This is a redux of a 2009 post, but it’s about time that I gave my newer readers a heads-up as to what we’re all about … if I had to point somebody to just one of my posts to get them started this would be the one; putting in all of the links nearly killed me 🙂

This is a redux of a 2009 post, but it’s about time that I gave my newer readers a heads-up as to what we’re all about … if I had to point somebody to just one of my posts to get them started this would be the one; putting in all of the links nearly killed me 🙂

______________________

I get a lot of questions, comments, and e-mails in general from new readers, and this one – from Chad – is reasonably typical of what I might see:

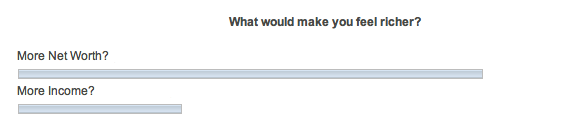

I’m turning 27; just got a job making 50k/yr.; on the market for my 1st condo to live in (and hopefully rent out a room); have 1 student loan at < 3% fixed interest. My goal is $7 million in 13 years.

1. I have very little to no knowledge of finance/investing. Do you recommend any resources to get me up to speed so I can understand what you write about?

2. Where does my situation put me in terms of Making Money 101 and 201, i.e. where do I go from here?

I appreciate ANY direction you can give me as I do not want to be stuck behind a computer in a cube for the next 30-40 years.

While I love reading these sorts of e-mails (AJC: I really do!], I have a hard time responding because I can’t / don’t give direct personal advice … but,

I can suggest that Chad think about:

1. Exactly HOW important that $7 million in 13 years is to him, and

2. Assuming it’s VERY important (critical even), how he is going to get there.

You see, my advice might change according to his Number – more importantly to his Required Annual Compound Growth Rate:

a) If low – say, no more than 10% to 15% – then I would point Chad to the various ‘frugal’ blogs (my personal favorite is Get Rich Slowly) and ‘starter books’ like The Richest Man In Babylon, or the more modern equivalent: Automatic Millionaire by David Bach, or anything by Dave Ramsey or Suze Orman.

Each would probably suggest something along the lines of:

– Keep your job; times are tough!

– Save as much of your salary as you can (max your 401k’s, then your IRA’s)

– Pay down ALL debt, following a Debt Avalanche or Debt Snowball, whichever is your favorite

– Invest any ‘spare change’ (after all debts are paid off and the requisite ’emergency fund’ has been built up) into a low cost Index Fund

… and, wait until your government-directed – or, employer-forced if you are retrenched and become unhireable – ‘retirement’. This is where that fully paid off home and a lot of candles and canned food stockpiled will really pay off … you won’t be able to afford real food 😉

a) If high – say, more than 10% to 15% (and, I would venture that $7 million in just 13 years would well and truly put Chad in the 50+% required annual compound growth rate category!) – then I would instead point Chad to books like Rich Dad, Poor Dad and The E-Myth Revisited and then towards this blog and its 7 Millionaires … In Training! ‘sister blog’ and suggest that he starts working his way through the back issues (well, posts).

After reading/digesting properly, he should be able to come up with his own plan … something along the lines of:

– Keep your job, but get into active stock and/or real-estate investing – better yet, start a side-business; because times are really tough(!):

i) A mildly successful part-time business might provide additional income to help you weather the financial storm and supercharge your savings, investment, and debt repayment plans

ii) A more successful part-time business might provide a built-in ’emergency fund’, tiding you over should you lose your job and/or unexpected expenses crop up

iii) An even more successful part-time business that can be started and/or survive during a recession may prove to become wildly successful once the clouds of the recession begin to lift, maybe even carrying you directly to your Number [AJC: do not pass Go, but do collect $200 million 🙂 ]

– Control your spending, and save as much of your salary as you can to build a war chest for starting / running your business

– Pay down ALL expensive debt, following the method laid out in the Cash Cascade, but keep your mortgage (lock in to current low rates) subject to the 20% Rule and the 25% Income Rule and seriously think about keeping your other cheap debt loans.

– Invest any ‘spare change’ from your job and business (after all expensive debts are paid off and the requisite ‘business startup fund’ has been built up) into quality ‘recession-priced’ stocks and/or true cashflow positive real-estate.

… and, wait until you have reached your Number (through sale of business and/or conservative valuation of your equity in your investment assets).

That’s it 🙂