What’s the difference between a strategy and a tactic?

What’s the difference between a strategy and a tactic?

The obligatory post-padding dictionary definitions here and here 😉

But, let me give you a personal finance example or two to explain why it’s critical that you know the difference!

If you spend some time on google, you will find whole blogs dedicated to “financial strategies” such as:

– managing your credit cards,

– eliminating debt,

– paying yourself first,

– building an emergency fund,

… and, so on.

Each blogger (or author – there’s been whole books written on each subject) will explain how his financial strategy will turn your life around.

But, these are not strategies at all … they are tactics, a means to an unknown end.

I’ll explain why …

For each of these tactics (or any other), I can give you a perfectly valid argument for why you should do the exact opposite of what the author recommends!

Here are couple of examples:

– The False War On Debt: http://7million7years.com/2010/11/10/the-war-on-debt/

– The Zero Dollar Emergency Fund: http://7million7years.com/2010/08/08/the-zero-dollar-emergency-fund-2/

… and, if you go back through my blog [AJC: an easy way is to just search for the word “myth”] you will find counterpoints to all of these – and other – ‘recommended’ financial tactics.

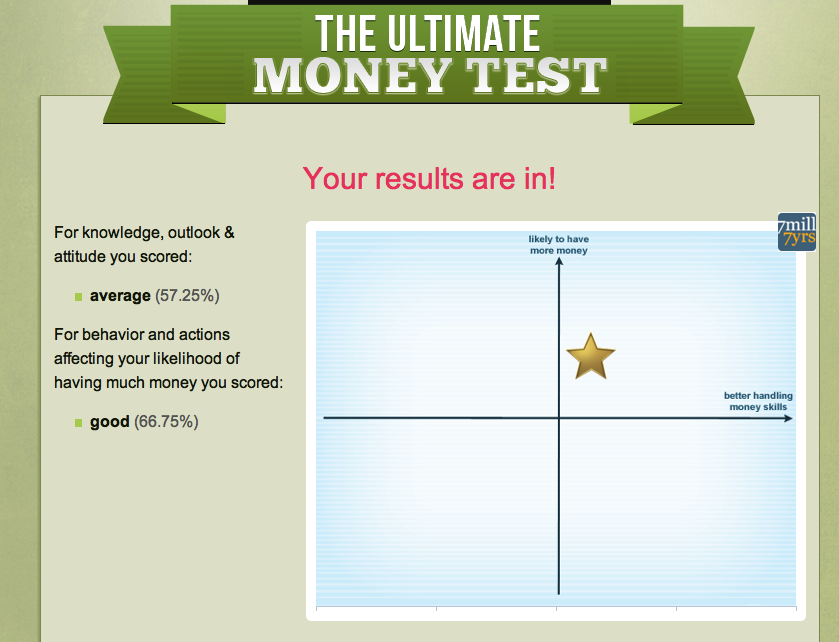

The reason is that I have a personal financial strategic goal: I knew exactly where I wanted to be ($5 million), when I wanted to get there (5 years) and why.

[AJC: for an audacious goal, you need a very strong ‘why’ to help drive you there … it’s a very tough road, and you’ll need all the emotional ‘boost juice’ that you can get! This is one of my earliest posts; you should read it: http://7million7years.com/2008/03/07/fire-up-your-true-passion-hot-passion-drives-massive-action-massive-action-drives-incredible-results/].

With such a goal, I needed certain financial strategies to get there [AJC: I actually ended up with $7million in 7 years]; my strategy was:

– Increase my income dramatically (for me that was achieved by quickly growing my business),

– Invest as much of that income as possible in real-estate and stocks (instead of spending my business profits on bigger houses and faster cars).

Therefore, the tactics that I needed included:

– Take on as much debt as possible,

– Buy insurance and have lines of credit available (instead of having cash lying around idle) in case of emergency,

– Paying myself first, second, third and fourth (i.e. saving much more than 10% of my business-generated income),

– Obeying the 20% Rule.

So, next time you are looking for financial advice, take the trouble to understand your strategic goal: how much do you want? when do you want it? and, why?

If your goal is simply to retire with $1 million in 40 years, then go ahead and buy that Kindle and load it up with personal finance best-sellers!

However, if your goal is “large and soon” then you, too, will need to ignore most of the so-called “good financial advice” that is floating around so freely. That’s why I started writing this blog 🙂