If you’ve noticed, I made a couple of adjustments to this blog:

If you’ve noticed, I made a couple of adjustments to this blog:

The first is that I have reduced my posting schedule to (generally) twice a week; I’m trying for a Mon./Thur. posting schedule, but – if you enjoy reading this blog (near-future multi-millionaires need only apply!) – your best bet is to sign up for the RSS/e-mail feed on my home page because I’m fickle … if I get the urge, I’ll post daily, or simply shift days to suit my increasingly challenged schedule 🙂

The second is that I’m posting more business-related posts (e.g. my Anatomy Of A Startup occasional series) … I am funding a series of startups with the ultimate aim of a Y-Combinator style of early stage entrepreneurship mentoring / funding program and what I am sharing in this series is real ‘special sauce’ stuff … like everything that I do, it’s usually simple but works!

Back to the first change: if I write less frequently, I’m hoping to challenge myself and my readers even more. To whit, my last post (inspired by Canadian Couch Potato’s brilliant post on the same subject) inspired a one week long comment-debate … one of the best that I have seen on this blog.

The main thrust was the debate around income v capital growth.

Jeff stated the ‘for’ argument best when he said:

The reasons why people desire rental income from real estate are the same reasons why people desire dividends from stocks…you get a cash flow without having to sell the asset at an inopportune time.

But, there’s a key difference between so-called ‘Income Real-Estate’ and its stock market equivalent – Dividend Stocks: Income RE produces REAL cashflow, Dividend Stocks produce FAKE cashflow!

To illustrate, let’s take a look, first, at income-producing real-estate:

Tenants pay rent; you pay costs; what’s left (if any) is real, spendable, excess income/cashflow that generally increases with inflation. Bad RE doesn’t produce an income. Period.

Now, let’s take a look at so-called Dividend Stocks (i.e. Company stocks that you buy specifically because they produce a nice, steady dividend stream):

Dividend-paying company sells stuff; they pay their suppliers and other costs; Good company produces profits / Bad company produces losses.

In either case, the Board meets and says “we gotta pay some dividends”.

The CFO says “But, we got bills to pay!”; CTO says “I got R&D to do!”; COO says “I got warehouses to build!”; CEO just wants to keep his job (he is hired/fired by the Board, remember) and says nothing …

The Board says: “Too bad. If we don’t look after our shareholders they’ll crucify us … even worse, they’ll vote us off our nice cushy board positions and we’ll even have to buy our own lunches!”

“Let the CEO deal with poor cashflow and working capital, insufficient warehouses space, outmoded products and technology, lack of marketing, and so on … heck, we’ll even borrow money from our provisioning funds or the open market, if we have to. No matter what, those Dividends must be paid … after all, we are a Dividend Stock!”

So, they say “no” to the CFO, COO, CTO, CMO … and, every other shmo’

Do you want your board fussing over distributing cash that it may or may not be able to spare? Or, would you rather that your Board focussed on building a GREAT company, with GREAT long-term growth and profitability prospects?

In order to answer that question, there’s one more feature of dividend stocks that we still need to examine; Kevin @ Invest It Wisely says:

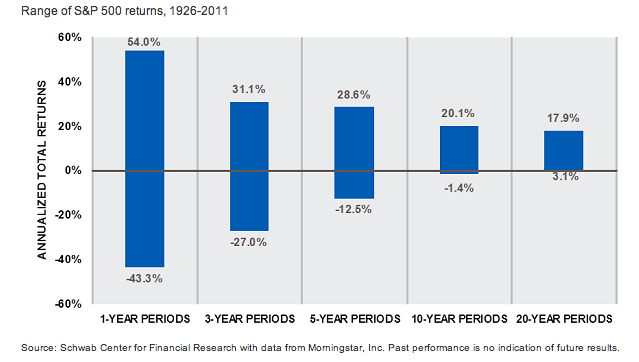

The pro-dividend guys do have a compelling case that dividends grow more smoothly than the ups/downs of the markets.

To which I say, “so what?”

As we have already seen, the apparent ‘smoothness’ of the dividend stream can be illusory.

And, what are you going to do with any dividends that you have received pre-retirement?

I presume that you are going to reinvest them so that you, too, can get to $7 Million in 7 Years (or, at least to your own relatively large Number by your own relatively soon Date).

In other words, you’ll just take that relatively nice, smooth dividend stream and throw it right back into the choppy market [AJC: Next, you’ll be telling me that you’re Dollar Cost Averaging … somebody, grab me a Tylenol, please!].

If you’re going to be fully invested in the stock market, for a number of years, then why don’t you at least buy some stocks in great companies that are going to grow, grow, grow … profits?!

If they happen to pay dividends, well great [AJC: you’re going to give it straight back to them, anyway, aren’t you?], and if they don’t, well who cares?

I mean, would you rather own “this dividend stock [that] has delivered an annualized total return of 3.10% to its loyal shareholders”? Or, would you rather own this never-ever-paid-a-dividend stock that has delivered an annualized total return of 20+% to its loyal shareholders for over 40 years?!

However, there is one special case (i.e what if you are already retired?) that I want to examine next time …

As I mentioned in my last post, my 19 y.o. son’s online business is doing quite well …

As I mentioned in my last post, my 19 y.o. son’s online business is doing quite well …