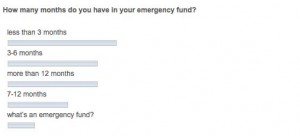

Last week I asked How many months do you have in your emergency fund?

Earlier, my blogging friend JD Roth at get Rich Slowly (GRS) asked the same question of his readers, and this is what he found:

| How many months do you have in your emergency fund? | ||

|---|---|---|

| GRS | 7m7y | |

| less than 3 months | 38% | 29% |

| 3-6 months | 26% | 24% |

| 7-12 months | 13% | 24% |

| more than 12 months | 14% | 16% |

This shows that more 7m7y readers have 3+ months living expenses in their ’emergency funds’ than GRS readers, which means …

… I’ve done a terrible job 🙁

On the other hand, if you answered “what’s an emergency fund?” good for you, you’re already a step ahead of the pack … you see, not everybody – including me – thinks that you need to have an emergency fund at all!

[AJC: At least not until after you reach Your Number]

For instance, Liz Pulliam Weston writes at MSN Money that you should have a $0 emergency fund, replacing it with a concept that she calls ‘financial flexibility’:

The whole idea that everyone needs a big pile of cash, and needs it right now, should be rethought. In reality, the failure to have a fat emergency fund isn’t inevitably a crisis. At the same time, those who feel safe because they have three or even six months’ expenses saved up might be kidding themselves.

Let’s say your take-home pay is about $4,000 a month. Although you have been spending every dime, you make a concerted effort to trim your expenses by 10%. This not only frees up money for your emergency savings but lowers the total amount you need to save from $12,000 to $10,800.

Still, it will take you 27 months — more than two years — to scrape together your emergency fund. And that assumes nothing comes up that forces you to raid your cache.

Let’s explore this a litter further: JD Roth has $10,000 in his emergency fund, but that doesn’t just represent $10,000 today …

…. it represents the future value of $10,000:

Let’s say that you intend to retire in 20 years, if you earn 9% on your money (say, invested in Index Funds) then you are giving up, say, 2% bank interest (by having your emergency fund sit in an ordinary savings account for quick ’emergency’ access) to earn 9% – or, a net of 7%.

That extra 7% earned represents about $8k in extra interest/profit that you are giving up for the benefit of ‘peace of mind’ in an emergency. But, we aren’t investing our money in Index Funds, because we are on a mission: we want to reach $7 Million in just 7 Years!

To us – that is, those of us on a steep financial trajectory – this $10k pile of cash represents seed capital for your new business venture or next real-estate acquisition [AJC: and, don’t tell me that an extra $10k wouldn’t be a big help for either of these endeavors] …

… now, $10k ‘invested’ at:

- 15% (stocks) grows to $35,000 after just 10 years

- 30% (real-estate) grows to $106,000 after just 10 years

- 50% (business) grows to $384,000 after just 10 years

… a slightly larger price to pay for peace of mind 🙂

I don’t view my “stash of cash” strictly as emergency fund, but more as my working capital from which I can draw down as needed (e.g. for the down-payment of the rental property I am buying). At the same time however, I want to make sure to have at least 6 mos of living expenses in cash, ideally 9+ mos. I track cash on hand using that metric monthly to know what my maneuvering room is. When the right opportunity comes along I want to be able to pounce on it. When I embarked on my 1st entrepreneurial venture I had close to zero cash, which left me with very little flexibility in handling tough situations. The next time around, I want to be able to march through the valley of death and not run out of water or cash in the middle of it.

“Financial flexibility” through reduced fixed costs is a no brainer but limited in effectiveness (some costs unavoidable unless you pack up and move in with the ‘rents). Further flexibility by relying on taking out debt as needed to cover shortfalls is a very risky proposition – even if you have lines of credit, credit cards with high maximums, lenders are prone to shut off your access to debt when you need it most.

So I like a little stash of cash as working capital.

“[Y]ou see, not everybody – including me – thinks that you need to have an emergency fund at all!

[AJC: At least not until after you reach Your Number]”

I find it interesting that the caveat to your statement is more or less implied. If given equal weight, I agree with your statements.

I discussed this post with my wife, who is more fiscally conservative than I, and she would prefer to err on the side of having an emergency fund established. She is willing to concede that finding a better vehicle than the money market fund — where we currently have it — is an option worth exploring. However, she is unwilling to go without some kind of liquid fund. On that note, keeping my wife happy by maintaining the fund prevents a lot of stress and strain, which itself is worth a significant sum. . . .

From my perspective, and dovetailing on the issue of liquidity, I am willing to rethink my position regarding the size of the emergency fund based on your overall point. Given that there may be ways to create additional liquidity in our budget, especially after we pay off the last of our high-interest, non-mortgage debt, perhaps the target of six months’ worth of expenses is overstated (which may already be a reduction of what I stated when I commented on the vote I cast in the poll).

One last qualifier of my statements: I earn a wage but my wife is a small business owner, a licensed in-home daycare provider. While my job and income are relatively secure and predictable, her income fluctuates based on enrollment. Having at least a modest slush fund — currently about $4,500 — allows us an immediate option to accommodate a more dramatic downturn in her income if it occurs.

TECHNOmancer

Hey Adrian, I’ve given this topic a lot of thought and how do you feel about seeing a typical ’emergency fund’ as more of a temporary ‘war chest’? In that, you are building up this cash savings reserve as fast as you can, while you scout for that next great investment opportunity(ie; stock in that excellent undervalued company that you researched, or that terrific foreclosure that you’ve scouted out in a great area that you want to purchase and turn into a rental property, or an excellent business idea or perhaps funding the expansion of your current business).

I figure that way, this money has a specific target(high returns that are more likely to get you to your number by your date) BUT, in the meantime, if Murphy pays you a visit while you’re building up this ‘war chest’, you have some liquidity(ie; emergency funding) to tackle that emergency. But, as soon as you have enough built up to take that next investment opportunity, take it with this money!

I think this system may have the added benefit of motivating you and pushing you harder to get the next bit of sum saved up for the next investment opportunity by two fold:

1). You’re all out of Murphy Repellent and need to get stocked back up quickly in case you’ll need some from an emergency!

and 2). You don’t want to miss out on the next big, undervalued, high-growth investment opportunity, do ya? So you better hurry and get it built back up.

Nothing like having 2 extra, fueled jet packs behind you pushing you toward your number by your date in addition to having your Life’s Purpose figured out and on the front screen of your mind while you make this journey.

What say you to this thinking and approach?

Careful, look at the 10 year US treasury – it’s very low right now. That really challenges your growth assumptions AJC.

Businesses that cash flow are the way to go.

Remember we are coming off huge gov’t stimulus- trillions of $$$ that won’t be repeated. The Obama administration is the last holdout but they are being kept at bay by the Senate..

-Mike

Pingback: P.E.P For Week of June 28- July 2, 2010 :: Prairie EcoThrifter.com

Pingback: The Murphy’s Law Fund- 7million7years

Pingback: A new kind of Bucket List …- 7million7years

Pingback: P.E.P for Week of June 28-July 2, 2010 | Prairie Eco-Thrifter