… a five pound box of money!

[AJC: I wonder how much that is?!]

Have a safe and wonderful Xmas and New Year!!

… a five pound box of money!

[AJC: I wonder how much that is?!]

Have a safe and wonderful Xmas and New Year!!

It’s only a couple of weeks since I told you about a new way to measure wealth, and here is an article on a respected blog telling you how to go about renting ‘stuff’ that you might need, so that you can appear wealthy!

It’s only a couple of weeks since I told you about a new way to measure wealth, and here is an article on a respected blog telling you how to go about renting ‘stuff’ that you might need, so that you can appear wealthy!

Now it might surprise you, unless you’ve read my original post, that I think the best ‘bang for buck’ way to be wealthy is to be Rent Wealthy …

… this is where, instead of owning that villa in France, you rent it. Instead of owning that luxury yacht, you charter it (with crew and caviar, of course. After all, you are wealthy!). And, instead of owning that expensive personal jet, you call up Warren Buffett’s company, Net Jets, and charter one (no maintenance or holding costs, either!).

And, the Get Rich Slowly article says that you can now:

… rent designer bags, sunglasses, and jewelry. Yep, companies like Avelle, Bling Yourself, and Wear Today, Gone Tomorrow will rent merchandise by the likes of Chanel, Hermès, Louis Vuitton, Prada, Chloé, Herve Leger, and more. For a monthly fee, you can carry the “it” bag.

One site, for example, will rent a vintage Birkin bag for $600 per week. The cost to buy a vintage Birkin is about $17,000 (I’ll give you a moment to stop choking…mmkay, better now?). A Coach bag that retails for $350 can be rented for about $30 a week, or $20 per week if you keep it for a month.

As the author points out, you can actually own the Coach bag in 4-and-a-half months, so renting would seem pretty stupid when you can just save up for one or two nice handbags and use those throughout the next year or so.

But that’s not the point: renting, financing, or even buying this sort of consumer item with cash is likely to be sudden death for your personal financial well-being (remember The 5% Rule for your personal possessions, including your car?!) …

… unless, of course, you are already rich!

And, that’s where I disagree with the author: I am not comparing the cost of purchasing the $350 Coach bag against renting it … I’m comparing owning, say, 12 of them (after all, what rich person can get by on just two changes of purse in a year? Ask Paris Hilton … ) against renting 12 to 24 of them – one or two per month!

And, you don’t have to worry about them taking up space in your closet – collecting dust – after you have already been seen in public with them …

Clearly, renting is a ‘no brainer’ 🙂

That’s why I like being Rent Wealthy; I can have pretty much whatever I want [AJC: within reason, and remembering my 10-1-1-1-1 spending thresholds to make sure it’s something I really want or need] without any albatrosses around my neck.

Once you reach your Number, and if you are rich enough, try being Rent Wealthy for a while … I think you’ll like it 😉

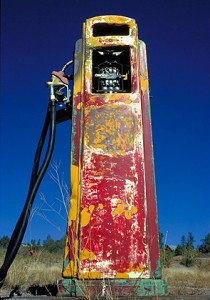

When your car runs out of gas, you go to the gas pump …

When your car runs out of gas, you go to the gas pump …

… when I run out of inspiration (as sometimes happens … not often, but sometimes) I go to the bloggers ‘gas pump’: Alltop.com, a compilation of articles from the best blogs on the web in almost any category that you would care to name.

I got excited when I saw the headline, there, of a CNNMoney article titled: Real estate in your retirement portfolio.

Excited, that is, until I read the first paragraph:

Question: How do REITs work? And is it prudent to have them in a diversified retirement portfolio?

This is the problem with the financial press in the USA: it’s directed to packaged financial products e.g. stocks, funds, REITS, and the list goes on … this is why average (and, 99% of ‘above average’) Americans will remain relatively poor.

It’s ironic then that the wealthiest Americans (and, I would suggest this to also be the case in all developed countries) made their money in business (including the business of investing) and keep their money in real-estate.

