Whilst it’s very tempting to go to your 4-F‘s (friends, family, financial planner a.k.a. ‘lifestyle planner’, financial advisor a.k.a. accountant) for advice on budgeting, I find that it’s quite a personal exercise.

Whilst it’s very tempting to go to your 4-F‘s (friends, family, financial planner a.k.a. ‘lifestyle planner’, financial advisor a.k.a. accountant) for advice on budgeting, I find that it’s quite a personal exercise.

In order to budget they – actually, you – have to ‘get’ … well … you.

Confused?

Let me give you an example:

I tried going to my accountant when I got back to Aus after a few years in the US, and here’s how the conversation went:

Him: Well, you could start off with a budget of $150k per year and see how you goMe: Start by writing 4 things on your whiteboard:1. Private Schooling for 2 children2. One to two overseas trips per year3. Invest in at least one startup per yearHim: OK, now what?Me: Write $50k next to each of thoseHim: OK, that’s $150k totalMe: That’s $150k per year, then you can add your $150k ‘starting budget’Him: Oh shi …

The steps to perform the only kind of budget that really makes sense are as follows:

1. Do a One-Time ‘As Is’ Budget

I described this kind of budget in this post, and it truly is the one and only time that I have ever made a personal budget.

It consisted of everybody in my family (at the time, only my wife and me) carrying around a pencil and piece of paper for a whole month …

… and, writing down every single thing that we spent a penny or more on during that month, whether by cash, check, credit card, or electronic transfer.

At the end of the month, it was fairly easy to categorize the expenses and tally them up. Of course, we also needed to prorate in some expenses, such as insurance, that are paid one-time, and prorate out similar multi-month expenses that may have been paid during that month.

At the end of it, you should have a fairly accurate picture of what you are currently spending.

2. Create your ‘To Be’ Budget

After my earlier post, you should have a reasonable idea as to how to do a Top Down Approach To Investing analysis.

It consists of working out how much money you need in order to stop work (retire … early!) i.e. Your Number, and when you need it i.e. Your Date.

Then you can work backwards to find out how much compounding you need and what investment vehicles can get you there.

But, the missing step is working out how much starting capital you need …

… now, I can’t tell you that, as it depends upon what you have in mind.

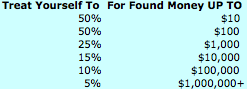

But, the chances are – and, to me, this is the sole point of doing your budget anyway – you will need to find a way to increase your savings to build up that little investing war chest of yours.

And, the best way to do that, is to start by paying yourself twice!

[AJC: most of the ‘how to’ detail in this post has been covered in the earlier posts that I have listed, above … don’t be afraid … go click some links!]

Now, that’s how to do a personal budget 😉

.

.