I have to admit that it’s very exciting seeing my two real-estate development projects coming to fruition [AJC: this is the architect’s rendition of just one of my two condo projects … click on the image to enlarge it … go ahead … do it … I’ll love you for it].

I have to admit that it’s very exciting seeing my two real-estate development projects coming to fruition [AJC: this is the architect’s rendition of just one of my two condo projects … click on the image to enlarge it … go ahead … do it … I’ll love you for it].

I’ll get back to that in a sec’ …

… first, let me tell you about a conversation that I just had with a friend, while we were playing poker today:

FRIEND: Do you find any parallels between business and poker?

AJC: It’s uncanny, but yes I do … and, it’s caused me to totally rethink the way that I think about money

Well, not so much ‘totally rethink’ as remind me about some important Making Money 301 lessons that I seem to have forgotten …

…. but, I keep getting side-tracked; back to the poker:

Case in point: I had quickly tripled my starting stack in a cash game but, just as quickly lost it on a series of bad beats; bad calls (by them, not me); and bad luck.

When you’re running hot, you feel invincible.

When you’re running cold, nothing that you do turns out right.

… and, your poker bankroll quickly slips away.

Well, it’s pretty much the same thing in business and personal finance:

Your investments and/or businesses are ‘on fire’ … the market’s running hot, and – if you’re smart – you cash out at the peak, building up quite a bankroll.

Maybe you even reach your Number.

What should you do then? STOP and smell the roses!

But, the trouble is, greed and the adrenalin kicks in … you believe that you’ve got the Midas Touch. And, you push for the next project.

… and, that’s the one that gets you.

You know, market downturn, bad luck, bad advisers, etc., etc. sob, sob, sob.

Which is, perhaps, why Ill Liquidity asked me:

I don’t get it. You make a tidy sum and retire from the rat race, paying yourself a salary… why go forth and try new money making ventures?

Given my own ‘stop and smell the roses’ advice in that regard, I agree, it’s hard to understand. Sometimes, it’s even hard for me to understand 😉

So, let me take a stab at explaining it; the story so far:

I made my $7 million in 7 years (mainly through reinvesting the profits of my businesses into buy/hold real-estate), and then made a heap more (by selling those businesses just before the 2008 crash), but ….

… then the crash hit, and here’s where my money went:

1. $1.5 million cash into my house in the US (you know I can’t sell that, right?)

2. $5 million cash into my house in Australia

3. 25% of what I sold the businesses for in taxes [AJC: sheesh!]

4. Lost 100% of my $3 million bonus on company stock price crash + taxes paid on the full $3 million [AJC: double sheesh! … but, it’s nice to know that I have a heap of capital gains tax credits to use for the rest of my life]

5. Gave my accountant $1 million to invest in the Aussie stock market for me … he promptly lost 75% in about 6 weeks. My fault for trying to time the market, not his 🙁

Don’t feel too sorry for me: when others try to get to sleep by counting sheep, I count millions!

Don’t feel too sorry for me: when others try to get to sleep by counting sheep, I count millions!

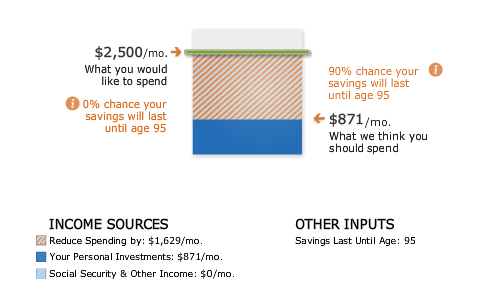

My problem is this:

All of this bad luck and bad management has left me with assets – not including my $5 million primary residence – that I consider just enough to live my Life’s Purpose.

But, I am an über-pessimist and I really want a large margin for error.

Now, in my rational moments, I realize that my house provides me that i.e. as soon as the kids move out, in approx. 10 to 15 years, we will sell down into a, say, $2 million apartment, which would free up another $3 million (all in today’s dollars, but the price differential should still hold true).

But, even that’s not good enough for me.

So the question that I am wresting with – and, have decided to put off answering until I have building permits for both projects in my hands:

Will I take my own advice and sell both development sites (with permits) for a tidy profit (if all goes well), or will I pull the trigger and dump most of my net worth into these developments to get the Really Big Bucks?

Only time will tell … but, you will be amongst the first to know 🙂

In the meantime, have you suffered any ‘bad beats’ lately?