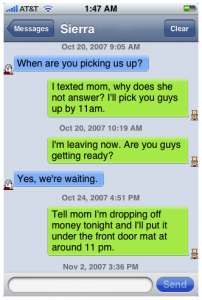

With this simple text message, I purchased a commercial property for $1.5 million (plus taxes and closing costs):

With this simple text message, I purchased a commercial property for $1.5 million (plus taxes and closing costs):

demo $75 and roofing $60 the rest $200 – $250 approx.

Good enough for me to close the deal!

Let me backtrack a little …

Over the past three or four weeks, I’ve been going through my numbers on developing a main road site into a high-rise condominium complex (60+ condo’s over 8 stories plus basement car-parking), but the project didn’t start that way:

It actually started as a buy-with-a-twist project that I favor so much (for good reason, I might add) …

…. the idea was to buy an unloved showroom/warehouse and rehab it into a bright, modern showroom with an excellent main-road frontage, then rent it out as a ‘buy/renovate/hold’ investment. It was only AFTER I made the decision to acquire it that we found out about the potential to rezone as multi-story.

So, let me walk you through the buy/renovate/hold scenario; you’ll be surprised [AJC: unless you’ve read this series of posts ] how LITTLE financial analysis that I do before acquiring 🙂

Step 1

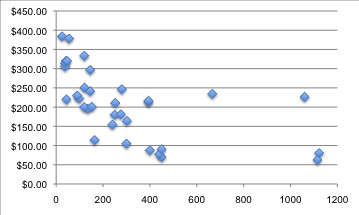

The first step is to understand what your end product is worth: to that end, I undertook EXACTLY the kind of analysis that I talk about in this post. This tells me that a showroom in this area should rent for approx. $250 per square meter (or, $23.25 per square foot) for office/showrooms in the 800 square meter (8,600 square feet) size range. It also tells me that the ‘capitalization rate’ in this area/market – at the current time – is approx. 5.5% to 6%, which is (a) not much in absolute terms, and (b) not even much when compared to prevailing interest rates.

So, now I know two things:

(i) Buying and holding a ‘ready made’ investment (i.e. something in good condition, already leased to a good tenant) ain’t gonna do much for my future financial well-being, and

(ii) Creating a ‘ready made’ investment for some other sucker … I mean, investor … could be the way to go.

Step 2

I now need to work out how much the project will cost me; which is easy, thanks to that little text:

– Purchase Price: $1,500,000

– Taxes and Closing Costs: $200,000 (approx.)

– Rehab costs; this is where that text – which was from my builder [AJC: whom, I should mention, is a trusted friend … otherwise, I would have looked for written quotes before proceeding] – comes in handy because it lays out the major costs for me:

– Demolition works – at $75,000 actually a large expense because the roof is asbestos and has been fire damaged, so needs to be entirely (and, carefully!) removed and disposed of; also, the building was formerly squash courts, so there are remnants of internal brick walls that need to be removed

– New roof – once the old roof is gone, it appears to be (surprisingly) cheaper to put up the new roof than it was to demolish the old!

– Renovations – now that we have a ‘clean’ four walls and (new) roof, $200k to $250k should be enough to render the horrible old yellow-brick exterior, put in nice large aluminum showroom windows, new plasterboard interior walls, suspend a new ceiling and associated lighting, dab a little paint on the walls, and put in some flooring (and, a little kitchen and bathroom) and we have a ‘new’ building for not much money!

[AJC: commercial renovations are generally cheaper on a per-square-foot basis than residential because the quality of finishes is lesser and there are no – or, small – kitchens and bathrooms to fit out]

Step 3

Now, I get to redo the sums:

a) I have an ‘as new’ showroom in a prime position that cost me $2,085,000 all up,

b) It provides a ‘net lettable area’ of approx. 800 square meters at $250 per square meter … we’ll have some letting, management costs out of this, but the tenants pay ‘all outgoings’, so let’s say that this nets $200 psm x 800 sm = $160,000 per year

c) This provides me with a $160k / $2,085k = 7.7% return

Step 4

Now, a 7.7% return isn’t shabby (in the local market that we are talking about); but, I could now turn around and find one of those lazy investors that we spoke about in the beginning … one of those guys who is after a low-maintenance, fully-let property and who is willing to accept a paltry 5.5% – 6% return.

They should be willing to pay me $160k / 5.5% to 6% = $2.7 mill. to $2.9 mill. or a cool $600k+ profit for not a lot of work/time on my part …

So, if I decide not to build the condo’s, my backup plan is complete 😉

Let me know if this long-winded series on real-estate has been useful to you …

Hi Adrian

Very useful. I’ve only done residential apartment refurbishment projects. Doing a commerical property in HK is generally reserved for insitutional players (and people with a lot more money than me) so I haven’t tried it yet.

A question: do you spend much time looking into vacancy rates and factor in holding costs (interest, rates etc) for the period from purchase date to when you get a tenant paying full rental? One of the things which I take into account whenever I buy a property is my ability to fund the mortgage payments and other outgoings while I am doing the decoration and hunting for an acceptable tenant.

Cheers

traineeinvestor

@ Trainee – Thanks; I found this methodology very useful, too … I actually have used it a number of times, now!

Yes, being able to fund the negative cashflow, preferably – as you say – in the startup period (“from purchase date to when you get a tenant paying full rental”) is critical.