According to an otherwise (and, unfortunately) highly flawed book that I reviewed some time ago, the rich keep their money for generations ONLY if they split their assets roughly one-third in a business, one-third in paper (stocks, bonds, mutual funds, etc.) and one-third in real-estate (incl. their own home) … since I called this “the most dangerous idea in retirement planning that I have ever read” (and, you will have to read this post to find out why), I had better give you my much simpler formula:

As I transition into Making Money 301 [protecting my wealth], I would happily keep 95% of my net worth in real-estate (incl. no more than 20% in my own home; remember The 20% Rule?) … and, I am NOT talking about REITs here, I’m talking buy/hold income-producing real-estate.

It’s certainly not the only strategy, but it’s one of the simplest and, IMHO still the best 🙂

While we’re on the subject, here is some good advice on valuing (and, improving the value of) you business from a business broker …

… if you like the info, here are the next three videos in the series:

http://www.youtube.com/watch?v=pbIbNZ-mHpA&feature=related

http://www.youtube.com/watch?v=4iwSIlo8VDA&feature=related

http://www.youtube.com/watch?v=XfKFvMUmc8c&feature=related

That’s it!

BTW: The last video is the only one that really answers the question about how to value a business 🙂

Last week I told you about a reader who thought that he wanted to sell his business, but pretty quickly realized (after a bit of prodding from me) that he was really selling a product as he had not made any sales as yet.

Last week I told you about a reader who thought that he wanted to sell his business, but pretty quickly realized (after a bit of prodding from me) that he was really selling a product as he had not made any sales as yet.

So, this week, I wanted to cover the basic ‘street smart valuation’ methods for selling (or, part-selling) various types of businesses:

1. Professional Practices

These types of businesses (e.g. accountants, finance/insurance/stock brokers, doctors, attorneys, etc.) generally are the easiest to value as their sale price is usually governed by industry-standard formulas, often based on some multiple of fees rather than profits.

So, an insurance broker may sell for, say 2 x annual fees/commissions.

The easiest way to find out how to value your professional practice is to buddy up to a few of your peers and see what experience they have and to ask your industry association. It is also useful to see if your accountant (or another) has experience with any of their clients who may have bought/sold practices in your specialty.

2. Small businesses

Most other sole practitioner and/or small businesses sell for a multiple of their profit (per their most recent income tax returns); typically the business is bought/sold for a multiple of 3 – 5 times after-tax profits, but the range can vary widely.

Brad Sugars claims that his opening (and usually closing!) bid is zero … but, he may take the over the business’ leases (premises and/or equipment); since most small businesses lose money – barely paying their owners a ‘salary’ – this can be a surprisingly good deal!

Of course, if a large company (preferably one listed on a stock exchange) wants to acquire you – and, you can demonstrate a history of good profits – you may be able to negotiate a larger multiple … perhaps heading in the direction of the multiple that the public company itself is getting on the stock exchange (you can find a company’s P/E ratio on any good finance web-site).

Somewhere around 7 to 10 times after tax profits would be considered outstanding.

3. Venture Capital Ready

Let’s say that you have a small business and feel ready to take it to the next level, but you need some additional cash, effectively by selling them part of your business (i.e. trading some of their cash for a lot of your equity) … after watching Shark Tank you feel that you are ready to negotiate with some venture capitalists. What will they pay for a share of your business?

Well, you really need to know what sort of return they expect on their money:

If a company does have the qualities venture capitalists seek including a solid business plan, a good management team, investment and passion from the founders, a good potential to exit the investment before the end of their funding cycle, and target minimum returns in excess of 40% per year, it will find it easier to raise venture capital.

Think about it; a venture capitalist may invest in 10 businesses and lose their money on 7 of them, break even on 2, and rely on your business to make up for the other 9 duds 😉

If they could make (say) just 4% on their money just by letting it sit in the bank, then surely they’re going to need at least 10 times that return if they give it to you on a 10-to-1 failure:success ratio, aren’t they?

Now, 40% returns means that if they give you $1 million, they will expect to be able to get out in 5 years and walk away with well over $5.25 million!

