Beware those who love stocks. Beware those who love bonds. Beware those who love gold, oil, futures, and so on.

Beware those who love stocks. Beware those who love bonds. Beware those who love gold, oil, futures, and so on.

Most of all, beware those who love real-estate!

OK, so I invest in real-estate …

… but, I’m not in love with it.

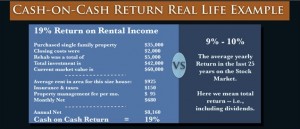

Take a look at the above infographic [click to enlarge]; a picture (with numbers) tells a thousand words:

This person claims that they (or a client) bought a single-family home for only $35,000 and now clear (fees, insurance, and property taxes) $680 a month in rent.

Since they put in $7k in closing costs and rehab when they bought it, they are really returning $8k a year, which is 19% a year.

The key to real-estate is that you can add value.

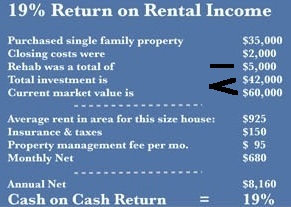

To see what I mean, check out the highlighted items in the enlargement, below:

By spending just $5k in rehab, the purchaser immediately increased the value of the property by $18k, from $42k to $60k. Presumably, this similarly increased the rents.

The problem with this type of example is that it is unrealistic: this example assumes that you paid cash for the property.

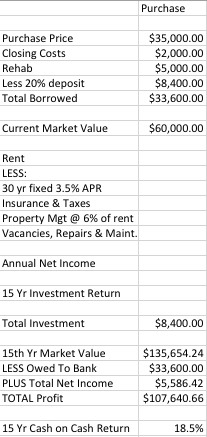

Instead, I’ve made a ‘more normal’ example from this one, to show you how cash-on-cash returns really work, and why RE really is such a good investment:

[you can download the full spreadsheet here: https://www.dropbox.com/s/ujuqaptgrr8hssv/Simple%20RE%20Analyzer.xls]

This analysis confirms that it is possible to get a 19% Cash-on-Cash Return, but:

1. You need to have a 15 year outlook; the first year produces a loss,

2. The assumed rent is VERY high.

The reality is that most residential real-estate tends to produce negative returns in the early years, and capital gains over the longer term. Whereas commercial real-estate tends to produce higher earlier returns but lower capital growth.

Still, by purchasing well, adding value (e.g. through a clever & economic rehab) it is possible to produce fairly reliable (when compared to the up’s and down’s of the stock market) cash-on-cash returns that blow away most other consumer-grade investments.

Those numbers seem suspect in most cases, and most lenders will not left you get a mortgage that small, or they will charge a lot more in closing. And you need to consider vacancy, leasing costs, and maintenance.

12% is a good cash on cash return, but you also forgot to include some other big benefits of real estate:

– principal loan reduction as the renter pays your mortgage down

– appreciation in the property, especially if you are leveraged a 2% increase in value is a net 10% if you put 20% down

– depreciation. This is a huge tax benefit.

Right now is a great time to get property in the US if you can get the loans approved and pick the right area and properties. It is a long term play, but a great way to get a solid cash flow and increase your assets.

I will agreed with Adrian that it is a slower play than a successful business, but is working out well for us.

Neil

Neil,

My partner and I put down $937,500 on strip centers. Our cash flow is $225,000. That puts our cash on cash at an astounding 24%! Suspect? Sorry, but it is a true story. Good terms from a bank.

Heath