Everybody has an opinion about the most important financial lessons that you can learn about personal finance. Just look at how many personal finance blogs there are [Hint: over 7,000 are listed] … and, here I am adding one more blog to that long list.

Everybody has an opinion about the most important financial lessons that you can learn about personal finance. Just look at how many personal finance blogs there are [Hint: over 7,000 are listed] … and, here I am adding one more blog to that long list.

What do these blogs suggest? What do they say are the most important lessons that their authors have learned along the way?

Is it to avoid debt? Probably [here are 50 blogs just focussed on debt reduction].

Perhaps, you need an emergency fund? Of course [Googling “emergency fund” brings up 1,050,000 results].

How about spending less than you earn? Naturally [Googling “spend less than you earn” brings up 844,000 results]!

Sure, each of these can be important …

… equally, each of these can actually hurt you!

It all depends on what your ultimate goal is. For me, it’s to live my Life’s Purpose, but let’s just wind that back a little to a more generic goal – one that doesn’t require a degree in philosophy to understand:

The most important financial goals are:

1. Satisfaction – having sufficient money on hand to satisfy your most important needs, and

2. Security – having sufficient surety that your most important financial needs will always be met.

Think about these carefully, as they appear to be similar … but, they are not the same:

One (satisfaction) points to understanding your true needs (physical, environmental, emotional, etc.) and ensuring that you have sufficient income to provide for them, whilst the other (security) points to forward planning of the cash-flow required now, whilst you are working, and in the future, when you are not.

And, financial satisfaction & security is only really achieved when you have:

1. Sufficient money invested to safely fund your required lifestyle (not to be confused with your current lifestyle) – by a date of your choosing and for the rest of your life – without needing to work, and

2. Sufficient cash buffer to ensure that you can maintain that lifestyle for a reasonable period should something go wrong (market corrections; real-estate vacancies; etc).

EVERYTHING else that you do (financially-speaking) has to take you closer to achieving the above.

To illustrate the importance of this, let me give you three examples:

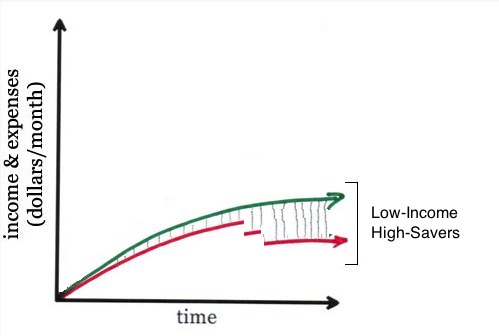

1. If you are young (say 25), happy to work in your current profession for the next 40 years, and living a frugal lifestyle is sufficient to satisfy your needs for the rest of your life, then financial security can be easily achieved for you simply by saving the equivalent of half your current after-tax salary (indexed for inflation) until you retire.

Of course, it would help if you avoid piling up debt, and put in place the necessary insurance (incl. an emergency fund), in case of any glitches along the way; in any event, most such issues will likely be nothing that another 4 or 5 years of hard work can’t resolve.

2. If you are in your 30’s or 40’s, entrepreneurial, and have desires in life that only early retirement can satisfy (e.g. you want to be a full-time artist; writer; traveller; and, so on), then you simply won’t be able to save enough to maintain the security of your lifestyle when you stop work in 5, 10, or even 20 years (even if you somehow manage to save 25% – 50% of your salary, accumulate no debt, and build up a huge emergency fund).

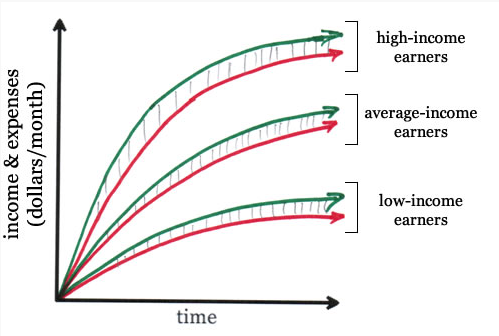

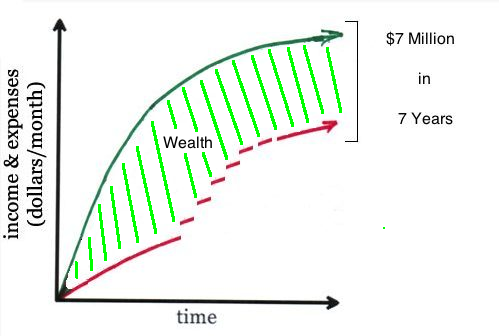

So, you will need to take my path: focussing on growing income first, then saving second (e.g. simple math shows that investing 25% of $250k a year will get you much further than saving 50% of $50k a year). Starting a business and actively investing as much of the proceeds as possible into real-estate, stocks, and bonds (rather than in your own lifestyle) has a better chance of taking you to an early, self-sustainable retirement [a.k.a. Life After Work] than any amount of debt reduction, emergency fund building, and so on.

3. If you have retired early (or late; it doesn’t matter), you are pretty much stuck with whatever level of lifestyle you have been able to satisfy from the retirement nest egg that you have built up … now, the main financial goal you need to focus on is security.

My recommendation is to now focus purely on capital protection and income:

Purchase real-estate outright and live from 75% of the net proceeds, and keep 2 years cash as an emergency fund, or purchase inflation-protected federal treasuries. Forget stocks; you will put too much strain on your heart and psyche as you watch your net worth double and halve every 7 to 10 years. That’s pretty much it.

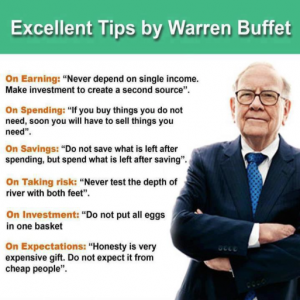

So, when people tell you their ‘Top 10 Strategies for Financial Health’, ignore them …

… any such set of strategies is meaningless unless you can first put them into context:

How do they help you achieve your desired level of financial satisfaction and security?