I’m sure that Miley thinks she looks great … and, I’m DEFINITELY sure that her audience does, otherwise why would they come to her concerts in droves? It sure ain’t for the singing 😉

I’m sure that Miley thinks she looks great … and, I’m DEFINITELY sure that her audience does, otherwise why would they come to her concerts in droves? It sure ain’t for the singing 😉

But, as cool as she may (or may not) be … she had better not be dressed like that when she’s going for:

– a job interview

– a bank loan (well, in her case this might be OK)

– a sales presentation

– etc.

In other words, it’s not important how you look, but that you fit in with how your audience EXPECTS you to look.

When we have a Life’s Purpose that transcends ‘today’, you can make these kinds of short-term trade-off’s – you know, the “but my friends are all …” kind – because you KNOW that you have a long-term pay-off (your Number/Date, allowing you to live your Life’s Purpose, which probably includes your dream lifestyle) that your friends are simply unlikely to ever achieve!

Let me give you an example of dressing (or presenting yourself) for your audience:

When I first started in business, I had three modes of dress:

– Smart casual for my clients, who were all tradesmen: I wanted to dress nicely (to present a good image) but not ‘stuffy’

– Suits for my corporate clients: my other business was much more corporate; whenever I had a client meeting, I would dust off my ‘power suits’ and ties (nowadays, you can dress more casual, but ONLY if your client does, also).

– Suits WITH gold watches/cuff-links/jewellery: for my meetings with the bank … I always want to leave my banker with the impression that I don’t NEED the money 😉

Now, this doesn’t mean that you can’t dress like Johnny Rotten after hours!

If that’s your ‘thing’ go right ahead … I mean, you gotta live, right?

BUT, make sure that your fashion accessories of the bodily kind can be TOTALLY hidden from view, come Monday!

Body piercings are fine; tongue/eyebrow/lip/ear piercings are not.

Small earings are fine; multiple piercings and ear ‘plates’ (the ones that enlarge the holes on your ears) are not.

Hidden tatoos are fine; visible ones are not.

Why?

Because the majority of people who you NEED to help you become successful (bankers, clients, partners) are nowhere near as broad-minded as you think!

Now, before you accuse me, my staff broke all the ‘rules’ … but, I was able to look beyond the physical (even if I had to endure a raised customer eyebrow or two), but don’t limit your market to me and the two other CEO’s out there who are as broad-minded as I am.

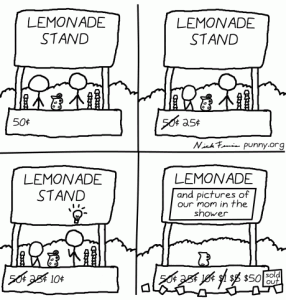

Let me give you another example:

A close friend of mine is CEO of a small public company. Interesting.

What his clients don’t know is that he has wall to wall tattoos on his body. Amazing.

BUT, he has to keep his shirt buttoned up (including his neck) and his sleeves all the way down to hide them … I guarantee that he regrets his tattoo decision for this reason.

So, that’s the sad truth about freedom of self-expression today; maybe it will change in a few years, maybe it won’t. Just don’t take the risk, if you want to reach your Large Number by Your Soon Date … it’s probably not worth it.

BTW: Nowadays, I don’t dress to impress anybody …

… on the other hand, I’ve already reached my Number. Have you?