networth tool? dunno

Where’s the Real estate proforma excel sheet? dunno

Where’s the life purpose worksheet? dunno

Where’s the life 10 questions to ask? dunno

If it’s not easy to access it won’t be shared with others.

Ok that’s it.

Saludos,

Luis

Pingback: Become an expert in your chosen field …- 7million7years

Pingback: The Myth of Compounding Interest ….- 7million7years