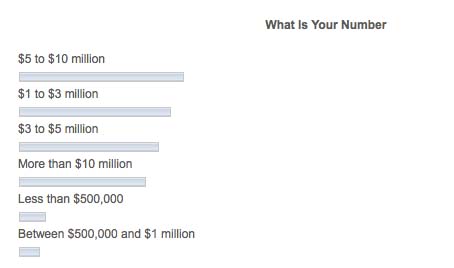

Well, it certainly took me a long time to ask the question (see Reader Poll: What Is Your Number?) and, it took me almost as long to answer it.

Why?

I’d like to say it was because I was forensically and actuarialy analyzing the results … I’d like to say it was, but that wouldn’t be the truth, which is much more mundane: it was mainly because I forgot all about it after our ridiculously long Australian summer holiday season (Aussie summer = USA winter) 🙂

So without further ado, here are the results:

Now, the first thing that you may notice is that the answers aren’t in any sort of obvious order; traineeinvestor was the first to notice:

The order … is not sequential. I fully expect to be awake all night trying to figure out whether this is really a cover from some experiment in behavioral finance.

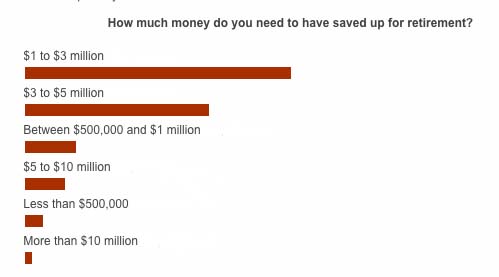

Actually, the reason is equally mundane: I was trying to copy the following poll from GenerationX Finance, but when you compare them, you’ll find out that I even got that wrong (!?!):

I presume that GenX ‘randomized’ the ranges to make his readers think through all the options before merely selecting the first one that looked OK; at least, that’s what I would have done had I not tried to copy him 😉

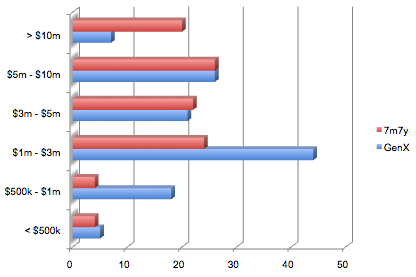

But, to help us analyze the results, I have graphed them side -by-side and in logical order:

OK, that tells me that we are on the right track:

– either I am attracting the ‘right’ audience for this blog (which is nice), or

– my readers have altered their perceptions of “how much is enough” based upon some of my preachings (which would be really nice).

Given that GenX’ers are born in the 60’s and 70’s (I was born in the – late! – 50’s … scary, huh?), I can understand why some may be aiming for only $1 mill. to $3 mill., but to my mind, it’s still too low; and for Gen Y and so on, inflation will decimate your living standard by the time you reach ‘standard’ retirement age, so you have no choice but to aim higher.

But given that so many of our readers have lofty targets – and, I just may be responsible at least in small part for at least a few – let me ask you, what would you like to see from this blog in 2010 that you haven’t seen (enough of) yet?

There are studies showing that comparative wealth/power/position/[insert attribute of choice] drives people’s feelings of achievement/happiness etc. Having more or less than someone else has an effect on how you perceive yourself (see the otherwise awful book Affluenza).

It follows that reading this blog and seeing that there are other people who are achieving more/earlier than you will have have and adverse affect on self-esteem and happiness levels and/or cause people to aim for a higher target or earlier date (or both).

So yes, Adrian. You probably are at least partly responsible for some of us setting such lofty goals. Years from now I will be sending you a bill for my therapy 🙂

I have certainly increased my target number because of you. Unless you really crunch the numbers, then you just don’t know how much you would need, or want…

But I think that there is a big different between what you “need” to retire and what you “want”. Your number is what I want. I could cut my target in half by focusing on what I need.

And there’s the rub. I wouldn’t be able to take advantage summer “down under” if I was limited to a subsistenance level.

@ Neil – What is the Number that you NEED to live your Life’s Purpose [AJC: rhetorical question, no need to answer :)]? To me, that is the minimum …

Adrian, what I need to make 2010 awesome is actually from my side. You consistently trawl up consistent, generous and HONEST information. I have to filter it through what I believe but I can put my bullshit filter on rest here.

Maybe subject matter on getting started in business, some interviews of smart people getting started.

What I really think would transform my 7m7y experience would be participating in your forum in a meaningful way, outlining my plans and finding mentorship or potential partners (sanity not a prerequisite, even Aussies can apply). You’ve already thrown in your ante, it’s perhaps time for people to meet you half way and develop some great stories along that road.

Here’s a thought, interview your favourite ‘next stage’ financial mentors on their thoughts. I’m reading Felix Dennis’ book. He is a bit loopy but very good fun.

Josh

I have several numbers on a wide range of need vs. want, but my most important is my F.U. number where I feel comfortable walking away from any employer or business if I have had it. Not quite there yet 🙂

@Jake – the F.U. number is an important one, but I prefer not to think about it – too easy to pull the plug prematurely.

@ Josh – Another Loopy Dennis fan … just like me! 🙂

http://7million7years.com/2009/09/20/how-to-get-really-rich-from-a-guy-who-really-knows/

Adrian,

You’ve mentioned the benefits of real estate investments a lot, I think it would be very helpful to highlight some of the potential problems- and strategies to deal with them.

Recently at Get Rich Slowly Baker made a few guest posts about his pretty negative experiences. The most valuable part though was the discussed of his mistakes and the comments that showed he wasn’t the only one to have troubles!

-Rick Francis

@ Rick – Problems? I don’t see any problems … esp. if you buy right, and don’t expect short-term miracles! 😛

Pingback: Risk is in the eye of the beholder …- 7million7years

I fall into the increased my number category as well. The taxman is going to take even a bigger bite out of my nest egg. I come too realize I’m going to need a bigger number. To be honest I’m not so sure I can get there, but I will do everything I can too!