So, here (in simple terms) is how they will make their offer to you (if you are still in self-delusional mode and think that you will be making the offer to them, watch some more Shark Tank!?):

1. Assess how much investment they will need to make in order to meet the growth needs of your business (this WON’T include giving you a pay-rise or any cash in your pocket … at least, not until THEY cash out first),

2. Decide how long they are prepared to wait to realize their investment (i.e. take their cash out by selling or IPO’ing the company)

3. Calculate the % and $ return they would need (in our example, this is the $5.25+ million that I mentioned above)

4. Assess what sale price the business is likely to get

5. Divide 3. into 4. and this is what minimum % of your company they will expect to get for their investment (in our example, this is $1 mill.)

So, if they think you have a $10 mill. business on your hands, they will want at least 53% of the company for their $1 mill. investment …

… and, I assure you, you will only get the $1 mill. if you are already doing really well 🙂

Welcome MoneyHackers!

Welcome MoneyHackers!

Here are three of my favorite posts to get you started; if you want to find out:

1. If $1 million will be enough to retire with, then click here, or

2. How much house you can afford, then click here, or

3. Why buying a new car is such a losing proposition, then click here.

Otherwise, please enjoy this article, then bookmark my home page (click here) and come back often …

____________________________________________________________________________________________

For those who don’t already know, I am a member of Money Hackers – a group of personal finance bloggers – and Lydia has just interviewed me; you can read the interview on the moneyhackers.net site by clicking here, or read the extract below:

What influenced you to start writing 7million7years?

I started out $30k in debt and made $7 million in 7 years, but the road was bumpy and I found that I had to learn most of the hard financial lessons myself. I started my blog so that others wouldn’t make the same mistakes that I did.

What encouraged you/where did you hear about becoming a 7 time millionaire in 7 years?

When I started out, I had two businesses which barely paid their own way, and I was in serious debt. But, I had no clear goal or reason to do any better. That all changed when I discovered my Life’s Purpose, which is to always be traveling physically, mentally and spiritually. I suddenly realized that I would need both a lot of free time and plenty of money to achieve what I really wanted in my life. In fact, I calculated that I needed $5 million in just a few short years. That epiphany started the amazing journey that took me from $30k in debt to $7 million in the bank in just 7 years.

What financial topic do you most enjoy blogging about?

My own financial journey and showing others how they can also free themselves from a life of work, debt, and drudgery by applying the same financial lessons that I learned. There are no scams or schemes needed to replicate what I achieved, if they just follow some good, old fashioned financial advice.

What crucial point have you learned through this experience of gaining 7 million?

Your money is there to support your life, yet most people act like it IS their life. No amount of money will ever be enough if you have no clear idea what you really need the money for. Find out what it is that you really want to do in with your life (and by when), then calculate how much passive income that you will need to get you there. Then come to my blog to find out how to safely build that income stream. But, once you have enough … STOP and smell the roses.

What 3-5 blogs are essential to understanding how to save money?

My blog isn’t really about frugal living and saving money, but more about accelerating your income through work, business, and investing. It’s also about protecting your wealth, through passive investment strategies (for example, using stock or real-estate). So, if my readers want to know more about saving than investing, then I recommend that they read:

1. JD Roth’s Get Rich Slowly

2. Steve’s Brip Blap

3. Pinyo’s Moolanomy

What is some financial advice you could give our readers?

Most people don’t really know how much house they can afford, so let me give your readers some very specific advice that will help them through every stage of their own financial journey: never have more than 20% of your Net Worth invested in your own house, and no more that 5% in all of the other ’stuff’ that you own (e.g. cars, furniture, computers, etc.). You can adjust the equity in your house by refinancing periodically (always lock in your interest rate when it is below 6% – 8%).

This means that you will always be investing at least 75% of your Net Worth, which is the only real chance that you have to get out of the financial rate race.

If you have your own blog, I’d like to hear how/why you started it … there’s plenty of space to share in the comment section, below …

Like you, I receive a lot of spam … fortunately Google’s g-mail picks most of it up and automatically dumps it into the ‘trash’ folder for me.

Like you, I receive a lot of spam … fortunately Google’s g-mail picks most of it up and automatically dumps it into the ‘trash’ folder for me.

Most of the spam that I receive is of the “congratulations you have won the Dutch lottery” or the “Mr Nagambi, a senior official in the Uganda government needs your help” varieties. It seems that most spammers are happy with my current vitality and physical dimensions 😉

The problem is, this kind of spam receives no attention, because it takes more than it gives: “give me your credit card number and I will give you some purple tablets” [AJC: either that, or steal your money … spam ‘n scam!].

