Ordinary folk don’t plan their finances during their working life, so what chance do they have in retirement?

Ordinary folk don’t plan their finances during their working life, so what chance do they have in retirement?

None.

But, that doesn’t apply to us smart folk who read personal finance blogs …

… WE plan our retirement according to either Poor Man methods, or Rich Man methods known only to a few i.e. The Rich!

By the end of this post, you will know the difference; whether you choose to believe me and what you choose to do with this information is entirely up to you 😉

So, here goes:

Conventional Personal Finance wisdom – clearly ascribed to by the majority of my readers – says that you pick a so-called ‘Safe Withdrawal Rate’ …

…. that is, the percentage of your retirement Nest Egg that you can withdraw to live off each year that you feel will be small enough that your money will last as long as you do.

A sensible objective, wouldn’t you think?

You can pick any % between 2% and 7% (even up to 10%, if you believe all of those Get Rich Quick books) and find some expert or study that supports your choice.

You then have a choice to

a) make that % a fixed amount of your initial retirement portfolio (e.g. let’s say that you retire with $1,000,000 and choose 4%, giving you an initial retirement salary of $40k p.a.), then increase that salary by c.p.i each year regardless of how your portfolio rises or falls [AJC: it’s called the “close your eyes and hang on tight” approach to retirement living], or

b) choose your preferred ‘safe’ withdrawal % and let that rise and fall according to the rise and fall of your your portfolio’s value … so, if you happen to retire a year before the next stock market crash, you could be withdrawing 4% of $1 mill. in one year, then 4% of $500k the next year [AJC: no problem, as long as you can stifle the urge to jump off a ledge when your income halves, as well]

Optimists will choose a withdrawal rate in the 5% to 7% range and pessimists will choose a withdrawal rate in the 3% to 5% range …

… Rich people will do neither!

Why?

Well, before you retire (i.e. now, while you are still working) you could draw a curve of your likely salary moves between now and retirement and you could pick a living standard that corresponds to that curve, using actuarial tables to basically create an inflation indexed annuity for yourself throughout your working life.

But you don’t.

Instead, you live according to your means – and, adjust as necessary – and, build up various safety nets (via cash reserves and insurances) as you deem prudent and necessary.

Why would you do any different after you retire?

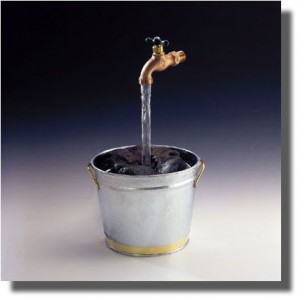

Poor people who retire put their money in a bucket and a little trickles in (interest, dividends, capital appreciation) and a lot gushes out (inflation, taxes, expenses, disasters).

You have a bad year or three, overspend a little, a couple of health issues, and you’re screwed [AJC: it even happens to retired sports stars, movie stars, and musicians. Ever heard of MC Hammer?].

But it doesn’t happen to smart Rich people, because they don’t drink from a bucket … they drink from a golden faucet:

They create – then live from – an income, both before retirement and after!

Think about our energy crisis past, present and future … all resolvable (we hope!) by switching to an abundant source of clean, green, renewable energy.

Now, think about all of your spending crisis past, present and future … all resolvable (you hope!) by living within your means a.k.a. creating an abundant source of renewable income!

That income can come from a family business that you retire from but retain “passive” part-ownership of; from venture capital activities; from real-estate investments; and, so on … in fact, from any investment that produces a reliable income stream that tends to grow at least in line with inflation.

Here is how I planned it:

1. I used the Rule of 20 strictly for planning purposes [AJC: this sounds like a 5% withdrawal rate, but who said that I’m actually going to withdraw the 5% each year?!]

2. I started creating a Perpetual Money Machine: something that will produce income that I can live off; in my case, it was RE bought with (or, for which I already have built up) plenty of equity or cash to ensure a healthy positive cash flow.

3. To cover ‘bad years’ and other contingencies, I retain at least 25% of the income stream until I have built up enough for TWO YEARS of living expenses and then I reinvest whatever is left over (i.e. buy another property every few years).

So, what if something goes wrong as it did for me when the GFC hit leaving me with too much house, another house I can’t get rid of, and $2.5 million of unavoidable stock losses [AJC: part payment for my business came in UK stock … yuk!], resulting in not enough income?

You go back to MM201 and start again (hence, my commercial property development activities) …

… after all, history has shown that your first fortune is by far the hardest 🙂

Seems to me, the hardest part of this whole thing is going to be insuring you have enough to last your entire life. I say this because I recently read about a woman who lived to be 115 years old. Now I am pretty certain,she never expected this, since I bet on one else in her family every lived that long. So, we have an unusually long life. What happens of you plan for 90 years, and live 20 years longer?

oops no one

@Steve – outliving my money is a concern. that is why i do not wish to rely on any drawdown of capital and hope to generate enough income from my investments to at least support my desired standard of living and preserve the real value of those assets. That way it does not matter how long i live.

Good post. I must bookmark this

@Adrian,

I agree you mathematically can never run out of money if you are living off just the returns. Inflation is important too- but properties should keep pace with inflation.

Steve,

One way to hedge against living too long is using annuities Mike Piper wrote on that strategy here:

http://www.obliviousinvestor.com/using-annuities-to-protect-inheritance/

It isn’t perfect since if you die early the insurance company wins- but it is a way to remove the risk of outliving your money.

-Rick

Adrian. I’m not a real fan of Annuities. Have never seen one that has a good return for your investment. If your lucky, you may find one with a short term(I.E. 1 year return of maybe 5%) with a lower return from there forward.Plus fees to manage that annuity might run you more than fees in a Mutual fund.

oops my bad, it wasn’t Adrian who was advising the Annuity, this lat post should have been addressed to Rick Francis,as I believe he was the one advising Annuities.

Pingback: A new kind of Bucket List …- 7million7years