If you own a boat that’s large, expensive, and is likely to take on water from time to time, you plan well ahead and put in a bilge pump.

If you own a boat that’s large, expensive, and is likely to take on water from time to time, you plan well ahead and put in a bilge pump.

But, if you have a dinghy and you’re paddling out on Lake Michigan, far away enough from shore to make swimming a poor second choice, then you carry a bucket … and, if the boat springs a leak (highly unlikely … it’s not a bad dinghy) or, water happens to come over the side from time to time …

… well, you start bailing water!

An Emergency Fund’s a little like that:

What you do depends on whether you expect the emergency [AJC: I know, it’s an oxymoron] or not. Of course, if you expect it – or, can reasonably foresee it (like problems with a beaten up old car), then it’s not an emergency at all … just something that you can’t budget an exact amount for.

But, you can provision for it; at least, as best you can.

But, true emergencies do arise – or, semi-expected events blow up bigger and/or sooner than you ‘expected’ – so what do you do?

Try and build up and emergency fund but not spend it even if a really great investing opportunity comes up [AJC: what’s the opportunity/cost of that?!]?

Or, why don’t you simply find a bucket of money that you can tap into IF an emergency arises … but, one that costs you zip (or, even makes you money) in the LIKELY event that an emergency does NOT arise.

Or, why don’t you simply find a bucket of money that you can tap into IF an emergency arises … but, one that costs you zip (or, even makes you money) in the LIKELY event that an emergency does NOT arise.

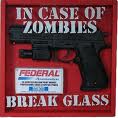

Here are some examples of In-Case-Of-An-Emergency-Please-Break-The-Glass Funds:

1. A HELOC (home equity Line of Credit) that you put in place on your home ‘just in case’

Use an online mortgage calculator to make sure that you can borrow enough to cover your likely living costs + the repayments for as long as you think it will take you to get back on your feet and repay the loan. This is a pretty good, flexible option that only costs what you use.

The other advantage is that you should be able to raise a LOT more than you can save … and, it will be available as soon as you put the paperwork in place (a true emergency fund could take YEARS to save).

On the other hand – say, if you lose your job and the bank finds out – the HELOC may be revoked just when you need it the most … of course, if you’ve already drawn down the funds before the ‘pink slip’ is in your hands …. 😉

2. Your 401k

There are usually provisions that allow you to borrow or withdraw funds against your Retirement Account; again, this may allow for ‘protection’ against fairly large emergencies (say, a few months off work), but it may come at a hefty opportunity cost … particularly, if the fund rules don’t allow for the funds to go back in on a tax-preferred basis, if you’ve managed to recover quickly enough.

Also, the tax and/or penalty interest costs may be quite high.

3. Your Car

Maybe you can do a sale and lease-back on your car .. or, maybe you can sell your car for cash and either use some of the proceeds to ‘trade down’ (therefore, freeing up some cash) or even make an exception to the “don’t finance a depreciating asset rule” by financing a (cheaper) one, instead (thereby, freeing up a lot more cash).

Remember, you’re really borrowing some money to tide you over in an emergency … you don’t expect to get out of it squeaky clean.

4. Credit Cards

Yep … this is the time that a bunch of credit cards sitting in a drawer can be really useful … but, it’s very expensive (19%+ p.a.) so make sure you only take this route for really short-term emergencies that you KNOW you can trade your way out of really quickly (i.e. less than a year).

5. The Three F’s

And … don’t forget that getting on your hands and knees and grovelling to your Friends, Family, or other associated Fools is also an option!

Anybody have any other true ‘Emergency Fund’ source ideas?

listed equities – with two day settlement it’s a pretty quick process to get my hands on the cash. The downside is that I could end up selling when I’d rather by buying.

unsecured overdraft – expensive but as long as I remain in good standing with the bank, it’s a possibility – I can get this in a day or two

loan against partnership capital – it’s actually quite a cheap source of funding but could take 3-4 weeks to put in place

ski mask, shotgun and a quick trip to the local convenince store – if all else fails, you get free accomodation and food for a few years

send the wife back to work – this would be a case of replacing one emergency with another….perhaps not…

@traineeinvestor, one way to avoid selling equities at the wrong time is to instead use a margin account as your source of emergency funds. You can than send in more cash or sell equities when the timing is better.

I find this discussion of emergency funds fascinating. There is so much noise in the personal finance circles about placing your emergency funds in a very short term secure instrument such as a CD or a money market fund, that it actually does disservice to the readers. What you gain in security, you give away (maybe more) in terms of returns, and tax efficiency. Besides, in cases of a true emergency (such as rushing some one to a hospital or buying a last minute air ticket), even a savings account may not work as you will have to contend with the limits on ATM transaction or wait for the bank to open.

Ideally, your emergency fund will consist of multiple sources of funding, some more liquid than others with an eye towards tax efficiency and greater returns.

You could also add the Cash value portion of a whole life insurance policy to the list. You can have the cash in your account within a day or two

Pingback: An Emergency Fund – Why You Need To Have One | Todays Daily News

A margin loan on any equities you own.

IRA accounts the principal you put in can be taken out penalty free before retirement age.

@ InvestorJunkie – Once the money comes out of the IRA, can it go back in again (i.e. once the ’emergency’ is over, and you have recovered, sufficiently, financially)?

@Adrian I’m not sure if it’s considered a loan (ie you can pay it back and not be stuck with the traditional yearly limits) or a withdrawal.

According to my research it’s a withdrawal, so you are limited to the normal yearly limits. Unlike a 401k/403b it’s not a loan.

Either way IMHO it’s best if people have any emergency savings to put it in a Roth IRA first before anything else.

[propaganda removed] 😉

Pingback: Short term cash and long term cash | Moneymonk

Pingback: In case of emergency break glass …- 7million7years

Interesting points – it’s really a question of leverage. If you’re already wealthy and you have a lot of equity built up in stable businesses, RE, etc then it shouldn’t be hard to get a loan when you need it. But if you’re just starting out and your networth is -$100k then a little spare cash could be what keeps you out of bankruptcy. If you’re overleveraged, fix that or save cash. If you’re underleveraged, invest your emergency fund. This is one case where acting rich before you really are can hurt you, like buying a big house and car because you just graduated and you “know you’re going to make it some day”.

@ Value Indexer – I say that the way to go from “acting rich” to truly “rich” is to invest your emergency fund cash because you can provision for most needs.

The next question becomes “what’s the difference between an emergency fund and a provision” and I say (a) amount (provision < emergency fund) and (b) purpose ... but, I'll cover this more in a later post 🙂

Pingback: Strategy or Tactic?- 7million7years

Some Indian options:Gold loans,chit funds/nidhis,credit unions,providend funds,loans from employer where applicable,loans against NSCs,KVPs and other government bonds.

Pingback: P.E.P for Week of August 9-13, 2010 | Prairie Eco-Thrifter