Good marketing, whilst often bordering on spam (be very careful not to cross the line, though!) gives in order to get: this could be free products (i.e. give me your e-mail address and I will send you my free report … followed by 7 carefully worded and timed sales letters), or simply some free information, like this unsolicited e-mail that I recently received:

Hi Adrian,

Only 43% of consumers will cut back on holiday spending this year, compared to 55% in 2008, according to a Consumer Federation of America survey. While increased consumer optimism spells good news for retailers, for Americans planning to “stretch” the budget, the New Year could bring falling credit scores, and with it, serious consequences.

Here are some fail-safe tips from FICO Credit Guru Shon Dellinger to help enthusiastic shoppers stay financially sound:

1. Be Smart with Credit. Using a credit card is ok – experts agree having 3-5 credit cards helps your credit, if used responsibly. But carrying a balance on your credit card leaves you (1) stuck paying interest that could cost you, in some cases, double or triple the cost of those gifts in the long run and (2) with a much lower credit score, which could jack up interest rates on your credit cards and jeopardize your chance of getting lines of credit elsewhere (buying a house, a car, etc.). Services like FICO Score Watch combat this by providing emails or texts alerting you to any changes in your FICO score (either positive or negative), and notifying you when you’ve qualified for a better interest rate. A credit score increase of 30 points will save the average consumer $105 per year.

For more information on FICO Score Watch, go to: www.myfico.com/Products/ScoreWatch/Description.aspx.

2. Resist “Short Savings.” The salesperson at your favorite department store offers you an instant 20% savings just for opening up a credit card in their name. While that $20 seems tempting at the time, it can quickly put you in debt if you’re not careful. The temptation of the deal is also one reason why the average consumer has a total of 13 credit cards. Opening new lines of credit can also hurt your credit score, so make sure the card meets your overall needs and not just your desire for quick savings.

3. Don’t Wait Till April! Many holiday shoppers use their Tax refund to pay off credit card balances left over from the holidays, which can be incredibly expensive, not to mention detrimental to your credit standing. A credit card balance of $500 dollars from January until April will cost you $237 dollars based on today’s average credit card interest rate.

Please let me know if you are interested in speaking with FICO credit guru Shon Dellinger about these credit saving holiday tips and what else consumers can do this year to assure that their 2011 New Year’s resolution isn’t fixing the damage they did to their credit in 2010. Also, the myFICO Forums can offer your readers helpful tips.

Cheers,

Ashley Kleinstein

Access PR for FICO

Now, I didn’t mind receiving this e-mail because it seems to offer useful information and isn’t directly asking for a sale, although I only gave it a cursory scan because my FICO score is just fine [AJC: and, thank you very much for asking 🙂 ].

Also, I know why this was sent to me: since it was sent under a PR agency’s moniker and I am a blogger, I surmise that they are really hoping that I (or the other personal finance ‘media’ people out there) will publish their content as an article [AJC: as I have ‘cleverly’ done here …. for all you new and aspiring bloggers out there, see how I just lifted some random content and made a post out of it? 😛 ]

What do you think? Is this an automatic delete? If you are not vehemently opposed to it, how would you improve the e-mail?

[Hint: I would present it as a free sample of an online newsletter and ‘click here if you would like to continue receiving it monthly …. usual price $79 for a year’s subscription, but free to you and no credit card required!’ to make it seem valuable]

You don’t get to become a millionaire without style and confidence …

… you have to admit that this guy has at least a bit of both!

Aside from the obvious [AJC: Believing that you can turn $1k into nearly $6k in just 2 weeks is obviously stupid, right?] …

… there’s a basic reason why you are doomed to failure with FOREX (i.e. foreign exchange) trading activities. First, though, let me explain what FOREX is for those who don’t yet know:

The foreign exchange market (currency, forex, or FX) trades currencies. It lets banks and other institutions easily buy and sell currencies. The purpose of the foreign exchange market is to help international trade and investment. A foreign exchange market helps businesses convert one currency to another. For example, it permits a U.S. business to import European goods and pay Euros, even though the business’s income is in U.S. dollars.

