There’s a debate going on at Quora (the question and answer site) about the cost of wealth managers:

There’s a debate going on at Quora (the question and answer site) about the cost of wealth managers:

What are the pros and cons of wealth managers vs passively investing in an index fund?

One of the issues is comparative fees:

– Index Funds typically charge 0.07% of funds under management.

– Wealth Managers typically charge 1.00% of assets under management.

So what do you get for the 14 times increase in fee?

Well, I wouldn’t know, because I wouldn’t go near a “wealth manager” with a barge pole …

… but, Scott Burns said it best:

40 years of investing has taught me that rented brains seldom help us build our nest eggs. Rented brains feel a deep spiritual need to build 20,000-square-foot log cabins in Jackson Hole with the return on our money.

It would be OK if that 14 times extra fee equated to extra returns, but the research shows that it really does only buy the wealth manager a good living – not us:

Eugene F. Fama and Kenneth R. French looked into this issue in their working paper titled, Luck versus Skill in the Cross Section of Mutual Fund Returns. Their study focused on U.S. equity mutual fund managers from 1984 to 2006. It’s no surprise that they found that in aggregate, actively-managed U.S. equity mutual funds performed below the market after costs. The big question they were trying answer was did the winning managers have skill or were they just lucky?

So, if you are prepared to read a few books and try a few things, then go ahead and try your own luck in the stock market … failing that, simply put your money into a low-cost index fund – a least, you’ll avoid the heavy management fees!

The only reason for appointing a wealth manager is because you are unable or unwilling to do the job yourself.

@ traineeinvestor – … in which case, you are unlikely to NEED one, either 😉

“unlikely” is right but there are some people who either need or should have one:

– lottery winners have a terrible track record of ending up in the poor house and could well benefit from a wealth manager

– people whose mental faculties are starting to fade may well be better off with someone else managing their money

– a lot of sports and entertainment stars have issues with money management as well

Adrian what about when a fortune becomes too big to count?

The run of the mill wealth managers serving the middle class and low level millionaires that you and I encounter are dispensable.

But isn’t there a class of professionals, not necessarily called wealth managers, who are needed to make and keep the really large fortunes?

How many of the really rich have any money in mutual funds?Or are retail investors in stocks?

Perhaps its best to try and find the better sort of people to manage our money and pay them well,as long as we are able to do better than we could by ourselves?

@ keerthikasingaravel – I’ll be able to update my post when I have “a fortune too big to count” … right now, it’s still firmly in ‘can self-manage territory’ 🙂

Hey Adrian,

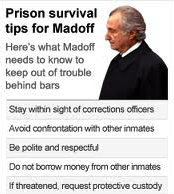

Thought I’d pop in and catch up on some of your posts. I agree with not having a wealth manager. Money is a POWERFUL force/motivator and dangerous when it’s in someone else’s hands. I’ve seen so many examples of fortunes lost to unscrupulous managers (Madoff, Enron, Bear Stearns, etc, etc, etc). Once it’s gone you will NEVER be able to recover it. My advice:

Keep your money close!

My grandmother is the only person I know who has a wealth manager, and it’s largely because (A) she’s got dementia – there’s no way she could handle things on her own these days (B) she doesn’t pay 1% in fees (I asked my dad, he said her manager charges her about 0.25%, but that may be because she’s been working with him for years) (C) she wasn’t in the position to handle things after my grandfather died and (D) because she’s pretty darn wealthy. I think each of those are pretty good reasons for her. But for me? NAh, not worth it!

For most people, it’s well worth it to figure out finance management on our own. This is the nest egg that will guide your later years and leaving it in the hands of someone who doesn’t have your interests at the top of his list doesn’t strike me as the best approach. And the thing is, it’s not very hard to learn enough so that you can intelligently manage your own money!

Dude, dividend stocks are not substandard investments. They may not yield as much as directly investing in your own business, but they can and do produce very respectable returns for many people.

Because some people hate this stuff. Their idea of fun isn’t spending free time reading finance blogs. And it can be tricky. I see people roll over company stock to an IRA. Uncle Sam loves it because they pay for their ignorance.

Bottom line: some people should use a low cost, fee only manager who pays attention to expense ratios and gets them properly allocated.

@ DIY Investor – … then they need to be resigned to under-market returns. Instead, forget allocation: put your money into a low-cost index fund; it’s all you need … and, Warren Buffett agrees (now, there’s a ‘wealth manager’ I would trust).