My uncle had a wish: he wanted to stay healthy. He heard that eating apples is good for you (you know, ‘an apple a day keeps the doctor away …’), so he started eating apples.

My uncle had a wish: he wanted to stay healthy. He heard that eating apples is good for you (you know, ‘an apple a day keeps the doctor away …’), so he started eating apples.

If one apple is good, he thought, then two must be better. In fact, he started eating apples religiously. He got Vitamin A poisoning. He stopped eating apples.

There is such a thing as ‘too much of a good thing’ 😉

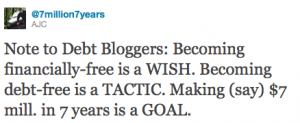

I sent out the tweet in the graphic at the top of this page because too many Twitterers/Bloggers – and their followers – eat too many apples.

Here’s what I mean …

If you’re healthy you get to run and run and run, just like a puppy does. Fun!

If you’re financially-free you get to do pretty much whatever your ‘freedom’ allows, and you no longer need to spend 8 hours a day (or more) at work for The Man. Whoohee!

But, being healthy and being financially-free are ‘wishes’ – something that you want. Just wanting something doesn’t mean that you’ll get it.

So, you eat an apple a day because a doctor told you it’s good for you … or you start paying off debt because a blogger told you that’s it’s good for your financial well-being.

But, the problem with these proscriptions is that there’s no prescription [AJC: yet another bad pun] … you need to be told exactly how much of a good thing is really a good thing, before you keep going and overdose!

You see, eating apples – as my uncle found – and paying down debt – as many blog-readers find out too late – can be good or bad for you, depending on how much you under- or over-do things. Eating apples and paying down debt are just tactics promising to help you get you to where you want to go.

With debt-reduction – as with apples – there’s an optimal point: it’s the point where it contributes most to your real goal.

If your wish is to become financially-free then your goal should be able to be expressed as a specific Number and a specific Date; you should apply debt reduction in such a way that it maximizes your chances of reaching that Number by that Date.

I have a hypothesis that the Number/Date bell-curve for my reader population – nay, the entire personal finance blogosphere’s readership – is well and truly centered where paying down debt only makes:

– absolute sense in the double-digits i.e. where most credit card, personal, and (many) auto loans sit today

– no sense (nonsense?) in the low-to-mid single digits i.e. roughly where home mortgage rates and student loans sit today

And, the remaining debts (say, between 5% and 10%), they can be paid off, if you have low financial aspirations but if you are aiming for $7 million in 7 years, I’m suggesting that these, too, need to be set aside for a while in favor of funding your latest startup and/or active investment.

Debt is a tool. Paying it off is simply choosing not to use the tool.

I will pay off the mortgage on the home when I retire, but until then it stays in place given how low the interest rates are.

I will leave the mortgages on the investment properties unless interest rates rise significantly. They are all P+I so will amortise eventually and, in the interim, the money is better invested elsewhere.

I too, will pay off the mortgage later.

For now, I’m focusing on buying quality companies that have a history of paying dividends. I’m trying to set myself up now so in 20 years, when the mortgage is done, I can retire very comfortably.

Cheers!

@ Financial Cents – It seems I’m not alone in my views!

On the other hand why don’t you focus on “buying quality companies” and forget the “history of paying dividends”-bit … dividends can be a false indicator of true company performance 🙁

http://7million7years.com/2009/01/14/the-fallacy-of-dividend-paying-stocks/

I think a lot of those debt-destroying blogs (maybe that is how I started…) have ridiculous amounts of bad bad debt. Like high APR CC debt.

@ Evan – Understood. That’s probably their motivation for starting to blog. But, enough is enough 😉

Pingback: Carnival of Debt Reduction » This week’s Carnival

Pingback: The War On Debt …- 7million7years