I was asked the following question:

I’m 28 and just came into some money (8 figures). About 70% is invested in stocks and the rest is cash. I don’t want all the money tied up in stocks. Should I buy apartments or land and build my own apartments?

Now ” 8 figures” is a lot of money … somewhere between $10 million and $99 million; I imagine, more than enough to retire on for any of my readers.

I retired at 49 years old having made $7 million (in 7 years), and had no desire to continue growing my money.

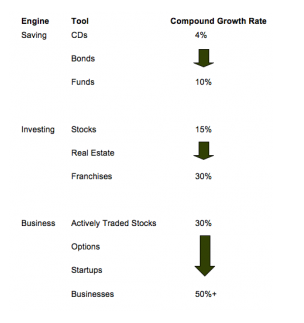

In fact, there’s two things to consider:

1. You can retire very happily on $10 million, and

2. There’s very little likelihood that whatever set of circumstances took you to, say, $10 million will be repeated.

In other words, if you are lucky enough to cash out a life changing amount of money, it’s time to go into ‘lock down mode’ with your money …

So I told her that this was very much the position that I was in, with three key exceptions:

1. You are a lot younger (I was 49; you are much younger)

2. I put $6m cash into my house, you won’t be that stupid

3. I embarked on an active asset management strategy, when I should have aimed for passive much sooner.

This means that I own a house, some real-estate developments, a couple of businesses, and I invest in startups.

Whilst fun & interesting, sometimes, they do nothing to improve my standard of living (ie I already have enough), and mostly & unnecessarily increase stress.

Instead, this is the strategy that I am slowly putting in place now, and the one you should begin with.

a) Stocks are too volatile as a retirement portfolio.

You will suffer mentally when your portfolio drops 10% in a single day … then, keeps dropping. It’s fine when it’s sitting in your 401k & you can tell yourself: “it’s OK, the market always bounces back & I still have my job”.

I have a friend in a similar situation to you; he sold his business and keeps 100% in stocks: he has watched his net worth halve 2 or 3 times since he sold his company … he has not enjoyed that ride.

b) Property is the right place to keep the bulk of your portfolio; but buy to own 100%, live from the income; and, never plan on selling.

Sure property can also correct – Hawaii has been victim of that, more than once – but, in every correction, people still need somewhere to live and must pay rent. Since you are never planning on selling, however, the notional value of your property at any specific point in time becomes moot.

c) Here’s how to put it all together:

1. Keep your cash in place for now. Instead, move your stock market holdings into real-estate. How much you move, and how quickly you move it depends on how bullish you are on the stock market.

I would be comfortable with a max. of 20% or 30% of my net worth in stocks. At the moment, it’s much less, but I still have too many even riskier assets in my portfolio, so my opinion doesn’t count, here.

2. Start buying a balanced portfolio of smaller residential and commercial properties in prime, established areas. Avoid new areas & new (e.g. off the plan) properties. I always buy small, entire buildings (e.g. quadruplex apartment blocks; self-contained office buildings on own title; etc.). Look for current (e.g. modest rehab) and/or future upside potential to increase long-term returns.

3. If you are slightly aggressive, plan to partially-gear these (e.g. borrow up to 50%), so that you can optimize for number of properties owned. Try to make sure that each property is at least slightly cashflow positive, after expenses (incl. mortgage, taxes, repairs, vacancies, etc.).

As you get older, aim to move to 100% owned: no borrowings.

4. After you have become comfortable with owning one or two of these types of rental properties for at least a year or two, you can think about developing your own. This should increase your returns, as you get to keep the developer’s margin & there may be depreciation or other tax benefits.

Warning: developing property is very attractive and very lucrative. In theory.

In practice, it’s also very risky & the great source of my personal stress. When markets turn, developers go bankrupt.

So, here’s the secret:

Only develop real-estate that you can afford to keep.

That way, if you’re having fun and the market is strong, you can sell and do it all over again, but if the market is weak, you simply add the property to your rental portfolio & ride the market out.

5. Aim for a cash buffer of two year’s living expenses at all times.

Since you are young, your expenses do not reflect your likely future expenses. In that case, aim for $500k cash buffer (2 x $250k pa likely future expenses, when you have a family). Double every 20 years, to account for inflation.

Every year, or two, if you have an excess of cash in your buffer, buy – or build – another property. Do not put more money into stocks, unless you plan on keeping it there for 7 to 10 years … even (especially) if the market drops!

6. You will also need to have a plan to buy a proper house (use cash) one day; you could reduce your stock portfolio when the time comes, to further reduce volatility, since you will probably have a family by then and risk will be even more of an issue then, than it is (should be) today.

In all other respects, live like any other person of your age, spending – and living – no more than 20% more/better than your peers. Aspire & create in the same way they do.

Take chances & enjoy life in the knowledge that you have a secret safety net that you can rely on for when times get tough.

Do nothing, though, that could destroy that net, even if you think it might make you even richer in the long-term. That would not be an optimal Life Decision.