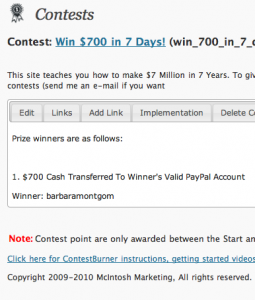

UPDATE: We have a winner in my $700 in 7 Days Giveaway … yep, ‘barbaramontgom’ (with 6 points) was chosen by random drawing (see below) and wins the entire $700 Cash!!!!!! Barbara just needs to send me an e-mail ajc [at] 7million7years [dot] com to claim her $700 cash prize (less any PayPal fees)!

UPDATE: We have a winner in my $700 in 7 Days Giveaway … yep, ‘barbaramontgom’ (with 6 points) was chosen by random drawing (see below) and wins the entire $700 Cash!!!!!! Barbara just needs to send me an e-mail ajc [at] 7million7years [dot] com to claim her $700 cash prize (less any PayPal fees)!

Bet you wished that you had entered 😉

Special thanks to Steve and Trisha who tied at the top of the leader board … if you send me an e-mail with your name/mailing address I will send each of you a $60 Apple Gift Card! Thanks to all of the others who entered and promoted the contest like crazy!

LAST CHANCE to enter my free contest: CONTEST OVER: in just ONE more today, I am giving away $700 cash to one lucky reader (drawn at random) as part of my $700 in 7 Days No Strings Attached promotion. It’s free to enter simply by clicking here.

________________

CNNMoney fields a question from a reader who’s scared that her money will run out before she does:

Question: I recently had to take early retirement at age 57 because of back problems. I’m now looking for a safe place to invest my retirement money where I’ll have no risk losing it. Any suggestions? — Donald H., Morris, Alabama

Yes, I have a suggestion: don’t post your questions to a financial ‘expert’ who still works for a living!

If you do, you’ll get answers like:

Answer: If the threat of losing principal were the only financial risk you had to protect yourself against in retirement, then finding a safe haven for your money would be pretty simple. You could plow your entire nest egg into Treasury bills or spread it among FDIC-insured savings accounts and CDs (taking care to stay within the FDIC coverage limits).

But while doing this would insure that you would never lose a cent of your money, it would also insure that your retirement stash earned a pretty measly return.

Good, so far … so, no cash. Got it!

What should she do instead (?):

If you want to have a decent shot at your retirement savings lasting as long as you do, you also want to invest in a way that has at least some potential for long-term growth.

[Keep some in cash and the] rest of your savings you want to keep in a diversified portfolio of stock and bond funds. Again, there’s no single correct mix. Typically, though, someone just entering retirement might have 50% or so of his or her portfolio in stocks and the rest in bonds.

Zowie!

Question: If you are aiming to retire, why do you want long-term growth?!

Answer: Because, you expect to lose some significant proportion of your capital to:

– Spending too much,

– Inflation,

– Market downturns.

In other words, the expert recommends to invest in a ‘wiggly line’ investment, hoping that the upswings outweigh all the downswings + spending after inflation is taken into account.

How well has that been working out for the past, oh, 20 years?

So, can you think of an investment that tends to grow with inflation, and provides income that also tends to grow with inflation?

Well those treasury-protected bonds certainly have principal that keeps up with inflation, but the returns are so low that income will become a real problem.

But, what about real-estate?

It’s where ‘the rich’ have kept the bulk of their retirement savings since time immemorial … I wonder why? 😉

Yep…stocks, real estate and (possibly) a few other things that do not have fixed returns, guarantees or unjustifiable high fees to eat into your returns.

Most of the time, my own “number” will be divided between real estate and equities. Some cash/short term debt securities or equivalent to ensure that I never need to sell things when prices are depressed but that’s it.

@ Traineeinvestor – stocks? I have a friend who retired with a multi-million portfolio of stocks circa 2000 … he’s endured two 40+ down cycles so far. Is he comfortable knowing that over a 30 year cycle that stocks will return 8%? NO … in fact, 2 years ago he bought a business: now he delivers chips to supermarkets (when his driver is sick, etc. he does it himself!),

Sure, stocks go up and down. Historically they have beaten inflation by a comfortable margin over the longer term. That’s not a guarantee of course which is just fine because no sensible person would want a guaranteed investment (other than a small amount of cash/near cash investments for short term needs).

I could write a whole post on why I would not want to rely on owning/running a private business once I am in “retirement”.

owning and running your own business when your in retirement? hmm doesn’t sound like retirement to me. I think that might be a great vehicle for obtaining your number/date,but once there, maybe switch up to something that gives you more free time.

well, I want to wish everyone who entered and promoted the site good luck in the contest. contests are always lots of fun.

I wanted to say congrats to Barbara on winning the contest and Thank you Adrian for adding the gift cards for Steve and myself. It was a fun contest and interesting to see how other people responded. Great information on this site- thanks again!~

Adrian, thanks for the gift certificate, and your welcome. I saw the note included with the gift ,thanking me for working hard on the contest. But when your involved with something that is fun,it really doesn’t feel like work,and there were a host of others that did a fine job as well. I also made some interesting finds out there that I’d like to revisit in the near future.Trisha,Congrats on the gift certificate.Barbara,congrats on your win, and thank you to everyone who helped promote Adrian’s contest. I hope you all had as much fun as I did.

Adrian,

I just want to say thank you! WOW I am still in schock that I won the contest…. it was a great Thanksgiving Day Surprise. Congrats to both Steve and Trisha who wom gift certificates as well.

… and, that’s a wrap 🙂 Thanks to everybody who participated!

Sure, hold a contest while I’m out globetrotting (both for work and pleasure).

Congratulations Barbara!

Neil (who is now way behind on the course)

@ TraineeInvestor responded to this post with a post of his own; check it out at:

http://aprivateportfolio.blogspot.com/2010/11/owning-private-business-is-not-for-me.html

For some reason, I wasn’t able to login to comment on his post, so let me say here that I agree that a business isn’t a great post-retirement choice.

Now, I can’t find the exact post – google site search is letting me down lately 🙁 – but I recall posting about a book that proposed keeping a business to drive your retirement strategy and ensure that your money passes on – after you do – through the generations. I also recall describing this as the “most dangerous idea in retirement planning that I ever heard!”