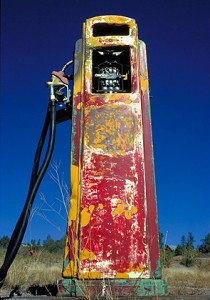

When your car runs out of gas, you go to the gas pump …

When your car runs out of gas, you go to the gas pump …

… when I run out of inspiration (as sometimes happens … not often, but sometimes) I go to the bloggers ‘gas pump’: Alltop.com, a compilation of articles from the best blogs on the web in almost any category that you would care to name.

I got excited when I saw the headline, there, of a CNNMoney article titled: Real estate in your retirement portfolio.

Excited, that is, until I read the first paragraph:

Question: How do REITs work? And is it prudent to have them in a diversified retirement portfolio?

This is the problem with the financial press in the USA: it’s directed to packaged financial products e.g. stocks, funds, REITS, and the list goes on … this is why average (and, 99% of ‘above average’) Americans will remain relatively poor.

It’s ironic then that the wealthiest Americans (and, I would suggest this to also be the case in all developed countries) made their money in business (including the business of investing) and keep their money in real-estate.

According to an otherwise (and, unfortunately) highly flawed book that I reviewed some time ago, the rich keep their money for generations ONLY if they split their assets roughly one-third in a business, one-third in paper (stocks, bonds, mutual funds, etc.) and one-third in real-estate (incl. their own home) … since I called this “the most dangerous idea in retirement planning that I have ever read” (and, you will have to read this post to find out why), I had better give you my much simpler formula:

As I transition into Making Money 301 [protecting my wealth], I would happily keep 95% of my net worth in real-estate (incl. no more than 20% in my own home; remember The 20% Rule?) … and, I am NOT talking about REITs here, I’m talking buy/hold income-producing real-estate.

It’s certainly not the only strategy, but it’s one of the simplest and, IMHO still the best 🙂

Great post! I like people who don’t follow the herd (since I don’t either) and look at things like this from a different perspective.

@ Investor Junkie – that’s not what I herd! 😛

I agree with you 100% on the buy and hold real estate and not in REITs. The 20% rule I’m with you as well on that also. This year commercial real estate is going to get hammered not sure I would want to be holding REITs at this time, but only time will tell.