It’s true, I am the ultimate Secret Blogger …

It’s true, I am the ultimate Secret Blogger …

… only two of my closest friends even know that I do blog – about personal finance – but, I won’t even tell them the name of my blog or my ‘pen name’!

[AJC: By now, you probably know that Adrian John Cartwood isn’t my real name – only the Adrian part is. For no reason that I can understand, my daughter started calling me ‘Adrian John Cartwood” when she was 7 … well, when the idea to write this blog sprang to mind in 2008, AJC was the natural choice!]

It’s not comfortable to talk about money: but, I resolved from Day 1 that this blog would need to be authentic and I would have to share the most gruesome details of my financial life.

So, when Bob asked:

From your “I’m a money hacker” post:

What is some financial advice you could give our readers?

Most people don’t really know how much house they can afford, so let me give your readers some very specific advice that will help them through every stage of their own financial journey: never have more than 20% of your Net Worth invested in your own house…

Do I understand from this post that $5M of your $7M net worth is in your own house?

… I can, from a position ‘protected’ by semi-anonymity, remind our readers that my $7 million journey represents a 7 year ‘slice’ of my financial life from when I started $30k in debt in 1998 and ended up with $7 million in the bank in 2004.

My recent ‘bad beat‘ post talks about what happened between 2008 and now 🙁

But, the years in-between (i.e. 2004 to 2008) were very kind to me: dominated by a series of sales of my Australian, New Zealand, and US businesses to a UK public company … it was almost literally raining money for those years.

But, this is a personal finance blog, not a business blog, so I concentrate on the $7m7y because I believe that is repeatable by almost any of my readers.

Even so, my $5 million (cash) house certainly breaks the 20% Rule (my net worth would need to be $25m+) but, it doesn’t matter!

You see, the 20% Rule only applies when you are still chasing your Number!

When you have reached your Number (Making Money 301), THE RULES CHANGE:

Remember when you calculated your Number?

You:

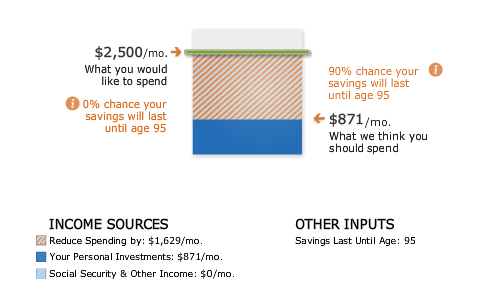

1. Took your required annual living expenses (of course, adjusted for future inflation until your chose ‘retirement’ Date) and multiplied that by 20, and

2. ADDED in the value of your house (plus any additional cash required to pay off the mortgage), initial cars, and any other one-time purchases.

Once you reach your Number, you no longer require 75% of your Net Worth to be in investments: you ‘only’ require the amount that you came up with in Step 1.

So, you can buy as much ‘stuff’ (houses, vacation homes, cars, etc.) as you like with any extra cash that you happen to have!

For me, it doesn’t really matter how much house I bought, as long as I still have >$5m in investments, generating my annual living requirements.

So, Bob, you don’t have to worry about me … yet … I just like to complain 🙂