This is quite typical of the types of questions that I receive from time to time:

This is quite typical of the types of questions that I receive from time to time:

I’m 21, and am clueless about finance. I want to start up a business at my mid 20s. Should I opt for endowment plans or unit trust?

The first thing you’ll notice is that there are no further details, as though there’s a ‘pat’ answer for every clueless 21 year old.

Still, let me suggest the following if you are 21 years old and also want to start a business ‘one day’:

1. If you consider yourself clueless about personal finance, start by reading everything you can.

Since you are young, start with I Will Teach You to Be Rich – I was weaned on a diet of Rich Dad Poor Dad, The Richest Man in Babylon, and so on …

Warning: The important thing to note is that these books are only to whet your appetite, they will NOT make you rich … once you reach a certain point, much of the advice will have to be discarded.

2. If you want to start a business in your mid-20’s the best way to prepare is by starting one now:

It doesn’t matter if the business is successful or not, the idea is to learn by doing.

While you are studying, you can easily start an online business: become an eBay seller; start a drop-shipping business; write a blog about your passion (or, perhaps about your financial journey) and package up some of the posts into a series of information products that you can sell.

3. If you are worried about company structures, don’t!

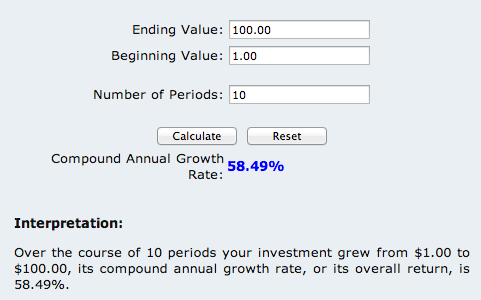

Just get started … and with your first $1,000 in savings (from 1.) and/or earnings (from 2.) see an accountant and do what they suggest … this isn’t the place for such technical advice.

If you do these simple things, you will be financially better off than 99% of your peers within years, if not months, and should remain so for the rest of your life.

Why?

Because they will remain clueless, whilst you will not 😉