If you’re a new reader, you’ll pretty quickly find out that I only write when I think that I have something useful to say …

If you’re a new reader, you’ll pretty quickly find out that I only write when I think that I have something useful to say …

So, the best thing to do is scan this post and if it’s interesting, subscribe by e-mail / RSS and I’ll pop a quick e-mail into your in-box if the urge to write does strike.

Today, I am inspired by a post written by moneycrush about success:

“Big goals take time, which means it can be especially hard to stick to them when they require both time and sacrifice.”

Here, moneycrush equates success with “reaching your goals”. giving an example of getting your house paid off.

So, this got me thinking about the nature of success:

On the surface, I am successful.

Certainly my friends and family talk to me – and, of me – in those terms.

Now, they don’t necessarily know my net worth (after all, that’s why I write here under a nom de plume), but they do know that I sold three businesses in three countries … so, they can connect the dots.

They don’t realize that, by their measure of success = money, I was already ‘successful’ well before before I sold my businesses, and well before those businesses even made any serious money.

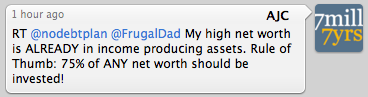

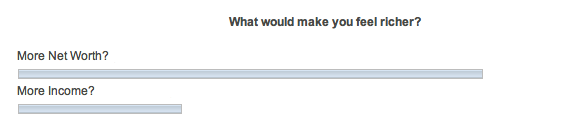

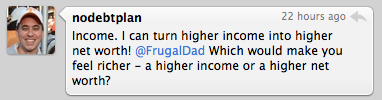

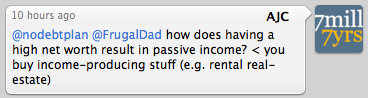

Because I was quietly doing what I advise my readers to do: take your income and use it to buy income-producing assets instead of spending it. What my family and friends don’t realize is that’s how I made I made $7 million in 7 years, starting with $30k in debt.

In any event, I still don’t consider myself successful.

That doesn’t mean that I’m one of those guys who chases ever bigger and bigger financial wins …

It just means that I measure success differently:

To me, success is when I am living my Life’s Purpose. And, money is just one of the enablers.

In 1998, I discovered my Life’s Purpose; it was simply to “always be traveling mentally, physically, and spiritually”.

Now, that means nothing to you … so, let me translate that into some practical incarnations of that Purpose:

– Travel … a lot. This takes time and money.

And, comfortably. For me, this means about $50k a year of business class travel. I’m about to experiment with a roll-up mattress on the business class ‘lie flat’ seats; if that doesn’t work, I’ll need to ‘upgrade’ to first class because lack of sleep on the long-haul flights from/to Australia kills me.

– Personal Finance & Public speaking … twin passions of mine. I hope to be able to combine these, one day. The money I might earn is irrelevant.

I rarely get to indulge in public speaking these days; the hidden cost of no longer being attached to the corporate world. But, I discovered this passion about 30 years ago, yet have spoken publicly less and less as time has gone on. This blog, as well as being a passion in its own right, is one step towards resurrecting myself as a public speaker. My book (out soon!) is the second.

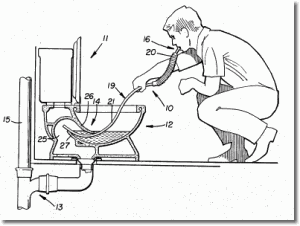

– Venture Capital … this goes with the ‘traveling mentally’ bit.

I must admit I was worried. Stories about VC’s investing in 10 businesses in order to (hope) that one may succeed scared me, with typical (VC-like) bricks and mortar investments requiring upwards of $250k each. Fortunately, the internet came along and I’m happily working on my little angel investing fund, which allocates $25k+ per investment. If 10 fail, well, it shouldn’t hurt much more than my pride. Fortunately, success rates are closer to 30%, so I’m told (hope!). In either case, but don’t tell my partners this, I’m only in it for the stimulation and … fun!

– the touchy/feely spiritual stuff. I’m not exactly the next great guru, but this doesn’t cost any money – or much time – and feels … well … nice.

So, for me success is more about what I do than what I have.

But, I am just starting to live my Life’s Purpose: I’m beginning to travel more; but, I am just starting my venture capital activities and my book isn’t out yet (hence, the speaking offers haven’t exactly flooded in) … so, I am working on my ‘success’ but am clearly not there, yet.

Now, I suggest that you find out what REALLY matters to you and go about becoming ‘successful’ too 🙂