I’m still technically on vacation – half way around the globe from my usual abode as I write this – but, I did promise to share the ‘missing piece’ of the Formula for Wealth:

This formula – were it not for the one factor that I added – would fail on two counts:

1. Wealth being a function of Capital and Time is merely another way of confirming the so-called ‘power of compounding’, which is no great shakes as 1,000 others have already sung its praises and hardly justifies me adding my voice, and

2. It doesn’t explain The Bill Gates Effect: why Bill Gates (and, Steve Jobs, and Warren Buffett, and Mark Zuckerburg, and Oprah) is rich and the rest of us (present company excepted) are not.

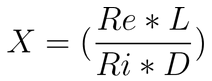

That’s why I added the key: the X-Factor …

… which, in itself would be totally useless, if I couldn’t explain it so:

For the non-mathematically minded (and, you have to be, because as a strict formula this is nonsense), the first part of the ‘formula’ expresses the classic Risk (Ri) versus Reward (Re) tradeoff.

This is logical: “Bill Gates is richer because he takes bigger risks. I’m risk-averse so I cannot be rich. No problem, back to frugality and 401K’s …”

The good news is that Risk and Reward are related: for every financial activity there is a built-in level of risk. Choose one and you automatically choose the other.

To a greater or lesser extent, you can treat this Risk/Reward Tradeoff as a constant (actually, a curve, but there is a fixed point on the curve for whatever financial investment activity that you undertake).

In other words:

1. You choose the level of Wealth (W) that you want to achieve i.e this is your Number

2. You choose the Time (T) that you have available i.e. this is your Date

3. You have a set amount of Capital (C) that you start with i.e. this is your savings

4. You calculate the required Annual Compound Growth Rate, which tells you what financial activity you need to undertake (e.g. stocks, business, real-estate, etc.)

5. This automatically puts you on a set point of the Risk/Reward curve.

So, by selecting your Number and Date in advance, you have – in effect – taken away all decisions and the Wealth Formula works automatically for you.

You have only two levers to pull that will determine if you succeed – and how well (Bill Gates well, AJC well, work-for-40-years well, or hobo well):

Leverage (L) and Drag (D).

I’ll explain these in the New Year 🙂

Hi Adrian

Hope you are having a good holiday.

As a small point (or possibly not so small), is there really a relationship between risk and reward that can be defined in terms of a curve? I thought that theory had been debunked. If you buy an asset cheap you have more potential reward and less risk than if you pay a higher price for the same asset.

As an even more trivial point – if you define “rich”, I’ll let you know whether you are the only one of “the rest of us” who is rich. 🙂

Cheers

traineeinvestor

@ Trainee – Fair comment: clearly, if you buy an asset at a discount you pay less, hence increase your potential reward … at the same time decreasing risk. This seems to debunk the notion of a ‘fixed’ relationship between risk and reward.

But, how do you buy an asset cheaper than the next bloke? I maintain that is only possible via luck or other forms of (L)everage 😉

Perhaps semantics, but important in the context of understanding what levers you really get to pull if you want to become rich (or simply reach a large Number / soon Date).

BTW: if you are 7m7y ‘rich’, then I have already stated that you are wasting your time reading this blog: you should be seeking advice from somebody who is at least 70m7y ‘really really rich’ 😉

Hi Adrian

On the first point, I go with timing. Buying things when they have been sold down. Shares in late 2008/early 2009 were a bargain as was HK real estate in 2003/4. I’m not buying cheaper than the next bloke – I’m buying from the next bloke.

On the second point, not being the entreprenurial type (unless you consider developing a professional practice as entreprenurial), it took me a lot longer than 7 years. Also, my name says it all – there are always new things to learn and believing that I can stop learning (especially from other successful people) would be risky (and a touch arrogant). I’ll keep reading simply because I value your insights.

Cheers

traineeinvestor

Pingback: Applying the Formula for Wealth – Part I- 7million7years