In 2009, Sports Illustrated observed:

In 2009, Sports Illustrated observed:

78% of NFL players and 60% of NBA players are bankrupt within two years of leaving the game.

From this Get Rich Slowly concluded:

Many professional athletes are horrible with money.

Why does this occur?

Investopedia in a recent article stated the obvious:

Athletes have a unique problem that many other professions don’t: the earnings window is small. While the more traditional careers may allow a person to work 30 to 50 years, a professional athlete will work only a fraction of that time. This leaves the retired athlete with the job of managing what they have to last for the rest of their life with only a fraction of their old salary being earned.

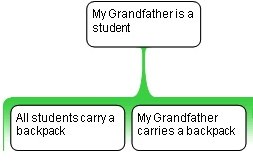

Whilst I agree with GRS that many sports players are horrible with money, this is simply an undistributed middle fallacy of the type:

- All students carry backpacks.

- My grandfather carries a backpack.

- Therefore, my grandfather is a student.

In other words, this problem is not isolated to athletes … they are just one class of people who have highly skewed earnings.

Others include anybody with what I call “Found Money”, which is my term for any one-off (or otherwise time-limited) sudden influx of cash. For example:

– Anybody who signs a major contract (athletes, musicians, actors, celebrities, even sales people or small business owners who “land that once in a lifetime deal”)

– Anybody who wins a substantial sum

– Anybody who inherits a substantial sum

… and, so on.

The Horrible Money Management Syndrome, that Get Rich Slowly incorrectly attributes to athletes, actually comes with the sudden influx of money i.e. it’s a problem with the source, not the recipient.

For example, there are lottery winners from all walks of life, yet the operators of the UK Lottery found that, on average, lottery winners had spent 44% of their winnings after just 2.5 years, which supports the anecdotal evidence that 80% will be entirely broke in just 5 years after winning a major lottery!

Whilst some sharp wits may observe that this is “because the qualifications for playing the lottery are being ignorant of the principles of mathematics” [AJC: for example, as one blogger recently observed, you are more likely to die from melting underwear than winning the lottery], my theory is that …

… you need to learn the lessons slowly on the way up, in order to stop yourself learning them the hard way on the way down.

In case any of you are planning to make a lot of money quite suddenly [AJC: even faster than $7 million in 7 years ‘suddenly’], you would be wise to heed the lessons that I taught my children when they were still very young (and, follow to this day):

When they get money [AJC: Any money: an allowance, a gift, find it on the street, etc.] half goes into Spending and the other half into Savings.

So, too, does it go for you: anytime that you get any additional money [insert ‘found money’ methods of choice: you’re a professional athlete; you win the lottery; you get a pay increase; a second job; loose change that you save out of your pockets; a gift; a manufacturer’s cash rebate; tax refund check; etc.; etc.] you Spend half and you Save half.

At least, this is advice that will tide you over until I share my Found Money System with you …

… next time 😉

Pingback: How to manage your life with just $19 Billion …- 7million7years

Pingback: A financial playbook for professional athletes …- 7million7years