If you find yourself asking a personal finance question like this one, this post will give you all the tools that you need to answer it for yourself:

If you find yourself asking a personal finance question like this one, this post will give you all the tools that you need to answer it for yourself:

I am in my early 20s, earning between $110-180k/yr depending on my bonus. Would it be inappropriate for me to drive a $50k Mercedes Benz?

Most people would deal with this by saying things like:

– Can you pay cash for the car?

– If you buy a Merc now, what will you buy next year?

– Save for your own home

– And, so on …

Which are all valid concerns …

… but there is one important question that nobody thinks to ask:

What is your current net financial position (i.e. net worth)?

Yet, this is the most important question to ask!

Why?

Because it’s your Net Worth that sustains you in retirement:

– Before your retire, you earn income

– You save and invest as much of your income as possible to build up your ‘nest egg’ (this is your net Worth on the day that you retire)

– After you retire, you live off the income (e.g. interest, dividends, investment income, etc.) generated by your Net Worth and/or deplete it over time

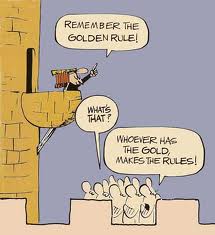

And, this takes you directly to The Golden Rule of personal finance …

… because, it’s the one financial rule to live by; the one above all others; the one that – if you follow it – will answer all of your financial questions and guarantee your financial future:

Always have 75% of your net worth in investments.

This means: at least until you retire at a time and place of YOUR choosing, that you should always have no more than the remaining 25% of your current net worth (tested yearly) as equity in your own home, car, possessions, etc..

These rules of thumb then follow:

– Have no more than 20% of your current net worth as equity in your own home

– Have no more than the remaining 5% of your current net worth in your other possessions. It is typical to split this 50/50 between your car and your other ‘stuff’.

– This means that you should have no more than 2.5% of your current net worth in your car. I suspect that the reader’s proposed Mercedes would break this rule.

There are a few important things to note, if you’re going to obey The Golden Rule:

1. You can – in fact, should -break the 20% Equity rule for your first house (otherwise, you will never be able to afford to buy one), but don’t upgrade for as long as you will be breaking this rule.

2. You will probably need to borrow money to buy your house (first and/or future home), but don’t spend more than 30% of your take home pay on the mortgage repayments, except – again – for your first house (but, only if you absolutely have to).

3. Never borrow money to buy a depreciating asset (e.g. car) UNLESS it’s required to earn income AND you have no other way of buying one. Even then, obviously buy the cheapest that will do the job, borrow the least, and pay it off early.

4. For a pleasant surprise, test these numbers annually: because your Net Worth will go up each year, yet your car and other ‘stuff’ will depreciate (check eBay). This means, you can actually afford to buy more ‘stuff’ every year or so, if you like, or just save up your ‘spare net worth’ for a couple of years to upgrade your car, etc. when ready.

So, are you following The Golden Rule?

If not, what do you have to change in your life so that you do?

My question is I don’t included depreciating assets in my net worth cars, boats, etc Does it that change the Golden rule percentage ?

@ Will – Another way of putting The Golden Rule is: Your Investment Net Worth [should] = 75% x Your Current Net Worth.

Your Investment Net Worth starts with your Current Net Worth but EXCLUDES depreciating assets e.g “cars, boats, etc” PLUS your own home.

Adrian,

You state “never” to borrow money for a depreciating asset for example a car. What about the opportunity loss incurred when you take that money and apply it to a asset that does not earn you money?

I think that buying a 20-30k car using the bank’s money at 1.5% interest (currently) and take it out for 5 yrs. With inflation around 3-4% and, in reality, more like 8% the bank would take more of the hit than you would. You could then use the cash you would have used to pay the car off to invest which would make money for you. To me that is a much better use of money than giving it up to a car that makes no money. Thoughts?

@ Michael – It’s risky (unless both rates are virtually ‘locked in’ for the entire period of the car loan) but, I have no real problem with that strategy!

Another way of looking at this is: if you do happen to have a car loan, and the interest rate is low (e.g. 1.5%), then don’t be in a hurry to pay it off if you can invest your money better elsewhere.

I’ve purchased two homes so far in my life and in both cases having 20% as a down payment was a must have, not because the lender told me I had to have it, but because it was the best move for me personally. Don’t let what a lender tells you is available guide your decisions. They don’t have your best interests in mind. They have theirs.

any negatives to having too much in investment net worth?,,,i”m at 98.5%

@ Money Beagle – Keep in mind that the 20% Equity Rule is NOT the same as putting 20% down (the former is 20% of your net worth at any point in time, the latter is 20% of the value of your home when you purchased it).

@ Brooke – Probably none, perhaps other than recognizing that (a) it’s unlikely to stay at that ratio as you house, feed, entertain, and educate your family, and (b) money is worthless, other than for spending now and/or spending later.

@ Adrian. I am thinking of buying some retail real estate properties, not cheap, but paying 30% right now, lending the rest for a period of 15 years in which the rent pays the loan. What do you think?

Christel (48 years young, or old!-)-)-)

Your rule seems out of touch with reality. For example, I’m looking to replace my 20+ year old car with a modest $9000 car in the near future. By your recommendation I shouldn’t buy that car until my net worth is $360,000. Instead, you recommend I purchase a $875 car, that means perhaps my 20 year old car is too expensive for me. I just finished university and although I make a good salary, it’ll be a while before I’m worth 350k+.

Am I understanding you correctly? How many people do you realistically think currently follow this rule?

Disregard my comment. I see this is not the blog I thought it was. 2.5% is probably realistic if you’ve got millions of dollars. I suppose your advice isn’t really for people that can’t increase their net worth by a million a year (*cough*me*cough*) Kudos to you for saving so much.

@ Christel – I love investing in real-estate; if you can buy well enough and/or put down enough (eg. 20% or 30%) to help make them cashflow positive from Day #1, then that’s an excellent long-term strategy.

@ D – Both comments are fair, and I’m glad that you made them, because I see now that I do need to clarify a couple of points:

– You are correct that your first car (or replacement car) may not (probably not!) fit into the 2.5% Rule; the key, then, is not to buy a better type of car than you NEED (for transport/work/etc.) until you can afford the luxury i.e. according to this Rule.

– By definition, these rules apply partly after you are on your way (e.g. have already bought your first home and your car), but equally SO that you can become wealthy.

I also need to add a little postcript: I don’t think you can SAVE your way to wealth; I do think you can BUILD your way to wealth by INCREASING your income and INVESTING according to The Golden Rule at your earliest opportunity.