Scott who – in my post proposing a Zero Dollar Emergency Fund – says:

I’ve given this topic a lot of thought and how do you feel about seeing a typical ‘emergency fund’ as more of a temporary ‘war chest’? In that, you are building up this cash savings reserve as fast as you can, while you scout for that next great investment opportunity (ie; stock in that excellent undervalued company that you researched, or that terrific foreclosure that you’ve scouted out in a great area that you want to purchase and turn into a rental property, or an excellent business idea or perhaps funding the expansion of your current business).

I figure that way, this money has a specific target(high returns that are more likely to get you to your number by your date) BUT, in the meantime, if Murphy pays you a visit while you’re building up this ‘war chest’, you have some liquidity(ie; emergency funding) to tackle that emergency. But, as soon as you have enough built up to take that next investment opportunity, take it with this money!

The short answer is that Scott has some cash lying around, and hasn’t yet figured out what to do with it. An ’emergency’ pops up, so the logical thing to do is to dip into that cash and use it to solve the problem.

I don’t have any issue with that: but it isn’t an Emergency Fund. It also isn’t a ‘war chest’. It’s just some spare cash lying around …

Of course, I’m overstating things for dramatic effect, here 😉

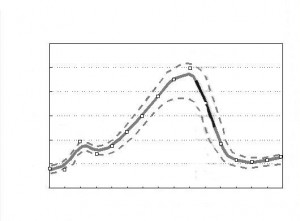

So, let’s take a look at the following graph to see what may be happening [AJC: I’ve adapted this graph from something to do with the ‘mating cycle of dogs’ that I found on Google image search, but I think it suits our non-canine purposes just fine!]:

Let’s pretend for a minute that this graph represents the amount of ‘spare cash’ that Scott has lying around (Y-Axis) at any point in time (X-Axis):

Scott starts building up his savings, has a little glitch as he realizes that he forgot to pay his car insurance premium by installments so he has to pay it all at once, then steadily builds up again until it reaches Scott’s ‘peak’ – his ideal Emergency Fund of $10,000.

Then Scott hits paydirt: an idea for a new online business, and he starts to spend that $10k on programming, domain name registration, hosting, Google Adwords and all the other stuff needed to get the ‘side business’ off and running. A couple of months and $9k later, Scott’s business is paying it’s own way [AJC: well done, Scott!].

Great, now Scott can start building that Emergency Fund again …

Do you see the problem?

The only time the Emergency Fund is adequate is between the time that Scott has managed to save up the full $10,000 and the time he starts spending the money on something else (in this case, his new business idea; it could easily have been a vacation, new car, girlfriend, or …?).

[Sigh] If only Life’s little ’emergencies’ knew how to fit into Scott’s calendar [double sigh]

I guess it’s up to me to propose a better solution …

Next time 😉

Unless I’m mistaken, those who disagreed with the idea of an emergency fund took issue with its opportunity cost, i.e. the money was sitting in a low-yield CD or money market account, whereas they would opine that it’s put to better use in the market, real estate, or business venture. This is a matter of personal preference and/or comfort with risk-taking but I think that it nonetheless misses one fundamental point: An emergency fund is self-funded insurance, not an investment. Its primary purpose is to anticipate the possibility of a loss and to indemnify it, NOT to function as a slush fund awaiting the opportunity for use in an investment.

My career is in the insurance industry – in claims and underwriting, not sales – and so I probably view this from a more technically informed position than most other people. However, this distinction is relatively straightforward. By no means am I saying that it’s wrong to put money to use in order to produce income. When discussing this particular topic, a person must consider whether his intent is to shield himself from an adverse event or to expect that a loss is unlikely to occur (assumption of risk), and so invest his capital instead.

The point about liquidity seems to lie below the surface of this discussion and is of greater interest to me. If I oppose the idea of maintaining a large cash reserve because the money is not achieving its fullest invested potential, how can I protect myself from an unforeseen event – or speculative loss – while not realizing a loss due to decreased returns (opportunity cost)? Second, or similarly, how may I maintain the liquidity of my capital should I plan to invest it unless or until a [speculative] loss occurs?

I would submit that maintaining liquidity by utilizing an insurance product alleviates the need for a large emergency fund and still protects me from the threat of loss. Put another way, there is a more limited opportunity cost, which is the premium paid, but the majority of my capital remains available for investment, which should allow me to seek greater returns. One caveat: If you use one or more insurance policies to achieve this, make certain that you read and understand what losses are or are not covered.

If all of this is off-base or in error, remember that I’ve done claims and underwriting, not sales. . . .

TECHNOmancer

the mating cycle has more than 12 data points.

I’m building a war chest via investments in stocks, etc.. the instruments can be readily liquidated to provided any needed cash for a wedding or dodge challenger, etc.

I agree with TECHNOmancer that it is largely the opportunity cost that I don’t like about emergency funds.

Credit cards, liquid investments like shares and bonds and asstes which generate cash flow will cover just about any emergency imaginable. If all else fails, a good credit rating and a personal loan from a bank will do the job as well.

That’s true, if you have great credit and keep the balances at or near zero on your credit cards, this can serve as your ’emergency fund’, while you keep your war chest working on its intended purpose; buying great investments.

@ Scott – Thanks for inspiring this post with your great comment; obviously, I made up the rest of the details to keep the story ‘interesting’ … I’m sure that your money management strategies have absolutely NOTHING to do with the mating cycle of a dog 😛

Haha, no comparison that I’ve found thus far Adrian! 😉