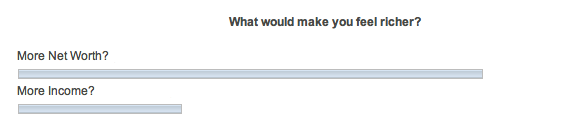

Last week I asked my readers what would make them feel richer: more income? Or, more net worth?

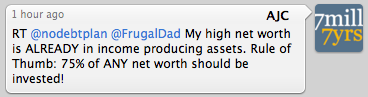

This was prompted by a Twitter Trail (my term for a thread on Twitter) that started with this:

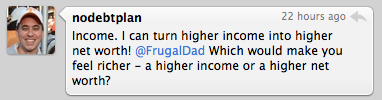

@NoDebtPlan articulates the classic fallacy: income makes you feel richer because it can be turned into net worth.

But, that is illusory: if your net worth is invested wisely, it’s pretty hard to lose all of it.

On the other hand, ask the millions of people who are ‘down-sized’, get injured, relocated, become under-skilled, out-voted and so on just how easy it is to lose your entire income … and, as soon as your income stops, you begin to feel very poor indeed 🙁

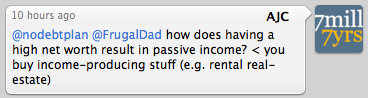

Of course, what’s the use of net worth if not to create income?

So, while it is certainly true that income can create net worth … that’s the beginning of the chain, not the end.

The whole point of net worth is to (a) live in / drive in / enjoy and (b) to create an alternate (passive) source of income so that you can eventually stop work, should you so choose (or be forced into).

Now I’m not talking from some book that I read: I created my $7 million in 7 years simply by exchanging income (from my business) into assets (income-producing real-estate and stocks) … and, you should do the same:

Remember that Rule of 75% … without it you, too, will always be a slave to earning an income 😉

How many millionaires are there?

how many people make more than 250,000 per year?

http://blogs.wsj.com/wealth/2012/03/21/millionaire-population-grows-by-200000/