[pro-player width=’530′ height=’253′ type=’video’]http://www.youtube.com/watch?v=MdmbkeJe6zo[/pro-player]

Late last year we had some discussion about so-called “safe withdrawal rates” i.e. what is the ‘magic percentage’ that you can withdraw from your bank account (or other investments) each year, once you are retired, so that you don’t risk running out of money?

Jacob from Early Retirement Extreme said:

It’s fairly well-established (by the original Monte Carlo paper) that the 4% rule is only good for 30 years. Also it only pertains to a broad market total return portfolio. For shorter periods I’ve seen people quoting up to 7%. For longer periods, 3% or less seems to be in order.

He also suggested for a “more extensive discussions see Bob Clyatt’s book”, which we started discussing last week.

Bob undertakes a reasonably good strawman-analysis of some of the existing thinking on Safe Withdrawal Rates then uses some of his own analysis to come up with three rules:

1. It’s OK to withdraw between 4% and 4.5% of your portfolio each year, but

2. You only need reduce the $ figure of the previous year by 5% to cushion the effects of a down-market, as long as you

3. Follow his recommendations for a highly diversified portfolio of stocks, bonds, bicycles, and sausages.

[AJC: OK, I made up the bicycles and sausages bit ;)]

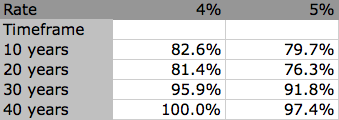

If you follow these rules, here’s your chances of NOT running out of money, depending on your time horizon:

Now, a few things bother me about this, indeed most discussions on this and other so-called Safe Withdrawal Strategies:

1. Here’s a bunch of people who generally advocate NOT to try and time the stock market, yet, in most cases (including Bob’s strategy, if you take the 5% option) you are trying to TIME the worst possible market of all: how long you expect to live!

2. There’s always a chance that your money will run out before you do – including in 7 of Bob’s 8 (recommended as ‘safe’ and ‘sustainable’) categories; and, in the one ‘safe’category, you still have to run the gauntlet of a nearly 20% chance of perhaps losing your money for 2 whole decades.

3. Even if you wind down your % to Jacob’s suggested 3% withdrawal strategy, Bob’s numbers [AJC: you’ll have to see the book for this one] still show an almost 15% chance of losing your money in the first decade.

Now, there are other Monte Carlo studies that show that withdrawal rates on 3% to 3.5% are pretty damn ‘safe’ … BUT:

a) Personally, I expect to live forever and expect my money to do the same, and

b) How close to ZERO (but never quite reaching it, according to the statistical analysis of 3% – 3.5% withdrawal rates) do I allow myself to get before I panic?

I can’t help thinking that you need to substitute the words “safe withdrawal %” for “the right length and strength of vines” in the video, above, to really understand what it would mean to suffer a prolonged market downturn in retirement 😉

I’ve said it before, and I’ll say it again: unless you have a perpetual money machine set up, there ain’t no safety in withdrawal rates!

It always interests me that people talk about how much to take but rarely how to take it and many people do not have a plan for weathering stock market downturns in retirement. If you face a 2008 in the first year of retirement and foolishly sell off part of your stocks you are in considerably worse shape than a person who has set aside sufficient monthly payments to weather a downturn.

AJC,

Nice video. I actually thought it was a ritual where there is a rope tied to his manhood and he has to throw a stone off the platform and hope the rope is long enough (like a frat ritual) but this is actually much worse.

Note that if you want to ensure you will only live to 80 you just need to ensure the vines are a few inches too long and give it a jump.

-Mike

Great Article, but Bob Clyatt’s math makes no sense to me. There is absolutely no way that one would be safer from running out of money with a longer time horizon (given they have the same withdrawal rate). If you have an 82.6% chance of still having your money after 10 years with a 4% withdrawal rate, then you have a 17.4% chance of running out of money. However, once you run out of money, you are done. There is no withdrawing next year. This necessitates that the longer your time horizon, the MORE likely you are to run out of money. Not less. Am I way off on this one?

Furthermore, for one to run out of money with a 4% withdrawal rate (adjusted each year for inflation) in 10 years, your portfolio would have to have 10 straight years of losses greater than 13.5%. If there is a 17.4% chance that you could see these kind of continued losses, it is time to get a new financial advisor!

These numbers just don’t make sense

In addition to the income machine, I like the idea of different buckets so you can withdraw from the ones that don’t have the pressure at the time the money is needed.

In the context of a 7m7y approach to wealth building, discussion of SWRs is meaningless.

I want my number to last forever without having to worry about the possibility of my wife selling my surplus (and non-surplus) body parts to maintain her lifestyle. A portfolio comprising mostly real estate and equities collectively yielding more than my cost of living + a safety margin backed by a cash/near cash buffer equal to 1-3 years of expenses to cover any emergencies or disruption to the cash flow gives me a larger number but spares me from having to worry about longevity risk or fretting over whether 3% SWR is really sustainable for 50+ years. The income from the equities and real estate should grow over time to more or less compensate for inflation.

Cheers

traineeinvestor

@ Trainee Investor – I’m with you on both the body parts and the strategy, although Mrs Cartwood is just mercenary enough to sell my kidneys, regardless 😉