If you read this blog often enough, you may be forgiven if you leave with the impression that saving is not important.

Of course, you would be wrong!

It’s just that enough is written elsewhere about saving – too much – that little is left for me to say here.

So much, in fact, is written about saving, that you would also be forgiven for thinking that it’s the Holy Grail of Personal Finance.

It isn’t …

But, if your aim is to begin Life After Work (a.k.a. early full/part-retirement) as soon as possible, then every dollar that you save now has a far greater meaning than you may, at first think.

Firstly, though, you have to eradicate from your mind the idea that each dollar that you save is to be closeted in the warm confines of your bank, perhaps sitting shoulder to shoulder with your other dollars in a 5 year CD, locked up like sardines in a tin can waiting for the day that the lid will slowly curl back, only to be quickly consumed.

Equally, you have to eradicate from your mind that the “invisible dollars” scraped from the top of your paycheck and secreted in the mysterious 401k will somehow pop up just when needed to save your retirement, like an airbag in a crash …

No.

It’s clear – at least to me and my long-time readers – that if you need a Large Number / Soon Date (that means, retiring early with a large enough bankroll to happily sustain you until your family finally decides to park you in some nursing home for the remainder of your drool-filled days), then you need to actively manage your money.

Perhaps you need to start a business? Or, you should start rehabbing some houses to build your rental portfolio? Maybe, it’s time to plunge head-first back into that Blue Chip Lottery called the stock market?

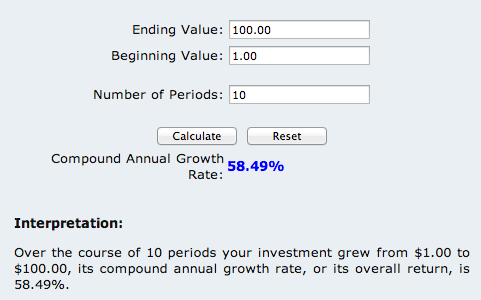

Whatever your ‘investing poison’, it should be clear (perhaps with the aid of a few minutes and a simple online compound growth rate calculator) that you need to actively work to gain Very Large Compound Growth on your Net Worth.

So, the value of each dollar saved now is not the paltry 5% to 8% return that others expect, passively watching their CD’s and Index Funds match-racing with Inflation …

… rather, it’s the value of using those dollars to build a small war-chest (OK, a modest level of seed-capital, may be more apt for most of us) that allows you to get started on your business / real-estate / stock-based plan.

And, it is every dollar that you add, or reinvest instead of spending, that helps to fuel the flames of growth.

Once you start to see the value of saving though the spectacle of building a modest pool of funds-for-investing, you begin to realize that every dollar that you save today is really the same as $100 in a mere 10 years time – if invested in a business.

If you don’t believe me, here it is in black (well, blue) and white:

So, slash those Coke Zero’s from your diet and start drinking tap water and, before you know it, you (too) will be a semi-retired multimillionaire, sitting on a beach in Maui …

Now, how do you feel about saving?

.

.

“sitting on a beach in Maui …

How do you feel about that?”

I feel good about that.

@ Patrick – Good pickup: I didn’t mean it to be rhetorical … I should have said “Now, how do you feel about saving?” (In fact, I just made the change. Thanks)

what’s a good amount to start at when saving for retirement right now im at 20000

@ John – if you want to retire in 10 years with $2 million, then $20k is a great start … assuming that you will use it to bankroll a scaleable business.

I just gave up my Starbucks habit with this in mind. The $5 I spend a week is now going into my investments instead!

@ Elizabeth – the key is that you have to have something WORTH giving up your Starbucks for i.e. an investment that will provide a high annual compound growth rate.

Pingback: Tin Stacker or Kite Flyer? Which one are you?- 7million7years

The most important take away from the article is this:

“Every dollar that you add, or reinvest instead of spending, that helps to fuel the flames of growth”

A perfect example of this is using accelerated tax deductions (e.g. cost segregation in real estate) to keep more of your money sooner to reinvest. The faster you can build your portfolio the better.

Speaking of cost segregation, I wrote off $600,000 in year one after purchasing several newer strip centers last year. My total tax bill was $5500 as a result. Too bad they allowed the Bush tax cuts to expire. No more bonus.

I’m not a huge fan of saving. I believe that investing money is much better than saving it. However, saving is important , and saving money is better than spending it on stuff you don’t need !