I’ve been thinking a lot about income lately, which is ironic as I don’t have any right now (at least, not in the traditional ‘work for a paycheck sense’).

I’ve been thinking a lot about income lately, which is ironic as I don’t have any right now (at least, not in the traditional ‘work for a paycheck sense’).

It’s also ironic because, when I did have an income, I didn’t worry about it at all:

Back in 1998, I had two businesses that, between them, managed to earn exactly $0 …

… what one business made (about +$5k a month), the other one managed to lose (about -$5k a month).

But, I wasn’t at all worried.

That’s because this break even scenario already took into account the cost of my (then) still-quite-basic basic lifestyle.

For example:

– I could deduct the cost of my cars as a business expense, so my business paid for those

– I could deduct the cost of my travel as a business expense, so my business (or the occasional consulting client) paid for those

– And, I could afford to pay myself a fairly basic (at least, for a guy with a family) $50k salary a year

So, with my combined businesses breaking even (after these expenses were taken into account), together with the fact that I could control my cost of living by delaying gratification (not to mention, my wife was still working and bringing in a decent income), I simply didn’t worry too much about earning an income.

But, all that changed when I started investing actively, and built up my first $7 million (in 7 years) fortune …

It changed for the worse!

Firstly, my cost of living increased. A lot.

Then, my wife stopped working. Of course.

And, my actively-generated income stopped. Because I sold my biggest business.

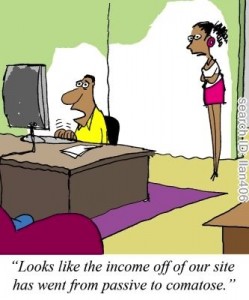

Now, I mostly have to rely on ‘passive income’ which is really just spending the money I have in the bank while I figure out how to make more money from investments than I spend on their expenses + the cost of my lifestyle.

And, that’s now a big number!

So, ironically, just when most people think that I have “f**k you” money, I have started to worry about income …

… simply because I have to create my own.

How about you? Do you worry about income? Why (or, why not)?

Do I worry about money? No!

As long as I have food in my belly, clothes on my back and a roof over my head, life is good and everything else is a luxury.

I live in a caravan and work for a low wage on an apple orchard, I can afford a few luxuries (laptop, smart phone, satellite tv) and the once a month day out to the cinema or to eat out.

The only time I ‘may’ be concerned about money is if I couldn’t put food in my belly or clothes on my back!

Great blog btw, been reading for a few months but never commented, keep up the great posts! 🙂

I certainly do every month Adrian. And the ironic thing is, I make far, far more money now since I completely own my own business, free and clear now from a business partner(not to mention that i’ve gotten further along on my wealth-building path). It’s just funny how i’m more worried than ever and more in a hurry than ever to get to my number, even though I have more available tools(income to invest) now than ever and i’m making quicker strides toward it! lol

Not sure there is really completely passive income, but you seem to be suffering a bit from lifestyle creep as well. The same thing has happened to us.

Right now we often trade money to replace time (by paying for more convinient/fast options), but if we can get out of the rat race, we shouldn’t be in a rush as much.

In good news, getting out of the rat race seems more possible as we have started the first side business in full force.

@ Scott – You’ve come a long way since we first ‘met’. It will be interesting to see what you manage to achieve over the next 3 years.

@ Neil – I remember exactly when my lifestyle creeped (more a quantum jump):

It coincided with my decision to increase my salary from $50k a year to $250k a year.

Now, that particular genie’s NEVER being stuffed back into the bottle 😉

Hi Adrian,

It seems like your biggest headache was increasing the lifestyle consumption from $50k to $250k a year… that being said, how do you keep this from further inflating?

Does it mean you will need $500K a year in a few years?

-Mike

@ Mike – In approx. 20 years, with no other lifestyle changes, yes. But, that’s already built into the Rule of 20:

http://7million7years.com/2008/01/30/its-never-going-to-be-enough/

Adrian, I’ve seen some things you’ve written. You seem like a smart guy, don’t sweat it!

This post has had me thinking for a while. And I think I may have come up with a different approach to your “Find your number, make your number, retire.” sequence.

What about gradual retirement. You start saving, and investing, and you try from the beginning to make investments that will begin to generate income – not necessarily monthly income – but at least annual income.

Every year, you calculate the income from your investments, and compare it with your current income from working.

You don’t use it though – it get reinvested straight-away, on top of your regular investment from your normal income’s savings.

As soon as your investment income = your current working income, you can retire.

In that way you’ve also secured your future, because you will continue investing a portion of your income, as you have been doing all along.

And because you’ve been doing this calculation all along, you aren’t making a major life-style shift at that point because you are “suddenly” rich – you simply stop working, and continue life as normal.

“As soon as your investment income = your current working income, you can retire.”

@ Ashton – Agree … with one minor alteration:

As soon as your investment income = your required working income, you can retire.