The current state of American financial thinking is terrible, if this is the best advice that “a senior editor with Money Magazine” can come up with:

Question: I’m 28 and would like to have $1 million by the time I retire at 65. What are some of the investing options I should consider? –Joshua Sin, Fresno, Calif.

Answer: I’m all for savvy investing, and I’ll get to what I think you should do on that front in a minute. But let’s not forget that when it comes to building wealth, investing alone won’t do it. –Walter Updegrave, Senior Editor, Money Magazine.

Walter Updegrave, the author, then goes on to provide a very interesting analysis of how to come up with the $1 mill by 65 – basically saying that it can’t be done:

If you begin putting away $100 a month starting now and continue doing so until 2047, the year you’ll turn 65, you would need an annual return of roughly 13.5% a year to turn that monthly hundred dollars into a million bucks.

What investment options can deliver a 13.5% annual return for almost 40 years? None that I know of.

True. Correct. Perhaps, Insightful.

But, I’ve said it before and I’ll say it again: who in their right mind cares?

Hasn’t Walt forgotten to ask the key question … why???!!!

Joshua is to be commended for thinking so far ahead, at the age of 28, towards retirement. But, shouldn’t our financial expert’s first step be to examine if the objective is reasonable?

Let’s give it a shot:

Choosing a much more reasonable go-forward inflation rate of 3.5% …

[AJC: The author assumed “a modest 2.5% inflation rate”; that’s just UNDER the current outlook for the next 5 years, pulling out of a major global recession … but, I wouldn’t bet FOR a 40 year recession, if I were planning my own retirement!]

… by the time Joshua turns 65 that $1 million will only be worth $268k.

What does that mean?

It depends on what Joshua does with the money; however, given that his 37 year financial strategy has been simply to ‘save’ (presumably via CD’s, Bonds, Mutual Funds, and the like), I guess we need to assume that he will continue that strategy in retirement.

Therefore, Joshua will have little choice but to abide by the ‘advice’ of the financial planning community, which will be centered around finding a ‘safe withdrawal rate’; a great way to find out what that might be for Joshua, is to plug his $268,000 nest-egg into the T. Rowe Price Retirement Calculator:

Now, what annual income would be reasonable for somebody like Josh to aim for in retirement? $150k a year? $75k a year?

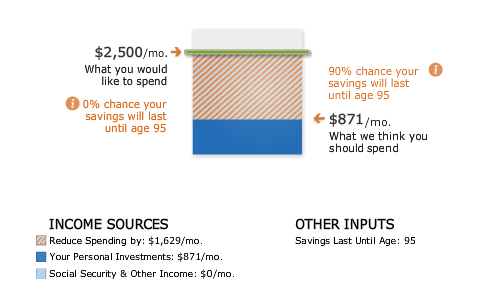

Let’s just say that he aims for $30,000 a year or $2,500 (before tax!) per month in today’s dollars; how well does he do with his $1,000,000?

Not very:

[AJC: PLUS whatever social security there may happen to be in 37 years time … how optimistic are you?!]

Do you think that Josh would have been more surprised to learn that:

a) he would need to average 13% p.a. on his savings to reach $1 mill, or

b) even if he made it all the way to his $1 mill. target, he would only have $871 per month to spend?!

Our readers represent a small but keen-to-learn cross-section of people interested in the subject of personal finance; let’s tell the financial services, advice, and publishing industries:

What sort of financial advice are you looking for?

Go ahead, leave a comment – especially if you’ve never done so before – and, we’ll challenge them to respond!

Well, I guess it really depends on what your goals are. It’s not too difficult to make a million by the time you are 65 if you start early (you do have to save more than $100/month though), but as you said, it won’t be worth nearly as much as it is now.

I’m investing monthly, and I hope to save enough to be able not to work if I don’t want to. I probably won’t make 7 million in 7 years, but I don’t really need that either. For me, money itself isn’t important, it’s the freedom to do what I like that counts. Not freedom to buy stuff, but freedom to choose what I do for a living. Someday, I hope I’ll be able to do whatever I like and not have to worry about if I make money doing it.

I, like most, would like to find a way retire early, and still have a fail-safe that will allow me to live comfortably after retirement even if I have to work until, say another 25 years or so has passed. Assuming I have a lifestyle that costs around $2K/mo to maintain (inc. mortgage), and that this cost would continue indefinately if I would like to keep living the way I’m used to:

1. How much do I have to save/invest per month for the next 25 years before I retire?

2. What return do I need to be able to spend $2K per year for 35 or 40 years after I retire in 25 years?

3. What investment vehicle will provide these returns?

4. How certain/reliable are these investments?

5. Can the lifestyle costs be expected to increase as health erodes due to aging and by how much?

6. What is the worst case scenario? Best case scenario?

7. What is your personal track record with investing and is this the same as what you are recommending? (quetion not for you AJC, but anyone else who proposes to give advice).

8. What goods are most affected by inflation, how big of a concern is erosion of purchasing power (e.g. an ounce of gold might cost a lot more, but a pound of wheat might be roughly the same, or cheaper, so is inflation a realistic concern if I don’t plan on buying any more gold when I turn 80?)

Thanks.

” freedom to choose what I do for a living”

@ Passiivinen Sijoittaja – When you’re circa 28 that is probably true; when you reach 40+ I’m guessing that you’ll drop the “choose what I do for a living part” 😉

But, I agree: while this blog is titled How To Make $7 Million In 7 Years, it’s really about reaching YOUR Number by YOUR Date.

But, at $871 a month (in today’s dollars), Joshua had better be planning the life of an Ascetic!

@ Modern Alchemist – Well, we know that $1 mill won’t even be enough for your $2k p.m. ‘fail safe’ 🙂

I think Passiivinen has it right–she wants the financial flexibility to do what she feels is important.

Ex: I am a public interest attorney making far less than I otherwise could. I could go work in private practice, earn more money, then retire early(er). But, I’d probably spend much of my retirement doing much of the same work for free that I currently do as my profession. There are two options that are somewhat hard to quantify: (1) work in private practice, earn a higher salary, retired early, then donated part of my time in retirement to public interest lawyering; or (2) make a career of public interest lawyering, earn less, retire later, but get to do the things I truly find important from the get-go.

@ Will – Your life isn’t about your money … your money is simply there to support your LIFE.

Ergo: make a conscious choice for (a) or (b) then run a slide rule over those numbers …. I still doubt that $1 mill in 47 years would be enough for YOU to retire on either 😉

Adrian,

Retiring today with $1M isn’t enough to support a lavish life style – with another 47 years of inflation it certainly will be far far less than enough.

Why would the editor choose just $100/month for his example? For an average american with a salary of around 50K/year $100/month is just 2.4% of his income.

-Rick Francis

@ Rick – Good question!

I have written to the editor, because I am obviously generally disappointed with the article, and am awaiting a response.

Reading about this, something just keeps popping in my mind. Is 50K a year really an average in the US? Is it before or after taxes? Because here, in Western Europe, where the quality of life is as good if not better, I would say the average per annum does not go beyond 35K.

That’s also something to keep in mind when calculating one’s Number…

@ TK – That’s why I chose $30k for my example ($2.5k pm)

… on the other hand, who wants to be ‘average’? 😉

“… on the other hand, who wants to be ‘average’?”

You got a point there 🙂

Let’s shoot for the moon. At worst, we’ll land among the stars.

Now I know how my nest egg will afford me only two cans of cat food per day. But with inflation it may only be one.