OK, so if the ‘secret’ to making money hasn’t changed in 50 years …

OK, so if the ‘secret’ to making money hasn’t changed in 50 years …

[AJC: if you didn’t read yesterday’s post, it’s simple: buy a rental property with about 25% down; renovate; trade up and start again; repeat until rich!]

… why are there so few people doing it?

It could be market fever: “the market’s too [insert excuse of choice: hot, cold, near, far, etc.]”; but, I suspect it’s the age old reason: you simply don’t know HOW.

Ok, so let me make it simple: save up a reasonable deposit (15% to 25% works for me), and do the most cost-effective renovation (also called remodeling or rehabbing, depending on what country you live in) possible.

The question is, what are the best ‘bang for buck’ renovations to do?

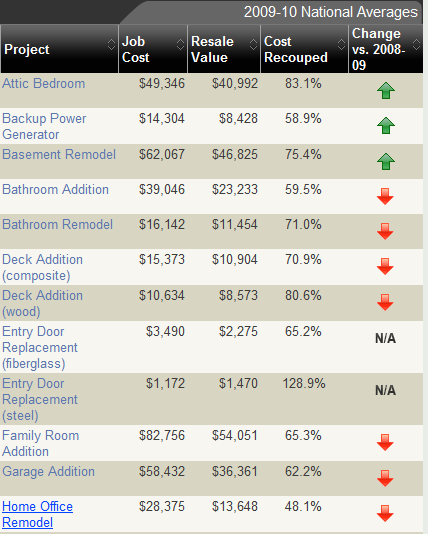

Well, here is a national summary of typical renovation/remodeling projects (including their average cost and how much resale value that they add to the project):

Despite this, I would not go about replacing all of the wooden front doors in my condos with steel doors! In fact, I would still look at:

1. Repaint / recarpet,

2. New blinds, door handles, light fittings (all of these can be quite cheap, as long as they work/look OK),

3. Kitchen remodel (you may be able to resurface the existing cabinets)

4. Bathroom remodel (you may be able to resurface the existing tiles, baths, and vanities)

5. Also, if it’s a house (not a condo), then you should paint the exterior and fix up the garden

6. Again, if it’s a house, perhaps the MOST ‘bang for buck’ rehab that you can do is to add another bedroom (especially to change a two-bedroom house into a three-bedroom house).

If you think it’s expensive, think again … just be very wary of your budget!

Here’s how it panned out for us:

We purchased one condo a street or two away from the beach:

– We bought for about $220k,

– Spent $15k on a rehab (paint/carpet, kitchen/bathroom remodel, door knobs and light fittings),

– Rented it out (we didn’t need to sell it).

It’s now worth $450k to $550k a mere 6 or 7 years later.

We then repeated with a block of 4 condos:

– Bought all 4 for $1.25 million,

– Rehabbed for $200k ($50k each condo), including the fees necessary to retitle from apartments (rental) to condos (rental or individual sale)

– It’s now worth $1.8 million to $2.25 million, a mere 6 years later.

For the four condo’s, we spent $50k in renovations (each condo: $200k total)), which bought us: paint inside/outside, new kitchen bathroom carpet, light fittings, security entrance for the building AND conversion of the front of the building into a private courtyard for one of the apartments, and conversion of the rear laundry into an ensuite bathroom for another condo in the block!

If you think the work is hard and/or time-consuming, we didn’t do the rehab on either project and didn’t even see the second project until 5 years after it was finished! We believe in outsourcing everything 🙂