You’re hard at work, trying to to reach Your Number, and you’ve cranked up your Perpetual Money Machine to make sure that you get there …

You’re hard at work, trying to to reach Your Number, and you’ve cranked up your Perpetual Money Machine to make sure that you get there …

… now, there’s not much to do except work the plan.

So, let’s fast-forward a few years and think about what happens when you finally reach Your Number.

If you recall, you calculated your Number simply by:

Taking your Required Annual Living Expenses (which you adjusted for inflation) x 20.

Now, where did this Rule of 20 come from?

It is simply the same as withdrawing 5% from your Number each year.

Picture your Number as a pile of cash that you made by saving, investing, or even selling your real-estate and/or business portfolio, and now it is sitting safely in the bank as cash or CD’s, earning bank interest each year. The question is, how much can you safely withdraw each year to live off (like paying yourself a wage) so that you never run out of money?

When you are busy ‘working’ (be that on a job, in a business, or on your actively-managed investment portfolio) you will dream of nothing but having that pile of cash that equals Your Number just sitting there.

But, when you have that pile – hopefully, very large pile – of cash you will suddenly realize:

1. You have to pay taxes on the interest,

2. You have to beat inflation,

3. You have to spend some of your capital to live,

4. You have to survive market downturns.

You have to hope this money lasts as long as you do!

… all of a sudden, you have to be VERY protective of Your Number.

So, a key question becomes: what is a SAFE percentage of Your Number to withdraw each year? Usually, a great place to start is by looking at what ‘the experts’ recommend …

Unfortunately, there is support out there for just about any annual % of Your Number (i.e. your retirement nest egg) that you may choose to spend, for example:

7% – Not so long ago, the financial services industry proposed spending as much as 7% of your portfolio each year in retirement.

6% – More recently, Paul Graangard wrote two books proposing a combined bond-laddering and stocks strategy that, he suggested, supported a spending rate as high as 6.6% of your portfolio each year.

5% – Investment funds routinely allow spending of 5% of the portion of their investment portfolios dedicated to simply keeping up with inflation. Indeed, my Rule of 20 appears to support this withdrawal rate, too.

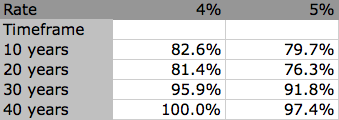

4% – A large number of studies – probably, the most famous of which is the so-called Trinity Study – advocate spending up to 4% of your initial portfolio (ideally, 50% stocks and 50% bonds, rebalanced each year), which provides somewhere between a 90% and 100% certainty that your money will last at least 35 years.

3% – A whole slew of new retirement planning tools (generally using a Monte Carlo approach to modelling tens, hundreds, or even thousands of potential economic scenarios) have been released over the last 4 or 5 years by the financial services industry, purporting to analyse hundreds of alternative economic scenarios to try and model what would happen to your retirement portfolio (i.e. simulating changes in interest rates, market booms and busts, etc.) to find the ideal ’safe’ withdrawal rate. A lot of these advocate very low withdrawal rates, typically in the 2.5% – 3.5% range.

2% – Some even advocate a totally ‘risk-free’ approach to retirement savings by investing close to 100% of your retirement portfolio in inflation-protected bonds (e.g. US Government Inflation-Protected Bonds – TIPS; Municipal Inflation-Protected Bonds – iMUNIs); historically, these have provided less than 2% return, after inflation but with total protection of your starting capital.

So, which is right?

.

.