One of my Finnish blogging friends shared this interesting graphic on one of their most recent posts …

One of my Finnish blogging friends shared this interesting graphic on one of their most recent posts …

The implication is clear:

The best investments …

… in fact, the ideal investment is one that maximizes profit at the lowest possible risk.

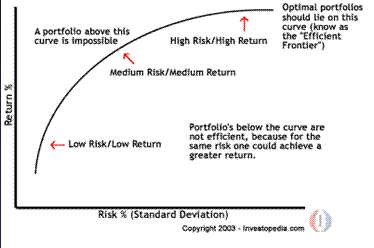

Whilst that is ideal, the real world – at least in my opinion – doesn’t work that way.

Why?

– You may not understand the investments that maximize profit at the lowest possible risk

– You may not have access to the investments that maximize profit at the lowest possible risk

In fact, the operative word here is ‘you’ …

… unless you are professional investor, who has access to – and understands fully – all of the investment choices available, you will not be able to surf the ‘efficient frontier’:

Because of access and education you may only be able to select from a few investments that, if you are lucky and choose well, approximate the efficient frontier, as represented by the four dots in the chart, below:

In this case, you have lucked out!

Two of your investments have hit the efficient curve smack on, and one is optimal (i.e. best combination of risk/reward), whilst the other will suit the most risk-averse amongst you, as it is efficient, yet carries the least risk (of course, it also produces the lowest return of all the ‘efficient’ choices available to you).

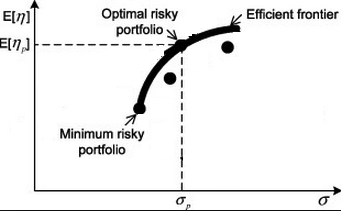

Maths aside, here (diagram to the left) is where I like to position my investments …

Maths aside, here (diagram to the left) is where I like to position my investments …

… and, where I think most (but not all) of you should like to position yours, as well.

It’s not optimal (higher reward, more risk); probably not even efficient; but, ideal … at least, for my (our?) purposes!

Any idea why?

Why do you think I actually like to assume more risk?

I’ll do a follow up post; in the meantime, I’d like to hear what you think my reasoning will be?

I might even send a signed copy of my book to the person with the best (not necessarily correct) answer 🙂

Good post, but the graphs are complete rubbish.

Risk and reward are not always related in such a linear fashion. Perhaps in listed securities, but there are alternatives.

Two things come to mind. Obviously more risk or variation exposes more opportunity to buy something undervalued simply because it’s mispriced by “noise.” You’d have to understand it well and have a good way to define what “undervalued” is; and thoses are some huge assumptions. The other thing I’m thinking is that the more risk involved in a new project, the quicker a bad project fail, and you will be minimize the amount of time and money invested in it.

I think where you are on the quadrant depends on where you are in the life cycle of the investment.

First I would like to look at quadrants:

1 2

3 4

1 High risk Low profit

2 High risk High profit

3 Low risk Low profit

4 Low risk High profit

Example you acquire a 4 unit using highly leveraged down payment and thus it break even on cash flow. Quadrant 1

You treat it as an investment and redistribute excess cash flow to to pay down the property until rent from 1 unit can pay for the entire mortgage. The rents from the other three units are all profit. Quadrant 4

We could both have the same amount of money to invest on an equivalent project but experience and skill set can put you in a lower risk category.

Now if you are investing in something you have never done before all of the aforementioned goes out the window!

I´d choose exactly the same portfolio as you. In my opinion volatility isn´t a good measure of total risk so I wouldn´t mind having better returns with higher volatility.

Because I don´t invest with great leverage and I have long investment horizon so I have privilege to ignore the variability of short term returns.

As long as longterm returns are high, I´m satisfied;)

High risk activities can give a high return. But in addition, investing in them will give experience that will lower the risk for subsequent equivalent investments (eg first foray into stocks, or high failure of small business in first year). So I think high risk is needed to make it big, and the sooner the better in terms of experience and education.

As an aside, I think money not invested finds a way to spend itself, so I worry less about potential losses for incremental investments. I may be biased since I am young enough to earn it back (I’m in my late 20s)

High risk for one, is not high risk for another. Risk is a perceived measure that can be lowered through ones knowledge and investment strategy. Generally speaking, high risk = high return. The trick is to select high return investments and work a strategy to de-risk these and invest with the highest level of certainty. Eg, Rule Number #1 investing.

@ Matthew – These graphs are anything but “rubbish”. Sure there will always be outliers, but if you graph the correlation between risk and return, the shape of an arc will be the formed.

Can you give examples of the investments your referring to?

Wayne@VisualFin: There are several anomalies in stock market that have higher returns with less risk (measured with StDev). Well educated investor can apply investment strategies which returns are boosted with value-, small cap-, low volatility- and momentum anomalies etc.

@Warren: Please explain!

@Jan: It isn´t easy to answer your question in short reply but I´ll try;)

By anomalies I mean ->

Low p/b-, p/b-, p/d- stocks have higher returns with less risk than stocks with high valuation ratios.

High momentum stocks have better future returns than low momentum stocks with less risk.

Low volatility stocks have better returns than stocks with high volatility.

Some academics (e.g Lakonishok) say that these great returns are due of market misspricing. On the other some professors claim (Fama & French) that returns are boosted with some missing risk factor (e.g financial distress) that cannot be explained with volatility.

Please read this nice summary article for extra information: What Has Worked In Investing

@Adrian – I like where you position your portfolio too… there are significant gains to be made with a moderate increase to your risk (vs the first graph), but taking on more risk does not gain you much more ROI. You increase your volatility certainly, however the long term of the investment should moderate that for the endgame result.

Technically it is a less “efficient” investment, but only statisticians care about that, not real world investors 😉

Sorry, have to edit my first comment, it didnt come out quite right! It should have read:

I like where you position your portfolio too… there are significant gains to be made with a moderate increase to your risk (vs the first graph), but taking on much more risk beyond that does not gain you much more ROI.

Pingback: I’m going to make a fortune, effective immediately!- 7million7years

Thanks for your comments everybody, don’t let my announcement of the prize – signed copy of my book; booby prize is TWO signed copies 😉 – stop you from continuing the discussion: http://7million7years.com/2013/03/25/im-going-to-make-a-fortune-effective-immediately/

@ Warren Graham – is this the paper that you meant to link to:

http://www.tweedy.com/resources/library_docs/papers/WhatHasWorkedFundVersionWeb.pdf