OK, so if the ‘secret’ to making money hasn’t changed in 50 years …

OK, so if the ‘secret’ to making money hasn’t changed in 50 years …

[AJC: if you didn’t read yesterday’s post, it’s simple: buy a rental property with about 25% down; renovate; trade up and start again; repeat until rich!]

… why are there so few people doing it?

It could be market fever: “the market’s too [insert excuse of choice: hot, cold, near, far, etc.]”; but, I suspect it’s the age old reason: you simply don’t know HOW.

Ok, so let me make it simple: save up a reasonable deposit (15% to 25% works for me), and do the most cost-effective renovation (also called remodeling or rehabbing, depending on what country you live in) possible.

The question is, what are the best ‘bang for buck’ renovations to do?

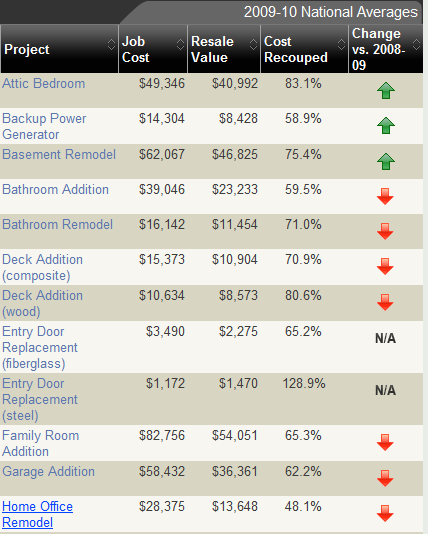

Well, here is a national summary of typical renovation/remodeling projects (including their average cost and how much resale value that they add to the project):

Despite this, I would not go about replacing all of the wooden front doors in my condos with steel doors! In fact, I would still look at:

1. Repaint / recarpet,

2. New blinds, door handles, light fittings (all of these can be quite cheap, as long as they work/look OK),

3. Kitchen remodel (you may be able to resurface the existing cabinets)

4. Bathroom remodel (you may be able to resurface the existing tiles, baths, and vanities)

5. Also, if it’s a house (not a condo), then you should paint the exterior and fix up the garden

6. Again, if it’s a house, perhaps the MOST ‘bang for buck’ rehab that you can do is to add another bedroom (especially to change a two-bedroom house into a three-bedroom house).

If you think it’s expensive, think again … just be very wary of your budget!

Here’s how it panned out for us:

We purchased one condo a street or two away from the beach:

– We bought for about $220k,

– Spent $15k on a rehab (paint/carpet, kitchen/bathroom remodel, door knobs and light fittings),

– Rented it out (we didn’t need to sell it).

It’s now worth $450k to $550k a mere 6 or 7 years later.

We then repeated with a block of 4 condos:

– Bought all 4 for $1.25 million,

– Rehabbed for $200k ($50k each condo), including the fees necessary to retitle from apartments (rental) to condos (rental or individual sale)

– It’s now worth $1.8 million to $2.25 million, a mere 6 years later.

For the four condo’s, we spent $50k in renovations (each condo: $200k total)), which bought us: paint inside/outside, new kitchen bathroom carpet, light fittings, security entrance for the building AND conversion of the front of the building into a private courtyard for one of the apartments, and conversion of the rear laundry into an ensuite bathroom for another condo in the block!

If you think the work is hard and/or time-consuming, we didn’t do the rehab on either project and didn’t even see the second project until 5 years after it was finished! We believe in outsourcing everything 🙂

I guess you live in a different real estate market than I’ve seen in Maryland. Big builders are sitting with properties killing them on carrying costs.

I would emphasize that you have to be very careful with leverage.

Good Luck!

@ DIY – Pick your market carefully; don’t overleverage; buy something that you can add value to (rehab; etc.); make sure you can rent to cover mortgage and other costs; lock in your interest rate for as long as possible; these sorts of properties can be found, if you look hard enough.

does market timing or luck have anything to do with anything?

Some of these prices seem quite inflated(although) I suppose your talking about prices as having someone come in and do it.

I’ve done a LOT of My Own work for about half these prices.

I didn’t do my own stairs because I thought it might be a heck of a lot of work. But regretted that decision as I saw how easy it actually was to do.;)

Maryland is an expensive area with little going for it right now. Not a lot of business coming into the area,so it won’t have a very liquid market for investment at this point.This is why so many builders are sitting on those properties and losing a ton to the Carry charges .

@ Ill Liquidity – Luck and/or timing (aren’t they the same thing?!) has EVERYTHING to do with it … but, I believe that you have to position yourself to get lucky.

@ Steve – Whilst OK when you are just starting out (and trying to raise cash through flipping your first project or two – in the right area/market), the risk you take as a DIY’er is that the stairs may only go up, but not down. Seriously, for the serious investor DIY can detract from your returns, by narrowing your focus to the ‘doing’ rather than the ‘planning’ (see my reply to Ill Liquidity, above).

@Steve,

If you do the work yourself you should consider the value of your time. If you wanted to make your money doing repairs wouldn’t it be a lot less risky to open up your own repair business?

Eventually you should be able to make a lot more per hour making new real estate deals than you could make with DIY repairs.

-Rick Francis

I am in the process of buying a rental – but am not relying on massive appreciation but rather having a good cash flow.

See the math on the property here:

http://notrichyet.com/?p=128

I hope to be able to avoid renovation costs in the short-term, but want to add a garage in the longer term.

There used to be a garage but it was torn down. Now there is a concrete slab. I am wondering what the cheapest but best looking solution for a garage is.

Having a garage would allow me to raise rent and much improve resale value (it is only property in the hood w.o. a garage – and it snows a lot in the winter).

Rick Francis says:

May 28, 2010 at 7:49 am

@Steve,

If you do the work yourself you should consider the value of your time. If you wanted to make your money doing repairs wouldn’t it be a lot less risky to open up your own repair business?

Eventually you should be able to make a lot more per hour making new real estate deals than you could make with DIY repairs.

Certainly you wouldn’t want to be making your own repairs all the time . After all, the idea in investing in real estate or any other investment is to free yourself to do the things you want in like. But in the beginning, your going to want to do these repairs as cheaply as possible to maximize returns .

perhaps a car port rather than a ful on garage.offers some protection and is cheaper than a garage.

@ Rick – Whilst you are technically correct, your assumption is based on Time = Finite; but, whilst Money = Finite as well (e.g. for your first deal, when you mak not have the cash to put down for your next deal), then DIY can be a way to increase the return on investment # 1, thereby allowing you to raise more cash for investments # 2, #3, and so on …

BUT, I never attempted DIY, myself 😉

@ Jake – I wonder if you couldn’t put that concrete slab to better use (i.e. if waterproof, meets council code, and is attached to the house) by adding another room (specifically, an extra bedroom)?

If not, you should do as Steve suggests and do your IRR on garage v car port.