Have you seen those acts where the magician calls a volunteer up from the floor, hands them a rope then says to “do exactly as I do”.

Have you seen those acts where the magician calls a volunteer up from the floor, hands them a rope then says to “do exactly as I do”.

The magician walks the volunteer, step by step, through the process of knotting his rope, while the volunteer tries to copy him exactly.

Of course, at the end, the magician’s rope is neatly knotted and the volunteer has rope all over the place and looks a little foolish.

You see, the magician has some extra steps that the volunteer doesn’t pick up, or performs in mirror image, so the trick is doomed to failure for him.

Of course, it’s all good-natured fun …

… but, it’s not so much fun when it happens in real life 🙁

For example, in my last post, I outlined some steps that retirees can take to create a “zero withdrawal rate” strategy for their retirement to virtually guarantee that their money will last as long as they do:

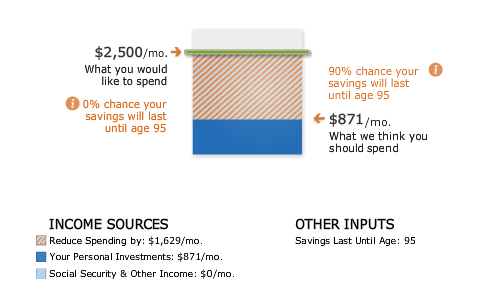

Now, 0% does not mean withdrawal nothing, but it does mean having a sustainable, self-regenerating supply of income; this is not as hard to achieve as you might think.

For example, you can create an ongoing stream of income from:

1. Inflation protected annuities (albeit expensive)

2. TIPS (albeit a low return)

3. 100% owned real-estate (albeit, needs management)

4. Dividend stocks (my least preferred as they are sometimes a sub-par investment that tends to rise-fall with the markets).

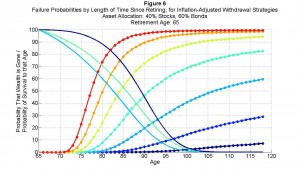

Remember, when you retire, you want not only ZERO chance that your money runs out, but you don’t even want to get anywhere near to zero by a wide margin.

A great feat … if you can pull it off.

But, you have to copy my strategies exactly … and, to do that you need to use your powers of observation to do exactly as I do. No deviation.

So, let’s take a ‘volunteer’ from the audience, Evan, who commented:

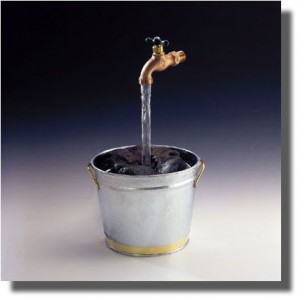

My goal is to have a little bit of all those buckets…right now I am trying to build the dividend portfolio.

Right strategy, but it seems that Evan missed the magician’s “secret step”:

You only implement these steps AFTER you have retired (at least, after you have reached Your Number).

Your goal should be to:

1. Have a large enough nest-egg (i.e. Your Number) to provide enough to retire with, and

2. To then ensure that it (i) keeps up with inflation and (ii) never runs out.

These strategies (dividend stocks, TIPS, 100%-owned real-estate, etc.) only work for Step 2.

They typically don’t provide enough return (including growth of capital and income) to build up the nest-egg that you need, in the first place!

So, if you implement them too early, your nest-egg will be too small to begin with …

Instead, you need to find a class of investment where both your capital and your income grow (at least) with inflation.

Here’s an example using real-estate:

a) BEFORE retirement, build up a large real-estate portfolio with 20% down, and refinancing at regular intervals to build up a large portfolio over time. Reinvest all excess profits into buying more real-estate. Use a mixture of residential and commercial to provide higher growth. Add value by building, rehabbing, etc. etc.

b) AFTER retirement (or, as retirement approaches) sell down your portfolio (particularly the lower-return residential component) until you have sufficient cash to pay out the prime commercial properties in your portfolio. Your aim is to own the best rental properties 100%, with a buffer for vacancies, repairs and maintenance, etc.

c) WHEN you get too old or ill to manage the portfolio (even with the help of qualified Realtors and property managers), sell out (or, leave instructions to your attorneys to sell out) and purchase TIPS (or bonds, if TIPS aren’t available).

Three radically different investment approaches … one for each critical stage of your life.