In a typical foreign exchange transaction a party purchases a quantity of one currency by paying a quantity of another currency. The foreign exchange market is unique because of … the extreme liquidity of the market [and] the variety of factors that affect exchange rates. As such, it has been referred to as the market closest to the ideal [i.e.] perfect competition.

My dire ‘doomed to failure’ prediction comes about because of that last sentence: FOREX “has been referred to as the market closest to the ideal [i.e.] perfect competition”.

Think about it: for every dollar, drachma, or rupee that you buy … somebody has to be on the other side selling. And, since you are ‘betting’ on the relative strength of one currency versus another, you are effectively betting opposing arguments.

You have the same points spread on the ball game, but you are betting on opposing teams … one winner, one loser.

Now, who do you suppose has better information? You, or the other guy?

Who do you suppose has better FOREX training and more experience? You or the other guy?

You are the amateur, the other guy is (probably) the professional who does this for a living …

Now, you can argue that people are trading currency because they are moving country, so the ‘relative strength’ argument doesn’t apply … or, that they are government agencies moving in and out of foreign positions for stability and political reasons … or, that they are corporates moving funds between various international subsidiaries …

Which all be true and yet another reason why you are gambling and they are expertly managing their portfolios.

The same double-sided coin argument applies to options trading … indeed, most other forms of trading: you bet one way and the person on the other end of the transaction has bet the other way. And, they probably know what they are doing …

… best case is that they are equally naive as you 😉

One winner, one loser.

So, that means that 50% of the traders out there must be winning and the other 50% losing?

Well, the stats – somewhat surprisingly – tell a different story; cast your mind back a few weeks, where taloudellinenriippumattomuus mentioned a Taiwanese study that found that (after costs) only 0.16% (or 1.6 per thousand) of traders [AJC: in this specific case, Day Traders, but I doubt whether FOREX or stock option traders fare much better] actually made a profit!

I’m sure that plenty of our readers have made – and lost – relative fortunes trading; if so, I’d love to read your comments …

Trent at A Simple Dollar poses an equally simple question: Do You Want to Appear Rich? Or Do You Want to Be Rich?

Trent at A Simple Dollar poses an equally simple question: Do You Want to Appear Rich? Or Do You Want to Be Rich?

Now, if this were a frugal-living blog, I think you know what my answer would be, but – like Trent – I have some personal experience of living beyond your means to keep up with appearances: I grew up in a house where my family clearly lived beyond its means.

But, my father confided our true financial position to me – and, only to me – so, I became financially self-sufficient at a very young age. Others saw this as me having a strong sense of responsibility; however, if they knew my dark financial secret, they would see it as merely as the early manifestation of a strong survival instinct.

Whatever the fiscal lessons that I learned at a young age, they have clearly been to my long-term financial benefit …

Having said that, by nature, I like the good things in life … being rich suits me 🙂

However, even before I made $7 million in 7 years, I knew how to appear rich by being clever with the money that I had.

For example, when my friends were buying new Australian or Japanese cars (hence riding the depreciation roller-coaster to the tune of 15% to 30% per year), I bought a ten year old 911 Porsche.

Not only did I have a ton of fun racing it – and, rolling it on and off tow trucks whenever it had mechanical problems 😉 – I made money when I sold it.

Clearly, buying used is one way to appear rich (and, enjoying some of the fruits of your labor now) without actually holding yourself back from becoming rich by overspending.

Another way is to avoid the fiscal habits of either the Debt Wealthy or the Buy Wealthy: don’t buy or borrow-to-buy ‘stuff’ i.e. depreciating assets like cars, boats, and vacation homes.

If you must have some of these things, then take a leaf out of the book of the Rent Wealthy: rent whenever you can afford to, otherwise go without.

For example, it’s been said that you can charter a boat that is one size larger than you could afford to buy five times a year for about the cost of owning that smaller dinghy that you were about to buy. Similar logic applies to vacation homes, etc.

Use this rule of thumb (i.e. at least 5 weekends a year – every year – of use) to help you decide when you should buy or rent … assuming that you could afford to buy according to the 5% rule 😉